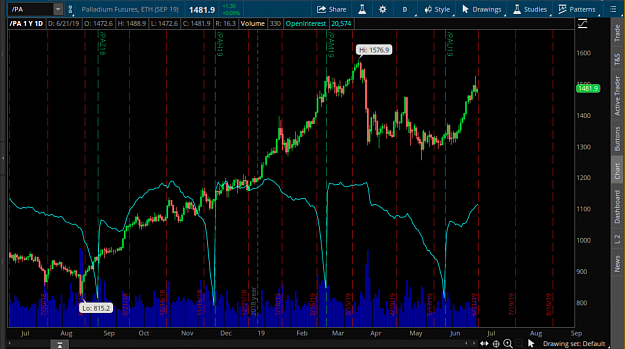

Palladium is not popular in day trading. I think it's because on Forex it have big spread and slippage. But on Futures market it is very interesting and good instrument for swing trading.

Let's trade it together.

My opinion for it

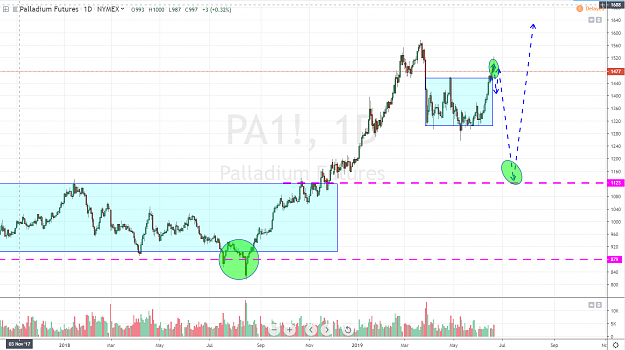

On daily chart we have a long balance, but good point for long will just after provocation, and test of zone, which we have on 1123.

The same test we had before:

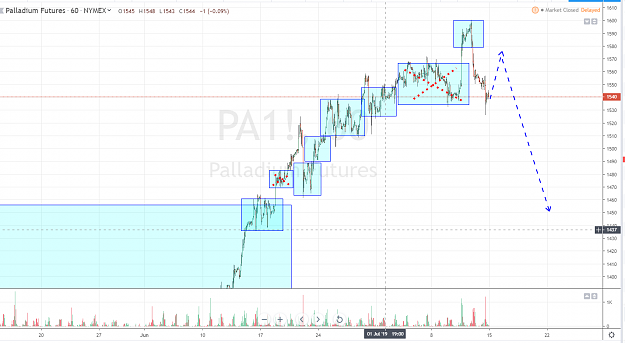

But on less time frame this movement what can be interesting for short, so i think we can find point for short on less Time Frame(TF)

What i'm waiting:

1. Provocation. We already have it.

2. Back inside the range. For it we have to wait.

3 I will open short on a test that zone what is forming now.

I wrote to myself this plan on monday

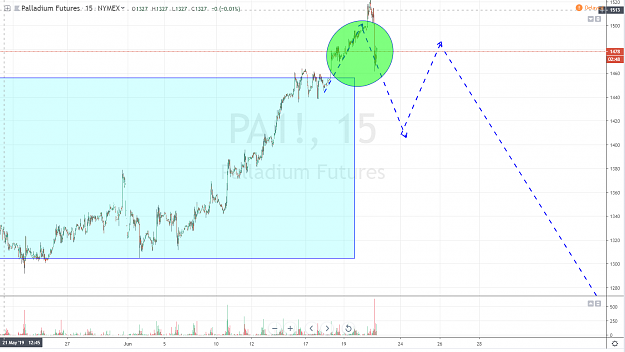

how it is on less TF now/

Let's trade it together.

My opinion for it

On daily chart we have a long balance, but good point for long will just after provocation, and test of zone, which we have on 1123.

The same test we had before:

But on less time frame this movement what can be interesting for short, so i think we can find point for short on less Time Frame(TF)

What i'm waiting:

1. Provocation. We already have it.

2. Back inside the range. For it we have to wait.

3 I will open short on a test that zone what is forming now.

I wrote to myself this plan on monday

how it is on less TF now/