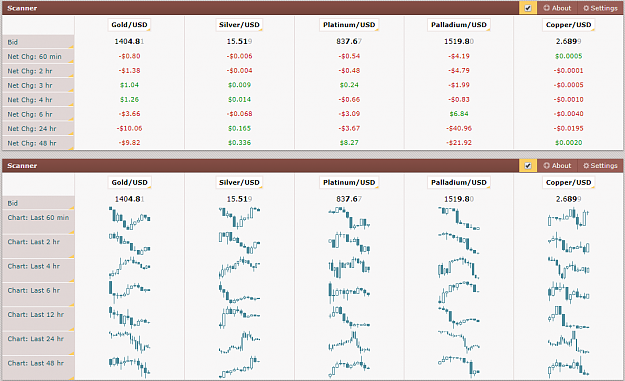

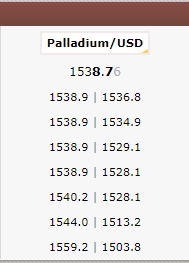

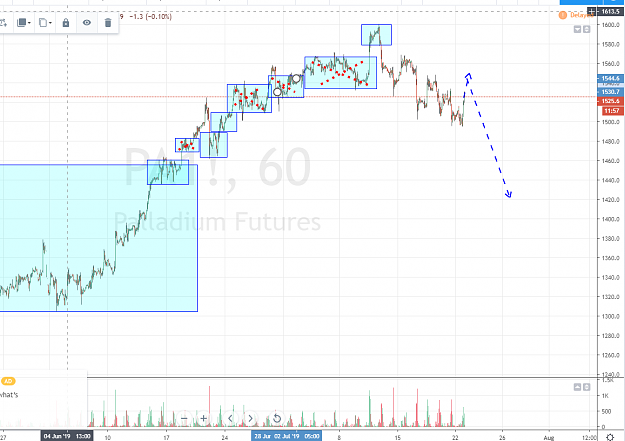

DislikedMy previous waiting some deep provocation was loose waiting - the palladium already did target for long. I'm waiting for some rollback and test step on daily chart. if they will give confirmation, i will open short on test 1570. Target 1450. {image}Ignored

Shorts should do well. Will add onto short around 1556

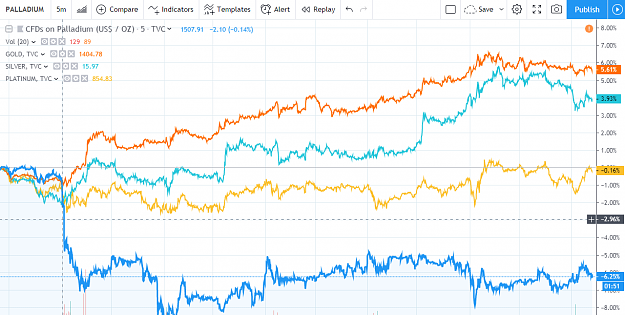

Thinking there may be further bearish was overall....

Double top on weekly? Downward pointing RSI, so exercising some patient with this one.....

4&1 All Time Profit:

$37,496