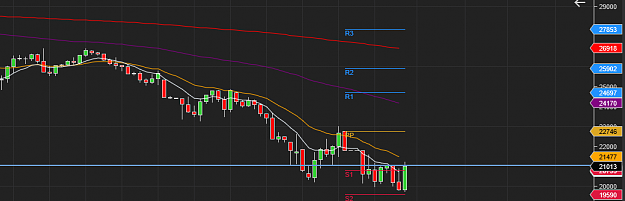

DislikedWhen SPX broke 2,400 I was surprised to see we had an orderly sell-off down to 2,380ish. It used to be when major support like that broke you'd quickly cascade lower but that hasn't happened at all during this sell off. Something is a little off here.Separately, something's also off about the bond market. The 10y should be going up when equities go down, but it peaked back on March 9th: {image}

Ignored

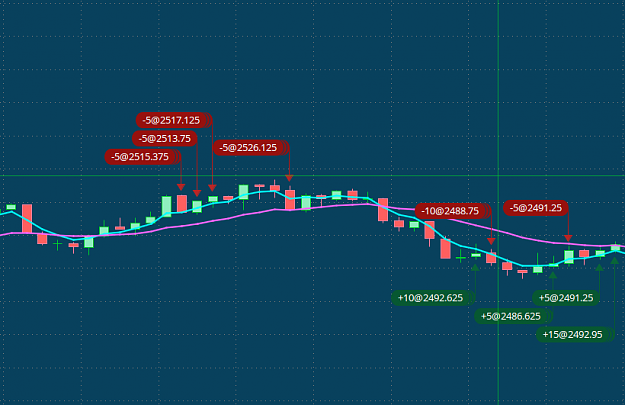

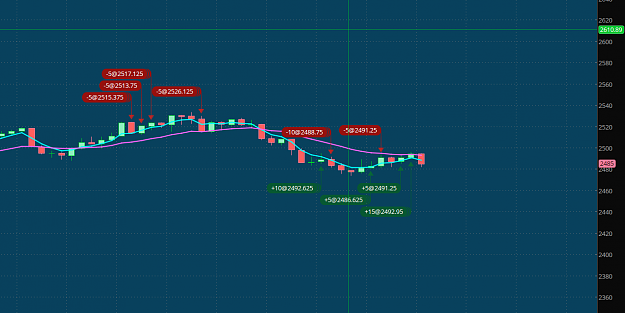

In hindsight I absolutely shouldve exited portion of that position 1 minute to nyse close, looking at the trades now it costed me way more than I excepted. Strange that we arent seeing more movement, it might be because of potential circuit breaker or something not sure, really weird though.

2