I'm starting this thread so that myself and other gold traders can discuss techniques, systems, and individual trades that we make. I've been trading gold for almost a year and a half now. I started my trading career with currency pairs and soon realized that I could limit my losses and take better profits with the oldest currency of all—gold.

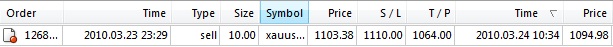

Without any further ado, I'll list my latest trade:

Without any further ado, I'll list my latest trade:

Inserted Code

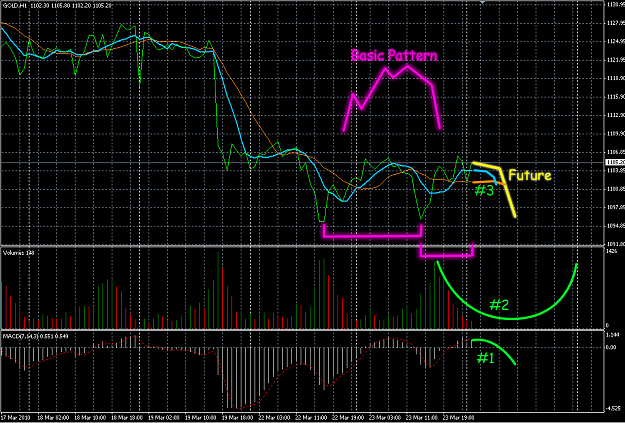

I went short for 5 ounces of gold at 1130 on March 17th and just recently exited the trade at 1099 (March 22nd). I took 150 dollars worth of profit on this trade.