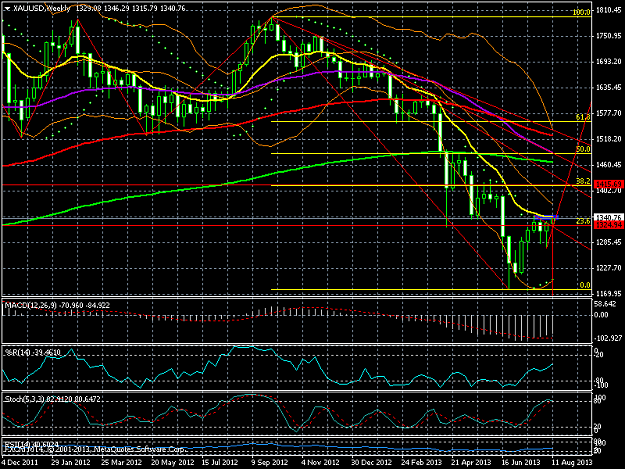

CFTC data indicated a 20-25% increase is gold shorts. I am not really interested in what some may think physical demand will increase due to better economics because when push comes to shove, when the institutions push the sell button markets move. Annnnnnd, gold is a fear trade. Why would it increase if the economics do?

When the facts change I change my mind, what do you do sir