Disliked{quote} ICM has suspended Palladium trading, their explanation: liquidity problems, referring to a Bloomberg article...Ignored

1

XPD/USD - Palladium vs US Dollar 0 replies

broker stop-hunted my palladium trade 9 replies

Disliked{quote} ICM has suspended Palladium trading, their explanation: liquidity problems, referring to a Bloomberg article...Ignored

Disliked{quote} Indeed. Unacceptable in my opinion. Very angry with them about that.Ignored

Disliked{quote} Global Prime e.g. did not suspend Palladium, so whatever ICM is doing, it smells like bucket shop ..Ignored

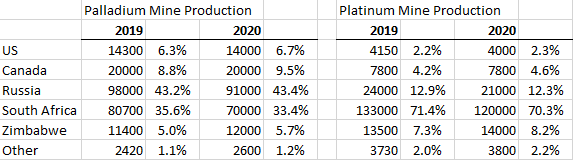

DislikedPalladium is outperforming the other precious metals and it's not really even close. {image}Ignored

DislikedPalladium is outperforming the other precious metals and it's not really even close. {image}Ignored

DislikedIf this concept is to hold (which seems valid in the medium-term given the slow speed of dispersion of production) the two should converge back towards 1:1 and Palladium would be a good short candidate barring any major steps backwards in 1) global COVID circumstances and 2) macro risk sentiment.Ignored

DislikedThe long Platinum/short Palladium trade thus far is profitable. It's likely this behavior continues as we move closer to 1:1 Palladium/Platinum, but must keep an eye on increasing news of variant COVID strains.Ignored