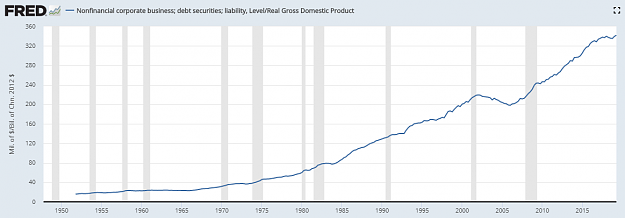

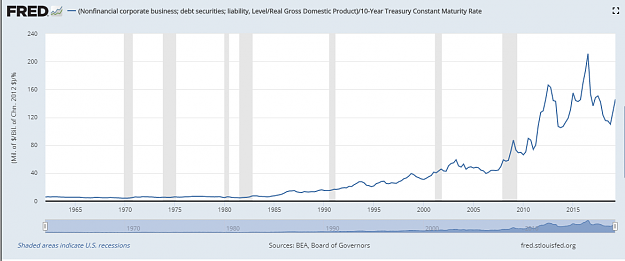

Over the weekend I had a conversation with a very good trader friend of mine from college. He's been trading 20+ years, is very knowledgeable, and has made a fortune in the markets. During our conversation he expressed concerns to me about debt levels in the United States, particularly associated with 1.) autos loans and 2.) real estate.

My initial reactions were:

So my initial reaction is it isn't a big deal. The reason I bring it up is because my trader friend is the type of guy we should be listening to. He and I both were buying back in January when everyone thought a recession was upon us. Given his track record I want to look into these debt issues further and see if he might be onto something I'm overlooking.

My initial reactions were:

- How bad can subprime autoloans really be? It seems like too small of issue to have a material impact on the economy.

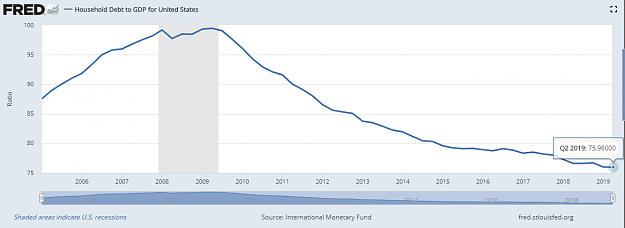

- Yes, high real estate debt could be bad if prices fall enough but how much can we really expect them to fall by?

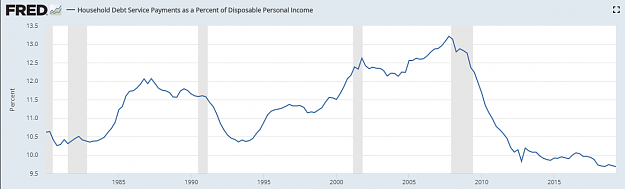

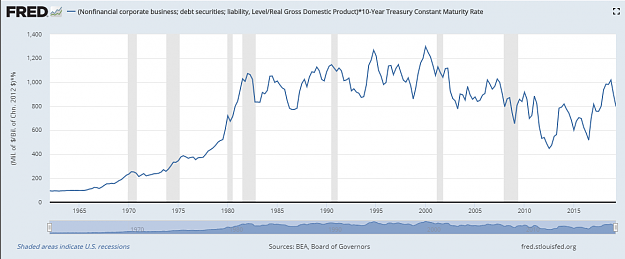

Further, we may have high debt, but interest rates are low so actual debt burdens are low:

So my initial reaction is it isn't a big deal. The reason I bring it up is because my trader friend is the type of guy we should be listening to. He and I both were buying back in January when everyone thought a recession was upon us. Given his track record I want to look into these debt issues further and see if he might be onto something I'm overlooking.

Self-sufficiency is the greatest of all wealth. - Epicurus

1