Forecasts

NFP

- Economists surveyed by Bloomberg are mostly in a range between 125K and 205K. Average forecast is ~162K while the median is 160K.

- Economists polled by Reuters are mostly in a range between 135K and 200K. The median forecast is 164K.

Unemployment rate

- Economists surveyed by Bloomberg are mostly in agreement at 3.5%.

- Economists polled by Reuters are mostly in agreement at 3.5%.

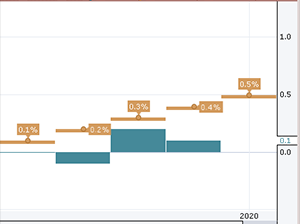

Average hourly earnings

- Economists surveyed by Bloomberg are divided between 0.2% and 0.3%, with more forecasting 0.3%.

- Economists polled by Reuters are also divided 0.2% and 0.3%, with most forecasting 0.3%.

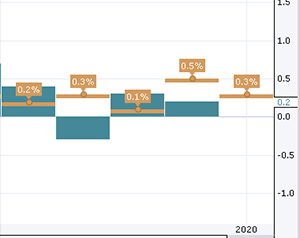

Recent Impacts (gold, eur/usd, and usd/jpy)

Last month we saw a much better than expected NFP as well as an upward revision to prior. The unemployment rate beat estimates (3.5% vs 3.6%). Wage inflation however missed, coming in at 0.2% vs 0.3% expected. Then, the prior month’s data was revised up to 0.4% from 0.3%.

Outlook

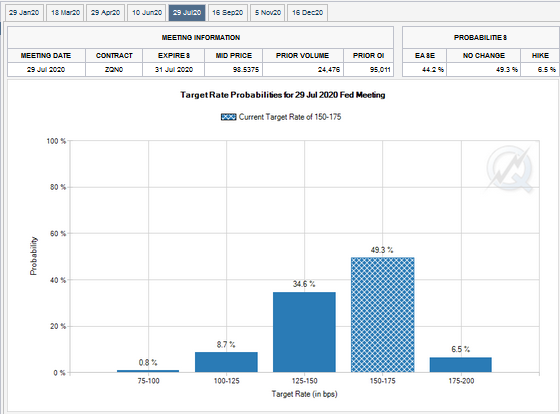

As always, US employment data is expected to bring heavy volatility across asset classes. Currently, the markets are focused on US-Iran tensions which have created a risk/on or off sentiment depending on the latest news cycle. Mostly risk off.

ADP employment data showed a big surprise, better than expected figure of 202K. However, I’ve said it before and I’ll say it again, don’t use ADP to predict NFP. It’s a trap! Last month ADP had one of it’s biggest misses in recent history while NFP beat forecasts by a wide margin.

Unemployment claims on average, was 5K higher (on a weekly basis) in December than in November. This suggests we should see this month’s NFP reading lower than last month’s (266K).

Avg hourly earnings tends to have more impact when the Fed is making changes to rates. Since they’ve changed to a neutral stance, the impact should not be as significant as it was in the later half of 2019. However, wage inflation always has the potential to trigger big moves, especially if it misses by more than 0.1%.

The unemployment rate is usually data that I don’t put too much emphasis on, but if it ticks down again it’ll hit fresh 50+ year lows. Whether significant or not, headlines will carry it and it would drive sentiment/markets.

Gold would move lower on higher than expected payroll data and avg hourly earnings, as well as a lower unemployment rate. In this scenario the US dollar would appreciate. Conversely, gold will head higher on a higher unemployment rate, lower payrolls, and lower avg hourly earnings. The tricky part here is that there’s a good chance some data comes in better, while other data misses. Then, there are revisions to contend with.

I recommend being patient and choosing your entries wisely. The US employment data usually gives us plenty of time to figure out what’s going on. If not, there’s always next time. Good luck out there!