With more than 10 years of experience in trading, I have found the best gold scalping strategy. I prefer gold because of the volume it offers, as it has an excellent amount of volatility. You can scalp this pair all day long. I am referring to the XAU/USD pair, which has the perfect amount of flexibility that you can use to your advantage.

Let's get into the strategy below:

Golden Indicators:

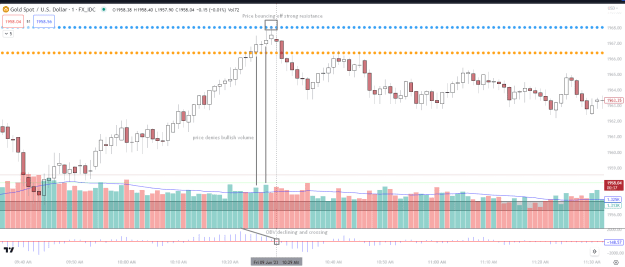

- Volume Indicator: You need a volume indicator, which I will attach below.

- 20 SMA in the Volume Bar: Stay with me as I elaborate on what this is for and how to use it.

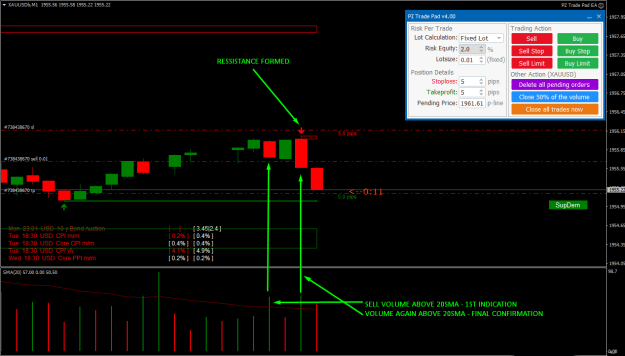

- Support/Resistance Area Indicator: You need a support/resistance area indicator on your chart, called SupDem, also attached below. Please note that these indicators are for MT4 version, and I apologize to MT5 lovers.

- News Indicator: Additionally, use an indicator to inform you when news is coming, so you can be aware of uncertain market volatility.

Golden Strategy:

Follow these steps closely:

