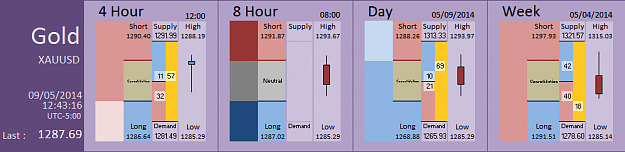

Friday May 9, 2014

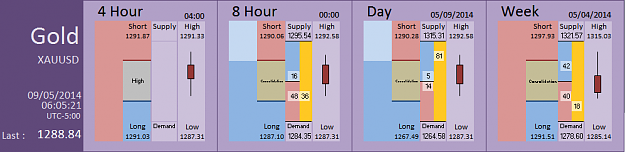

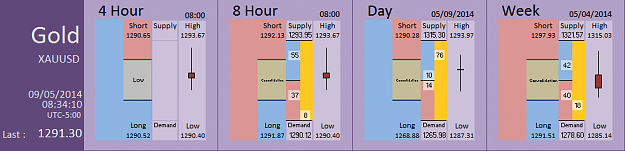

Chart #1

On the 4 Hour, (1) the market is Bearish below 1291.03, (2) Supply has overcome Demand such that we have a High, (3) we have a Retracement Level @1291.03.

On the 8 Hour, the market holds a Bullish Bias above 1287.10. The market returns Bullish above 1290.06 and Bearish below 1287.10.

On the Day, the market holds a Bullish Bias above 1267.49. The market returns Bullish above 1290.28 and Bearish below 1267.49.

On the Week, the market is Bearish below 1291.51 with Demand @1278.60.

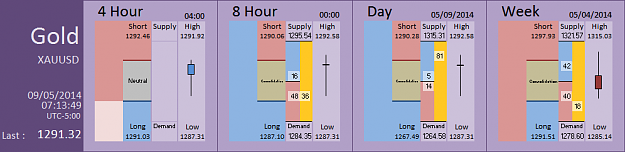

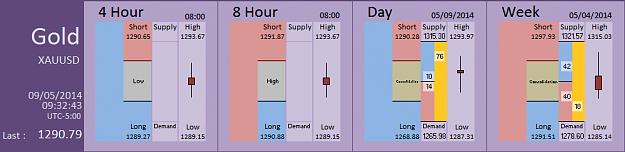

Chart #2

On the 4 Hour, the market holds a Bearish Bias below 1292.46. The market returns Bearish below 1291.03 and Bullish above 1292.46.

On the 8 Hour, the market is Bullish above 1290.06 with Supply @1295.54.

On the Day, the market is Bullish above 1290.28 with Supply @1315.31.

The Week remains unchanged.

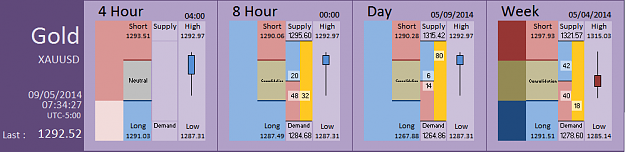

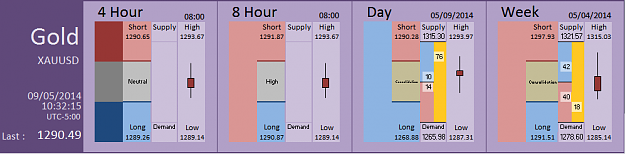

Chart #3

On the 4 Hour the market holds a Bearish Bias below 1293.51. The market returns Bearish below 1291.03 and Bullish above 1293.51. Notice how the 4 Hour recalculates the target High for the Bullish momentum in the market (compare Short value with Chart #1 and Chart #2 above).

The 8 Hour and the Day remain unchanged.

On the Week, the market has re-entered the Passive Consolidation Zone between 1297.93 and 1291.51.

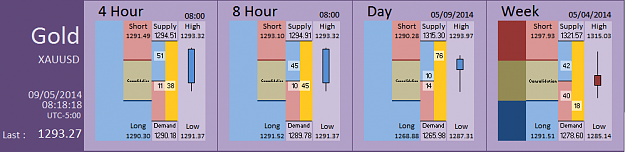

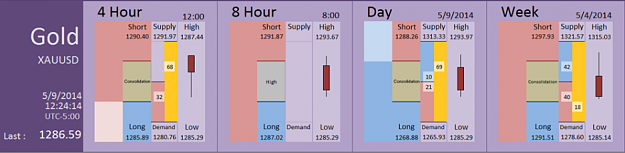

Chart #4

On the 4 Hour, the market is Bullish above 1291.49 with Supply @1294.51.

