Hi! My name is Ryan. Welcome to my interactive trading journal!

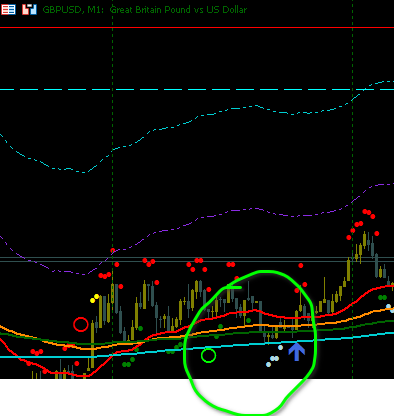

I'm trading forex and crypto for a while. Have created several custom indicators and EAs.

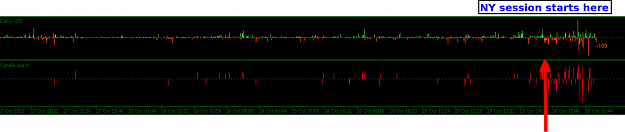

In most cases I'm trading London and NY sessions on forex, and NY+ on crypto.

Timeframes are: 1m, 15m, 1h, 4, 6h and 12h.

Indicators used:

Indicators used:

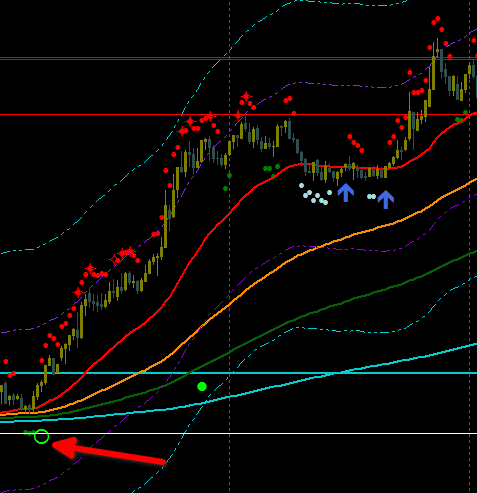

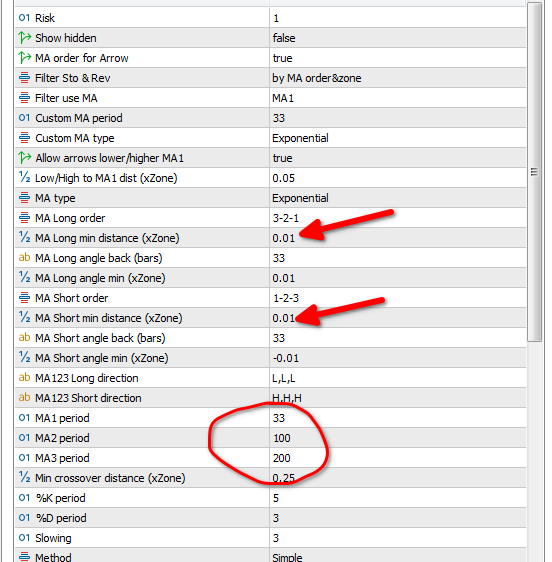

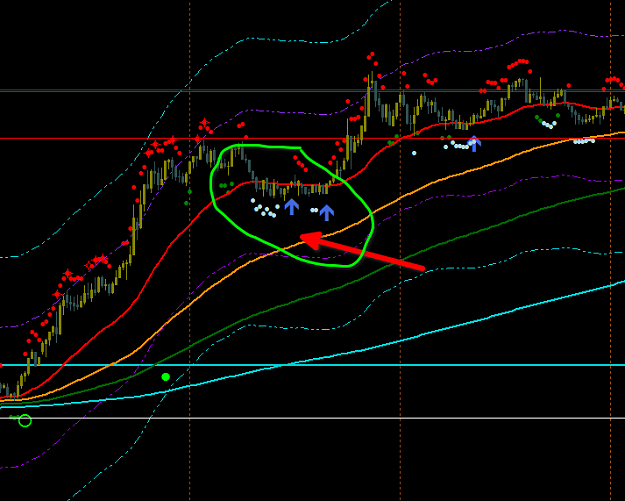

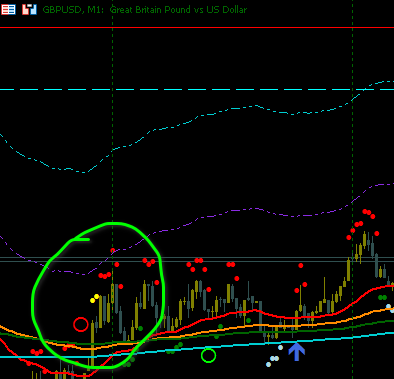

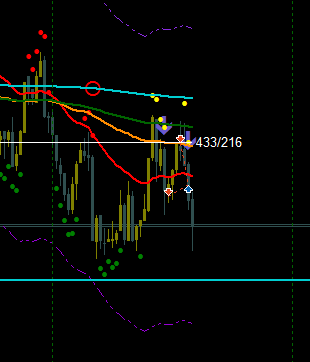

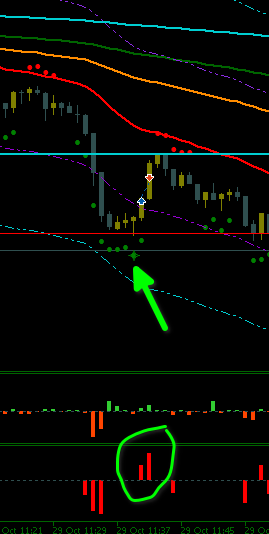

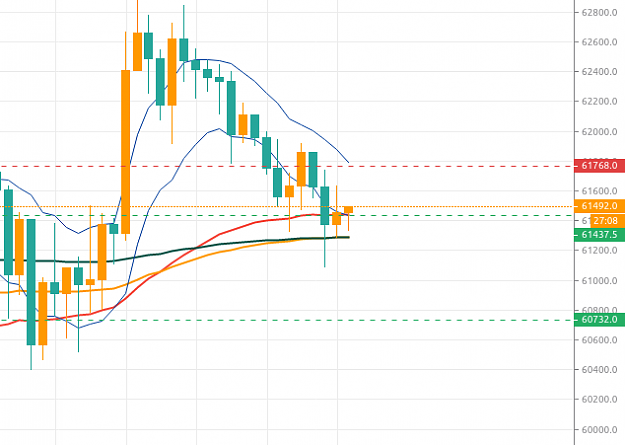

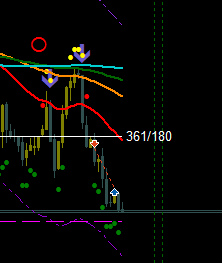

1. Moving average. This is great indicator. I'm using 8 low, 8 high, 50 / 100 / 200 EMAs on every timeframe.