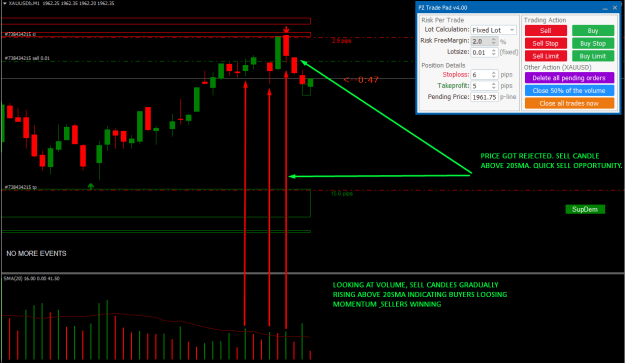

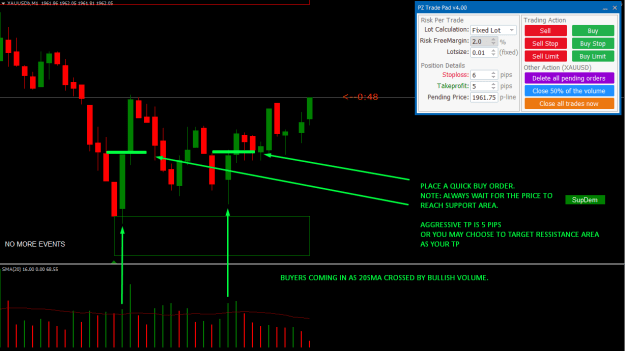

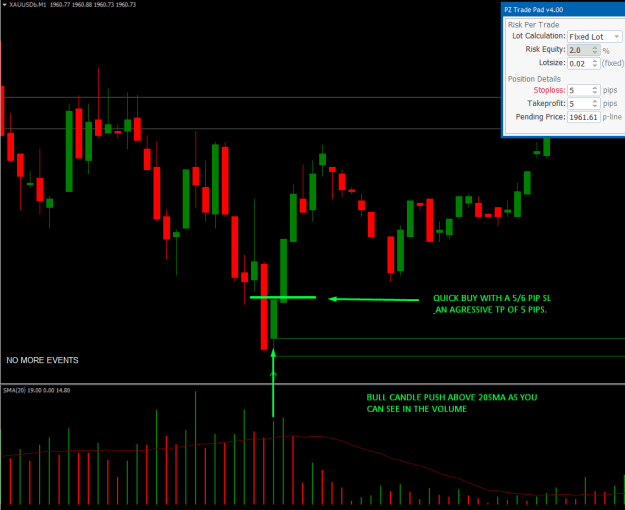

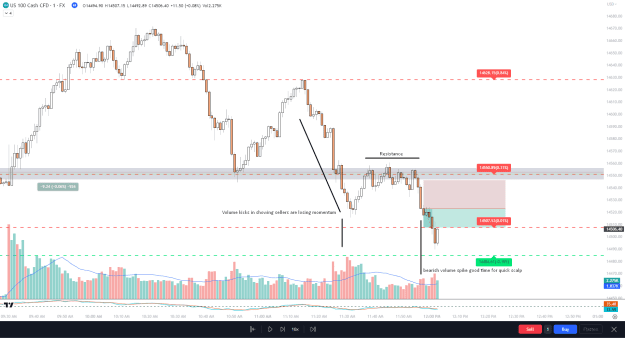

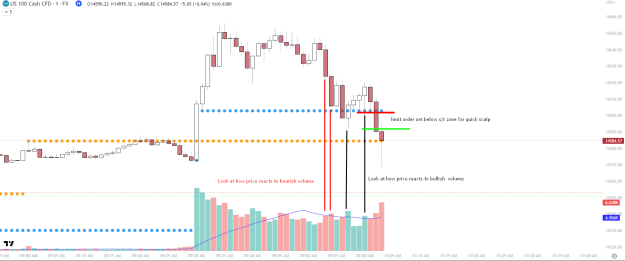

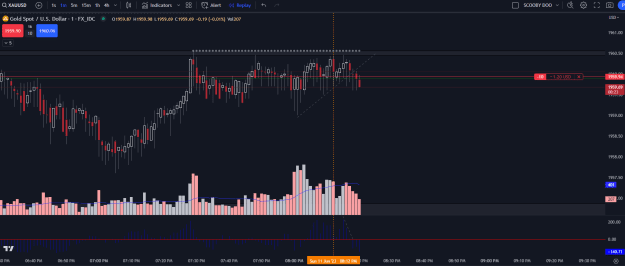

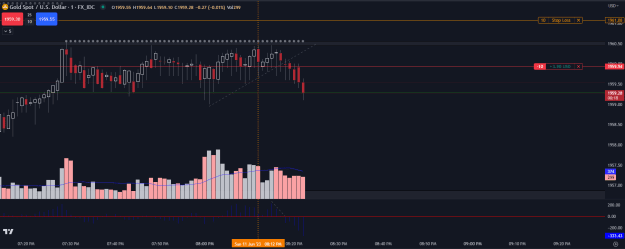

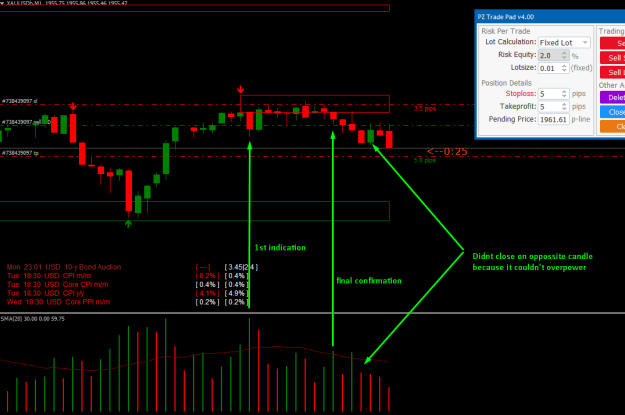

Step 1: Price must be in the support or resistance area before you consider a trade.

Step 2: When I say "consider," it means you observe. Only take a trade when everything aligns.

Step 3: Start analyzing the volume:

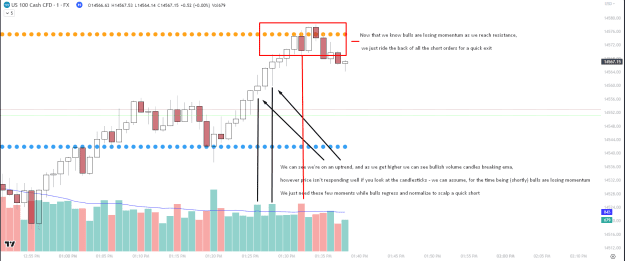

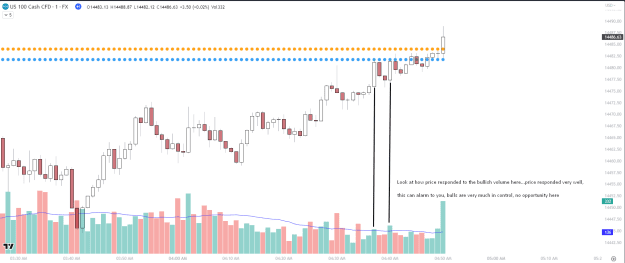

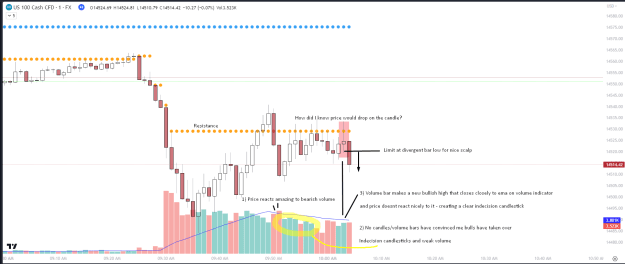

(imagine....) Volume is below the 20 SMA.. No one is winning...Previously, buyers were the winners, so buyers are still in power.....New volume is just printed and it couldn't cross the 20 SMA, indicating buyers are still in power but losing momentum.....Suddenly, a new volume prints and crosses well above the 20 SMA, candle was red indicating sellers coming in. Perfect sell indication because it's also in the resistance area.

