AMENDMENT:

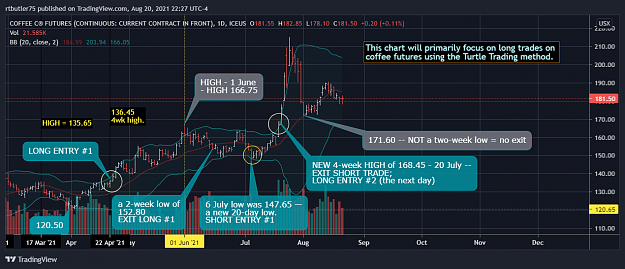

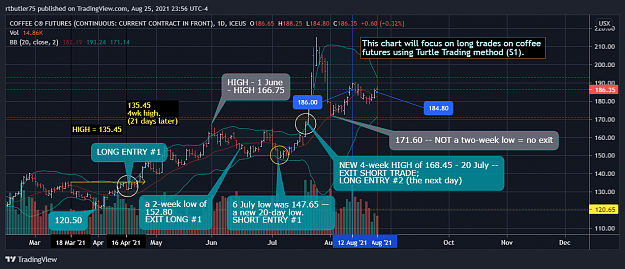

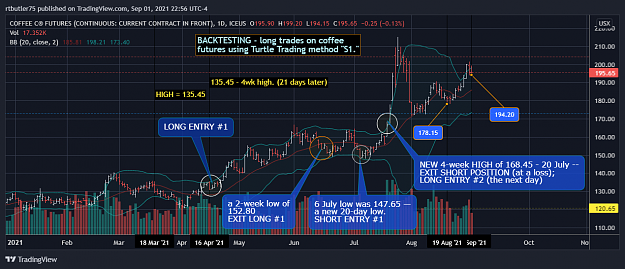

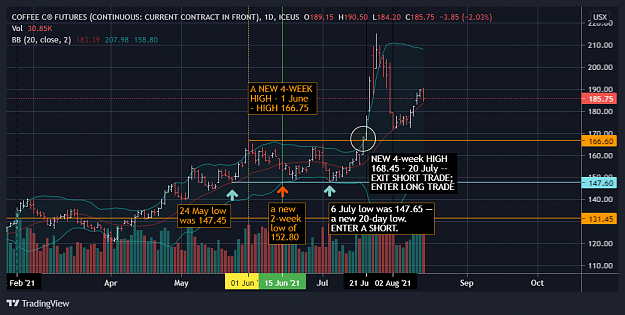

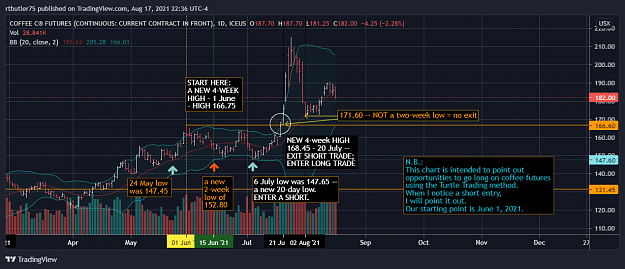

I used June 1st as a starting point for my back-testing.

But if I had entered a long there, I would have exited

at the vertical green line, which marks a new two-week low price.

Such an exit would have meant a loss, followed by a second

losing trade--a short entry just before the price went long.

But the Turtle Traders stress obedience to the system without

impulsive second-guessing.

So far, an entry after the circled high price is still profitable.

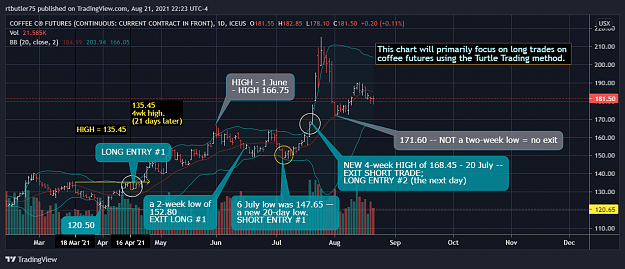

I used June 1st as a starting point for my back-testing.

But if I had entered a long there, I would have exited

at the vertical green line, which marks a new two-week low price.

Such an exit would have meant a loss, followed by a second

losing trade--a short entry just before the price went long.

But the Turtle Traders stress obedience to the system without

impulsive second-guessing.

So far, an entry after the circled high price is still profitable.

Life happens at the level of events. Trust only movement. - Adler

1

![Click to Enlarge

Name: [JP225]-ECNH1.png

Size: 32 KB](/attachment/image/4017541/thumbnail?d=1629409200)

![Click to Enlarge

Name: [SP500]-ECNH1.png

Size: 31 KB](/attachment/image/4017542/thumbnail?d=1629409208)