2.3.1.3 Volume Bars

- One problem with tick bars is that order fragmentation introduces some arbitrariness in the number of ticks. For example, suppose that there is one order sitting on the offer, for a size of 10. If we buy 10 lots, our one order will be recorded as one tick. If instead on the offer there are 10 orders of size 1, our one buy will be recorded as 10 separate transactions.

- This is further exacerbated by ‘matching engines’ that split fills up into many artificial partial fills

- Volume bars circumvent that problem by sampling every time a pre-defined amount of the security's units (shares, futures contracts, etc.) have been exchanged. For example, we could sample prices every time a futures contract exchanges 1,000 units, regardless of the number of ticks involved.

2.3.1.4 Dollar Bars

- Dollar bars are formed by sampling an observation every time a pre-defined market value is exchanged. Of course, the reference to dollars is meant to apply to the currency in which the security is denominated,

- First, suppose that we wish to analyze a stock that has exhibited an appreciation of 100% over a certain period of time. Selling $1,000 worth of that stock at the end of the period requires trading half the number of shares it took to buy $1,000 worth of that stock at the beginning. In other words, the number of shares traded is a function of the actual value exchanged.

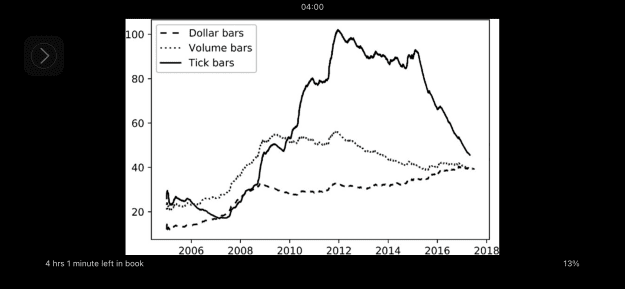

- If you compute tick bars and volume bars on E-mini S&P 500 futures for a given bar size, the number of bars per day will vary wildly over the years. That range and speed of variation will be reduced once you compute the number of dollar bars per day over the years, for a constant bar size. Figure 2.1 plots the exponentially weighted average number of bars per day when we apply a fixed bar size on tick, volume, and dollar sampling methods.

- the number of outstanding shares often changes multiple times over the course of a security's life, as a result of corporate actions. Even after adjusting for splits and reverse splits, there are other actions that will impact the amount of ticks and volumes, like issuing new shares or buying back existing shares (a very common practice since the Great Recession of 2008). Dollar bars tend to be robust in the face of those actions.

2