Step 4: Use PZ Trade Manager (or your preferred trade manager) to execute the order as soon as you have confidence. Scalping is about timing and speed.

Trade Management:

- This strategy is extremely powerful, but you must remain attentive to your order. Don't leave it unattended. Monitor how it progresses.

- If a decisive volume crosses the 20 SMA in the resistance area (and you took a sell), you can be confident it will move in your favor unless another volume overpowers the previous one.

- As the trade progresses, continuously minimize your risk. Drag your stop-loss line to a comfortable area.

- Remember, this is an aggressive procedure, and you need to remain stealthy. Soon, you will gain confidence. You'll learn that even if the last candle was big and red but price will go up because the volume was low for that candle.

Notes:

- Volume crossing the 20 SMA, followed by another volume crossing the 20 SMA, is a confidence booster.

- When volume is declining and suddenly a new volume crosses the 20 SMA, it is a directional superpower.

- Stick to trading within the support/resistance zones. Avoid trading in the middle. Out-of-zone trading is for when you become a master at reading volume.

Psychology:

- You lose only when you lose inside of yourself.

- It works as long as you believe it works.

- There's no need to beat yourself up over a market that is built on randomness.

- Hope, might, and possibilities are bad ways to trade. Confidence comes from certainty.

- A strategy is meaningless without experience. The more experience you have, the better, but it should be approached objectively.

- You may not like or feel an emotional attachment to a particular setup, but you execute it like a cold-blooded killer.

- When you lose, question why. When you win, question how.

Wish you a successful trading Journey!

(Use a zero spread account with lowest possible commission/pro account with tight spread)

Recommend zero spread broker: https://www.hfm.com/sv/?refid=376050

(This strategy is Not suitable for standard account)

Let's get into the strategy below:

Golden Indicators:

- Volume Indicator: You need a volume indicator, which I will attach below.

- 20 SMA in the Volume Bar: Stay with me as I elaborate on what this is for and how to use it.

- Support/Resistance Area Indicator: You need a support/resistance area indicator on your chart, called SupDem, also attached below. Please note that these indicators are for MT4 version, and I apologize to MT5 lovers.

- News Indicator: Additionally, use an indicator to inform you when news is coming, so you can be aware of uncertain market volatility.

Golden Strategy:

Follow these steps closely:

Step 1: Price must be in the support or resistance area before you consider a trade.

Step 2: When I say "consider," it means you observe. Only take a trade when everything aligns.

Step 3: Start analyzing the volume:

(imagine....) Volume is below the 20 SMA.. No one is winning...Previously, buyers were the winners, so buyers are still in power.....New volume is just printed and it couldn't cross the 20 SMA, indicating buyers are still in power but losing momentum.....Suddenly, a new volume prints and crosses well above the 20 SMA, candle was red indicating sellers coming in. Perfect sell indication because it's also in the resistance area.

Step 4: Use PZ Trade Manager (or your preferred trade manager) to execute the order as soon as you have confidence. Scalping is about timing and speed.

Trade Management:

- This strategy is extremely powerful, but you must remain attentive to your order. Don't leave it unattended. Monitor how it progresses.

- If a decisive volume crosses the 20 SMA in the resistance area (and you took a sell), you can be confident it will move in your favor unless another volume overpowers the previous one.

- As the trade progresses, continuously minimize your risk. Drag your stop-loss line to a comfortable area.

- Remember, this is an aggressive procedure, and you need to remain stealthy. Soon, you will gain confidence. You'll learn that even if the last candle was big and red but price will go up because the volume was low for that candle.

Notes:

- Volume crossing the 20 SMA, followed by another volume crossing the 20 SMA, is a confidence booster.

- When volume is declining and suddenly a new volume crosses the 20 SMA, it is a directional superpower.

- Stick to trading within the support/resistance zones. Avoid trading in the middle. Out-of-zone trading is for when you become a master at reading volume.

Psychology:

- You lose only when you lose inside of yourself.

- It works as long as you believe it works.

- There's no need to beat yourself up over a market that is built on randomness.

- Hope, might, and possibilities are bad ways to trade. Confidence comes from certainty.

- A strategy is meaningless without experience. The more experience you have, the better, but it should be approached objectively.

- You may not like or feel an emotional attachment to a particular setup, but you execute it like a cold-blooded killer.

- When you lose, question why. When you win, question how.

Wish you a successful trading Journey!

(Use a zero spread account with lowest possible commission/pro account with tight spread)

Recommend zero spread broker: https://www.hfm.com/sv/?refid=376050

(This strategy is Not suitable for standard account)

Attached File(s)

Protect your capital