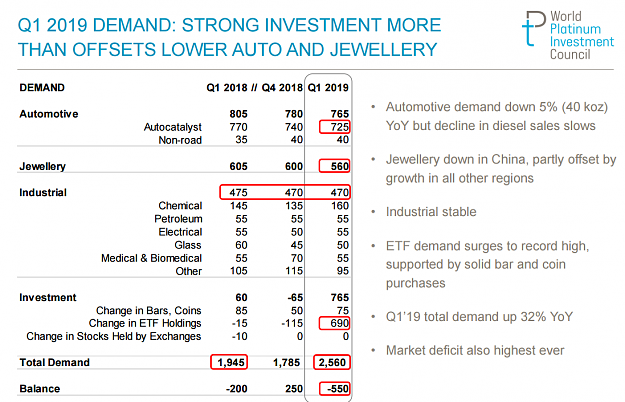

Disliked{quote} Great info Ric! Thanks for the insights. It doesn't bode well for South Africa if demand drops. They produce 70% of the world's newly mined platinum.Ignored

Yes indeed.165 metric tons (110 from South Africa) was mined in 2018. That is 17% less than 2017. In fact Platinum mining has been on the decline ( with 2017 as an exception) since 2014. The demand just inst there.

- Ric

Be humble or get humbled

1