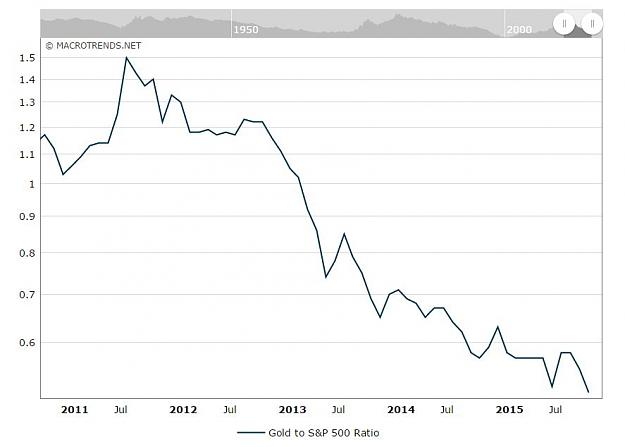

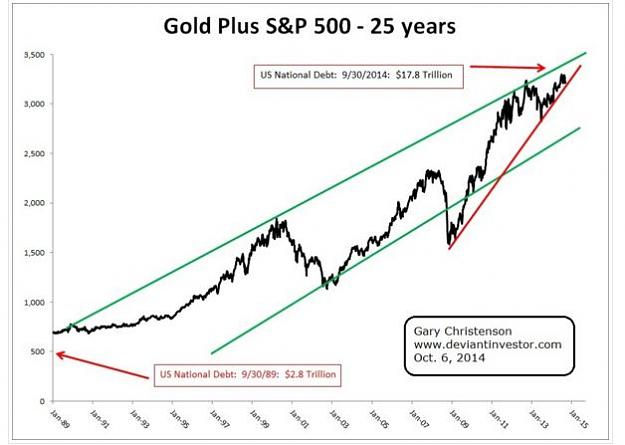

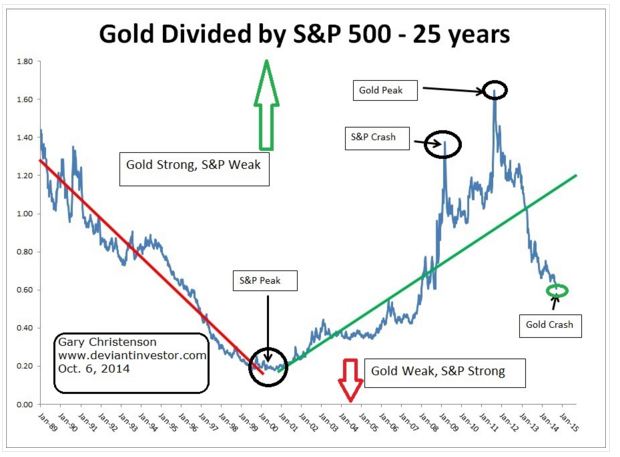

Traditionally S&P500 and Gold form Inverse Correlation.

Lets take a look at what the term as "RISK ON/OFF" sentiment means to us:

Risk ON : Positive Global Macros,more QE from Fed/Other central bankers and Outcome positive henceforth Stock Markets,Oil,Bonds Soar North

Risk OFF : Negative Global Macros/War tensions/Fed Rate Hike ==> Stock Markets,Oil,Bonds Drop South (We are currently in Risk OFF environment with Oil(Brent/Crude) both falling apart below 30$/barrel and continuing to grind down

One other important thing to keep in mind during Risk OFF environments like now is that "Safe Heaven Currencies" like USD,Japenese Yen(JPY),Gold are in demand.

EUR USD is the funding currency meaning when global stock markets drop off including German 30 a.k.a DAX30 index topples , "EURO" gets natural demand owing to its funding currency status.

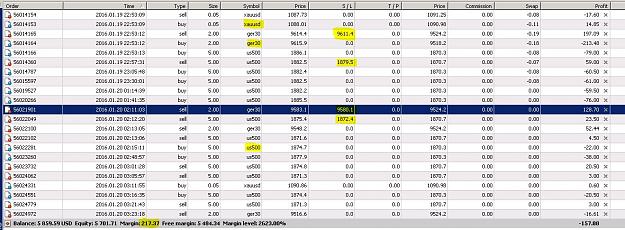

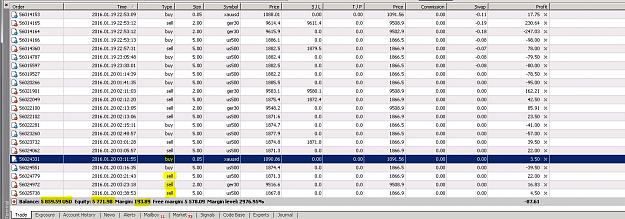

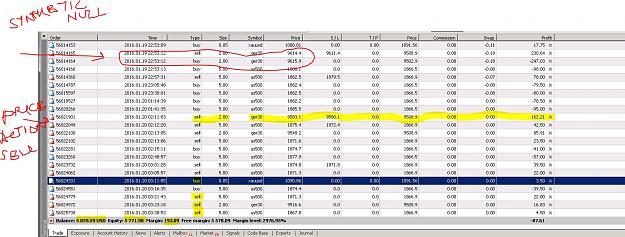

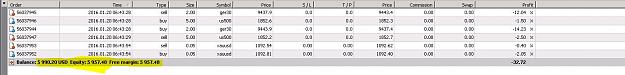

As the topic states, lets get to some real trading with S&P500(US500) and Gold(XAUUSD) . Most brokers do offer both these instruments to trade 24 x 5 now we need to be picky about choosing the right broker to trade them with lower margin requirements,spreads, no commission charged and lower swaps.

I will illustrate a very simple and profitable way to trade these instruments using only price action in subsequent threads as proof of concept .

Lets take a look at what the term as "RISK ON/OFF" sentiment means to us:

Risk ON : Positive Global Macros,more QE from Fed/Other central bankers and Outcome positive henceforth Stock Markets,Oil,Bonds Soar North

Risk OFF : Negative Global Macros/War tensions/Fed Rate Hike ==> Stock Markets,Oil,Bonds Drop South (We are currently in Risk OFF environment with Oil(Brent/Crude) both falling apart below 30$/barrel and continuing to grind down

One other important thing to keep in mind during Risk OFF environments like now is that "Safe Heaven Currencies" like USD,Japenese Yen(JPY),Gold are in demand.

EUR USD is the funding currency meaning when global stock markets drop off including German 30 a.k.a DAX30 index topples , "EURO" gets natural demand owing to its funding currency status.

As the topic states, lets get to some real trading with S&P500(US500) and Gold(XAUUSD) . Most brokers do offer both these instruments to trade 24 x 5 now we need to be picky about choosing the right broker to trade them with lower margin requirements,spreads, no commission charged and lower swaps.

I will illustrate a very simple and profitable way to trade these instruments using only price action in subsequent threads as proof of concept .

Scoobi doobi doo