On the 8 Hour, the market is Bullish above 1293.10 with Supply @1294.91.

On the Day, the market is Bullish above 1290.28 with Supply now @1315.30.

The Week remains unchanged.

Chart #5

On the 4 Hour, (1) the market is Bullish above 1290.65, (2) Demand has overcome Supply such that we have a Low, (3) we have a Retracement Level @1290.65.

On the 8 Hour, the market is Bearish below 1291.87 with Demand @1290.12.

The Day remains unchanged.

On the Week, the market is Bearish below 1291.51 with Demand @1278.60.

Chart #6

On the 4 Hour, (1) the market is Bullish above 1290.65, (2) Demand has overcome Supply such that we have a Low, (3) we have a Retracement Level @1290.65. The market returns Neutral below 1290.65 and Bearish below 1289.27.

On the 8 Hour, (1) the market is Bearish below 1290.88, (2) Supply has overcome Demand such that we have a High, (3) we have Retracement Level @1290.88.

The Day and the Week remain unchanged.

Chart #7

On the 4 Hour, the market is Neutral between 1290.65 and 1289.26. The market returns momentarily Bullish above 1290.65 and momentarily Bearish below 1289.26.

The 8 Hour, the Day and the Week remain unchanged.

Chart #8 - Notice how the Day is now Bullish above 1288.26

On the 4 Hour, the market holds a Bearish Bias below 1290.40. The market returns Bearish below 1285.89 and Bullish above 1290.40.

On the 8 Hour, (1) the market is Bearish below 1287.02, (2) Supply has overcome Demand such that we have a High, (3) we have a new Retracement Level @1287.02.

On the Day, the market holds a Bullish Bias above 1268.88. The market returns Bullish above 1288.26 and Bearish below 1268.88. Notice how the Day is now Bullish above 1288.26.

On the Week, the market is Bearish below 1291.51 and the Unfilled Gap Indicator (i.e. Yellow Bar) now indicates 18%.

Chart #9 (Last)

Notice how the 8 Hour is now Neutral above 1287.02 and below 1291.87. The market returns momentarily Bullish above 1291.87 and momentarily Bearish below 1287.02.

The 4 Hour, the Day and the Week remain unchanged.

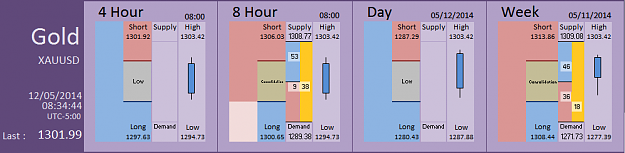

Chart #1

On the 4 Hour, (1) the market is Bearish below 1291.03, (2) Supply has overcome Demand such that we have a High, (3) we have a Retracement Level @1291.03.

On the 8 Hour, the market holds a Bullish Bias above 1287.10. The market returns Bullish above 1290.06 and Bearish below 1287.10.

On the Day, the market holds a Bullish Bias above 1267.49. The market returns Bullish above 1290.28 and Bearish below 1267.49.

On the Week, the market is Bearish below 1291.51 with Demand @1278.60.

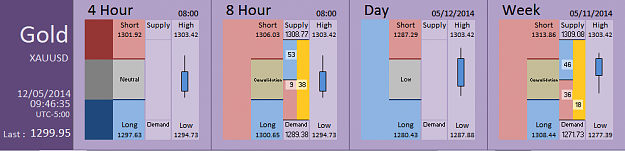

Chart #2

On the 4 Hour, the market holds a Bearish Bias below 1292.46. The market returns Bearish below 1291.03 and Bullish above 1292.46.

On the 8 Hour, the market is Bullish above 1290.06 with Supply @1295.54.

On the Day, the market is Bullish above 1290.28 with Supply @1315.31.

The Week remains unchanged.