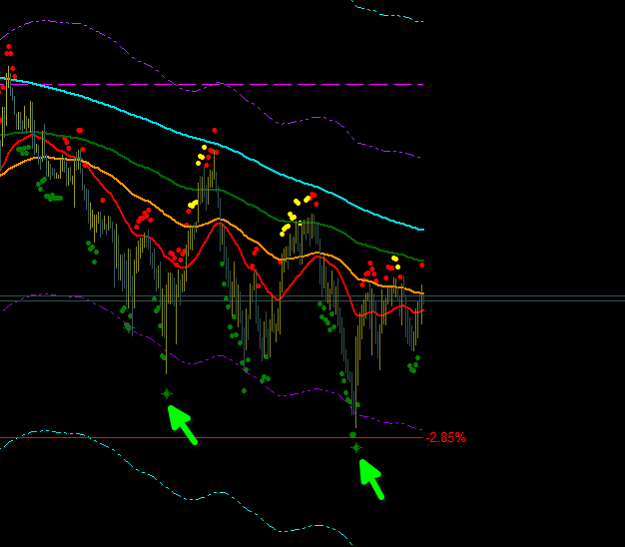

2. Stochastic. Great to find exits. You can use RSI if you don't like Stoch. I'm using Stoch because it has 2 lines and it generates much more variants for algo trading.

3. ADR. I'm using it like an index to check candle size, distance for TP/SL and even to calculate the lot sizes.

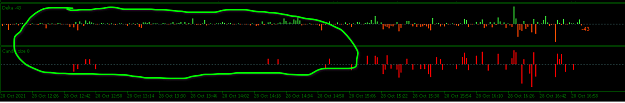

4. Volume/Delta. This is the heart of my trading system. Forex has no volume, so I have to take it from CME futures.

5. Candle size, Daily open, Asian high/low and others. I'll try to explain everything.

NB: I have custom indicators used, but you can use most of them for free from MT5. I don't have MT4, but I think every indi is available for that platform too.

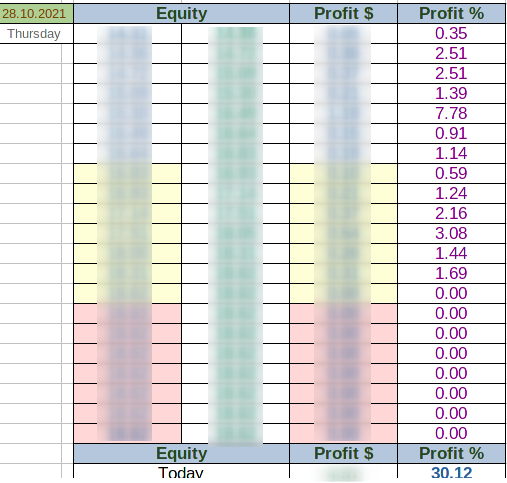

Daily profit target is 5%.

