This thread is where I'll be posting my views and other commentary on the metals markets.

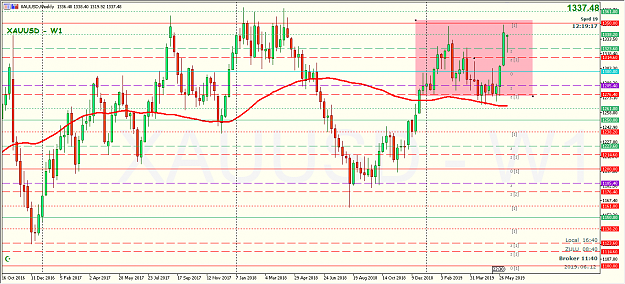

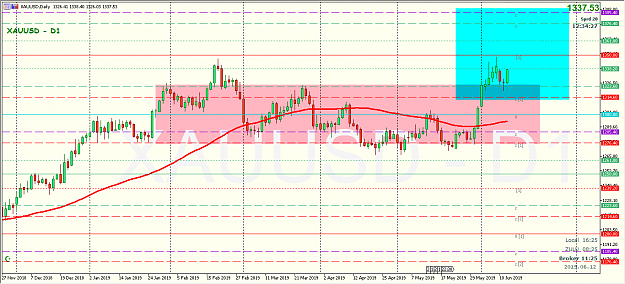

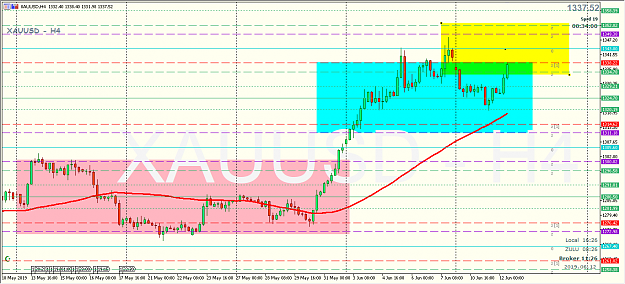

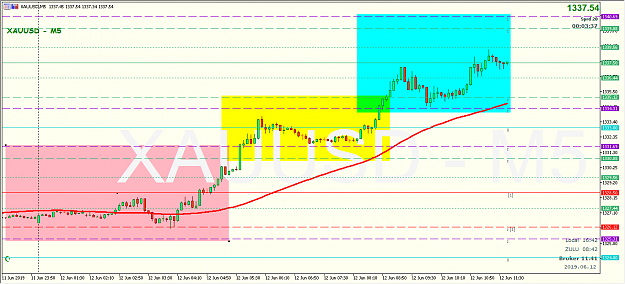

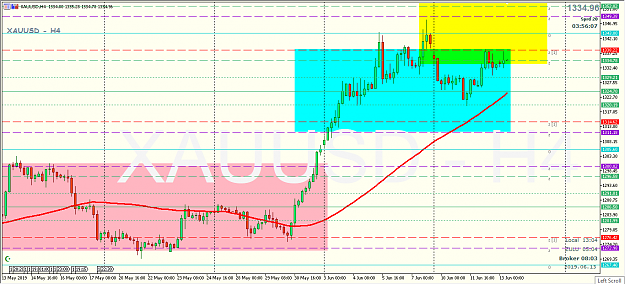

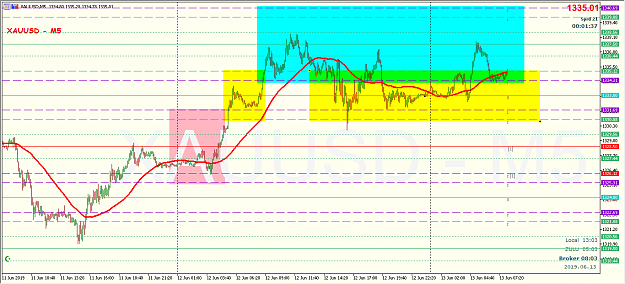

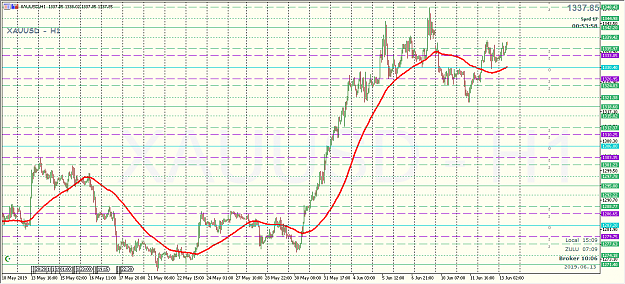

The S/R levels (i.e. likely bank trader order levels) as depicted in their respective timeframes in my following posts have not changed, and will likely NEVER change regardless what happens in financial markets.

What follows is my own world view, developed from an institutional trading career dating back to 1995.

I won't comment much on fundamentals except by way of snarky comments which may or may not jive with the pseudo intellectuals who alway need to be "right".

To be clear: I'M NOT INTERESTED IN CONVINCING ANYONE. If you, the reader, need convincing, go find a market goo-roo someplace else.

Enjoy!

The S/R levels (i.e. likely bank trader order levels) as depicted in their respective timeframes in my following posts have not changed, and will likely NEVER change regardless what happens in financial markets.

What follows is my own world view, developed from an institutional trading career dating back to 1995.

I won't comment much on fundamentals except by way of snarky comments which may or may not jive with the pseudo intellectuals who alway need to be "right".

To be clear: I'M NOT INTERESTED IN CONVINCING ANYONE. If you, the reader, need convincing, go find a market goo-roo someplace else.

Enjoy!

I'm not trying to convince anyone. I'm not in the "convincing" business.