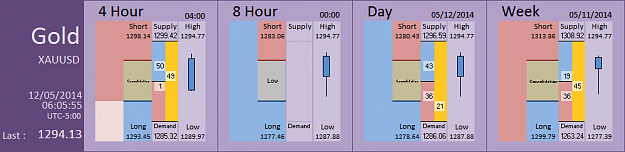

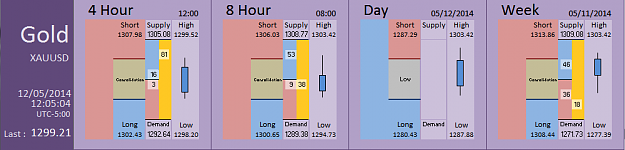

Chart #3

On the 4 Hour the market holds a Bearish Bias below 1293.51. The market returns Bearish below 1291.03 and Bullish above 1293.51. Notice how the 4 Hour recalculates the target High for the Bullish momentum in the market (compare Short value with Chart #1 and Chart #2 above).

The 8 Hour and the Day remain unchanged.

On the Week, the market has re-entered the Passive Consolidation Zone between 1297.93 and 1291.51.

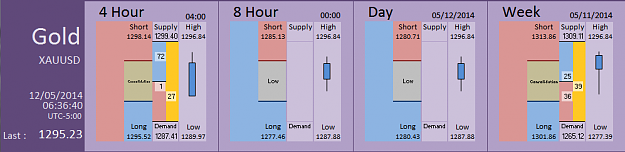

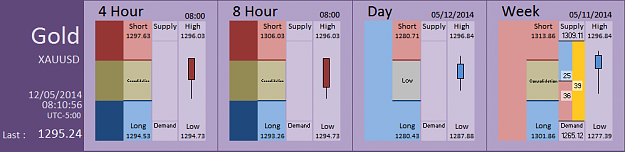

Chart #4

On the 4 Hour, the market is Bullish above 1291.49 with Supply @1294.51.

On the 8 Hour, the market is Bullish above 1293.10 with Supply @1294.91.

On the Day, the market is Bullish above 1290.28 with Supply now @1315.30.

The Week remains unchanged.

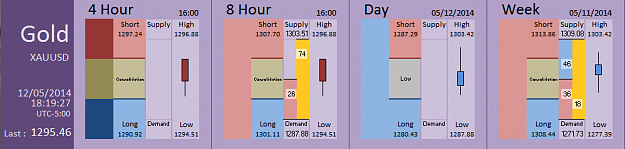

Chart #5

On the 4 Hour, (1) the market is Bullish above 1290.65, (2) Demand has overcome Supply such that we have a Low, (3) we have a Retracement Level @1290.65.

On the 8 Hour, the market is Bearish below 1291.87 with Demand @1290.12.

The Day remains unchanged.

On the Week, the market is Bearish below 1291.51 with Demand @1278.60.

Chart #6

On the 4 Hour, (1) the market is Bullish above 1290.65, (2) Demand has overcome Supply such that we have a Low, (3) we have a Retracement Level @1290.65. The market returns Neutral below 1290.65 and Bearish below 1289.27.

On the 8 Hour, (1) the market is Bearish below 1290.88, (2) Supply has overcome Demand such that we have a High, (3) we have Retracement Level @1290.88.

The Day and the Week remain unchanged.

Chart #7

On the 4 Hour, the market is Neutral between 1290.65 and 1289.26. The market returns momentarily Bullish above 1290.65 and momentarily Bearish below 1289.26.

The 8 Hour, the Day and the Week remain unchanged.

Chart #8 - Notice how the Day is now Bullish above 1288.26

On the 4 Hour, the market holds a Bearish Bias below 1290.40. The market returns Bearish below 1285.89 and Bullish above 1290.40.

On the 8 Hour, (1) the market is Bearish below 1287.02, (2) Supply has overcome Demand such that we have a High, (3) we have a new Retracement Level @1287.02.

On the Day, the market holds a Bullish Bias above 1268.88. The market returns Bullish above 1288.26 and Bearish below 1268.88. Notice how the Day is now Bullish above 1288.26.

On the Week, the market is Bearish below 1291.51 and the Unfilled Gap Indicator (i.e. Yellow Bar) now indicates 18%.

Chart #9 (Last)

Notice how the 8 Hour is now Neutral above 1287.02 and below 1291.87. The market returns momentarily Bullish above 1291.87 and momentarily Bearish below 1287.02.

The 4 Hour, the Day and the Week remain unchanged.

Using the FIA, traders need only "Sell the Highs" & "Buy the Lows".