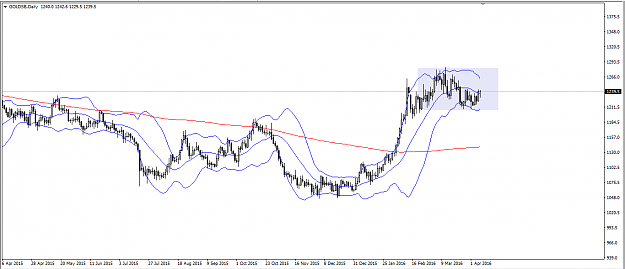

Gold is showing a very bearish picture on my view. Technically speaking, we can sell gold below 1186 as basic techinicals like Moving avereges might break thier trend and MACD seem to get into negative zone with a crossover on signal line. And Also with Elliot wave we can picture market to touch the lows of 1140 with stop loss at 1200.

I hope your trade goes good.

Best of Luck

I hope your trade goes good.

Best of Luck