Daily profit target is 5%.

Strategy basics used in most cases:

Strategy basics used in most cases:

First we must determine the trend. I'm using 1h and 15m time frames for that. Both my be in sync. Then we can stay on 15m/1h TF or dive deeper even on 1m TF to find the signal to trade.

The main rule is that we must trade only volatile pairs, where are a lot of volume detected and the movements are big. Next we must find imbalance and utilize that. Big volume + imbalance let us hide our trades with big player trades.

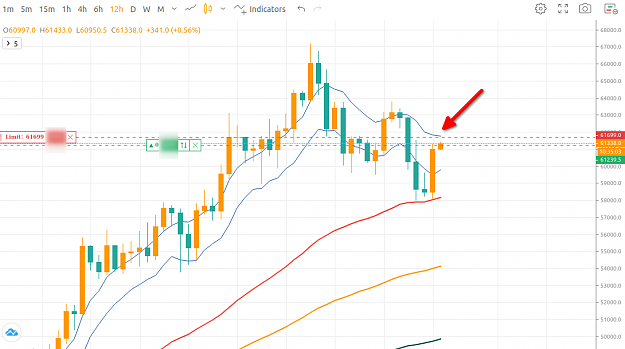

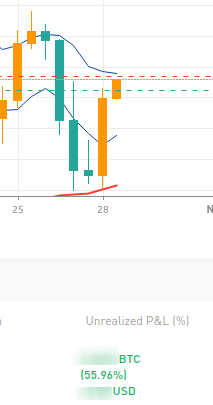

Notes for crypto. On bull market if you own crypto you are 1x long by default. So it is better to trade BTC futures nominated in BTC, not in dollars. So trading it with forex brokes make no sense. Also if you are trading btc futures are can have rebates for market orders and positive funding every 8 hours for shorts. Also there are no liquidation price for 1x shorts. So it is barely impossible (but you can try) to scalp it on 1m tf. That's why my crypto trades are on from 15m to 12h timeframes.

Notes for crypto. On bull market if you own crypto you are 1x long by default. So it is better to trade BTC futures nominated in BTC, not in dollars. So trading it with forex brokes make no sense. Also if you are trading btc futures are can have rebates for market orders and positive funding every 8 hours for shorts. Also there are no liquidation price for 1x shorts. So it is barely impossible (but you can try) to scalp it on 1m tf. That's why my crypto trades are on from 15m to 12h timeframes.

What is not used by me: praying, sitting and waiting for the miracle. If the entry is wrong - jump out immediately. I'm using hedging, but my stats say that I'm not good in hedging and all my losses comes mostly from that kind of trades. So you can use hedges or you can just use stop losses. For me stops are better. Also hedging is not working on EU and GU, 50/50 works on XAU and works perfect on BTC. Just because the movements are much bigger. So keep that in mind.

House rules: To all who has another strategy/approach - please keep away. I don't care how you trade, how much you earn and what you think about my trading.

Keep your thoughts yourself.

Let's go!

I'm trading forex and crypto for a while. Have created several custom indicators and EAs.

In most cases I'm trading London and NY sessions on forex, and NY+ on crypto.

Timeframes are: 1m, 15m, 1h, 4, 6h and 12h.

1. Moving average. This is great indicator. I'm using 8 low, 8 high, 50 / 100 / 200 EMAs on every timeframe.

2. Stochastic. Great to find exits. You can use RSI if you don't like Stoch. I'm using Stoch because it has 2 lines and it generates much more variants for algo trading.

3. ADR. I'm using it like an index to check candle size, distance for TP/SL and even to calculate the lot sizes.

4. Volume/Delta. This is the heart of my trading system. Forex has no volume, so I have to take it from CME futures.

5. Candle size, Daily open, Asian high/low and others. I'll try to explain everything.

NB: I have custom indicators used, but you can use most of them for free from MT5. I don't have MT4, but I think every indi is available for that platform too.

First we must determine the trend. I'm using 1h and 15m time frames for that. Both my be in sync. Then we can stay on 15m/1h TF or dive deeper even on 1m TF to find the signal to trade.

The main rule is that we must trade only volatile pairs, where are a lot of volume detected and the movements are big. Next we must find imbalance and utilize that. Big volume + imbalance let us hide our trades with big player trades.

What is not used by me: praying, sitting and waiting for the miracle. If the entry is wrong - jump out immediately. I'm using hedging, but my stats say that I'm not good in hedging and all my losses comes mostly from that kind of trades. So you can use hedges or you can just use stop losses. For me stops are better. Also hedging is not working on EU and GU, 50/50 works on XAU and works perfect on BTC. Just because the movements are much bigger. So keep that in mind.

House rules: To all who has another strategy/approach - please keep away. I don't care how you trade, how much you earn and what you think about my trading.

Keep your thoughts yourself.

Let's go!

Observer effect