U.S. PCE Inflation, Fed Chair Powell Speech, BOJ Meeting Minutes: Macro Week Ahead

U.S. PCE Inflation, Fed Chair Powell Speech, BOJ Meeting Minutes: Macro Week Ahead

By:Ilya Spivak

Stocks are at risk as markets struggle to rebuild risk appetite after dovish guidance from the Federal Reserve

- Stocks, gold and the U.S. dollar fail to find follow-through on dovish Fed guidance

- Minutes from the Bank of Japan policy meeting might catalyze the Japanese yen

- U.S. PCE inflation data and a speech from Chair Powell come amid market closure

Looking at weekly performance statistics, financial markets were defined by a dovish lead from the Federal Reserve last week.

The central bank stuck to its forecast of three interest rate cuts for 2024, even as it upgraded growth and inflation bets when it updated its Summary of Economic Projections, alongside the policy announcement on March 20.

Stocks rose, with the bellwether S&P 500 adding just over 2% and the tech-tilted Nasdaq 100 up nearly 3%. Treasury bond yields fell at the front and back end of the curve. Two- and ten-year rates declined 2.9% and 2.5% respectively. The U.S. dollar weakened against all its major peers except the Japanese yen, where the Bank of Japan was in focus.

Did markets really cheer a dovish Fed?

That seems deceptive, however. Looking beyond the markets’ initial kneejerk reaction to the Fed’s pronouncements, a hugely different picture emerges. Wall Street failed to follow through, with stocks returning a flat result in the two days after the rate decision. The greenback rose, and gold prices fell.

Interestingly, yields continued to slide but the losses were concentrated at the long end of the curve, with the 10-year rate down 1.8% in the last two days of last week’s trade while the two-year shed just 0.4%. This was the inverse of what happened in the Fed’s immediate aftermath, where near-term rates underperformed.

Perhaps most tellingly, the priced-in policy path stands little-changed. Fed fund futures are pricing in 70 basis points (bps) in rate cuts for 2024. That is a mere 3 bps away from the 73b-ps tally where markets settled after Chair Powell and the Federal Open Market Committee (FOMC) had their say.

This leaves the markets wrestling with a critical question: was the expectation of Fed stimulus the sole driver of the upswell in risk appetite since November 2023, and if so, is that tailwind now exhausted?

Here are the macro waypoints that are likely to shape price action in the week ahead.

Bank of Japan (BOJ) summary of opinions

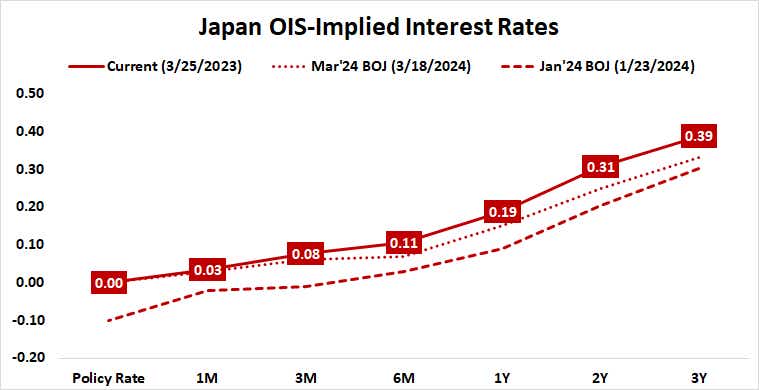

The Japanese yen slumped last week after the Bank of Japan (BOJ) lifted its target interest rate from negative territory and retired the policy of yield curve control (YCC), a cap of 0% on the 10-year Japanese government bond (JGB) yield, as widely expected. Dovish rhetoric alongside these moves signaled rapid tightening is unlikely.

From here, traders will be keen to digest an editorial summary of the proceedings from this month’s fateful policy conclave to gauge BOJ official’s reaction function going forward. If BOJ appears prepared to keep raising rates amid signs of returning economic vigor, the yen may rise.

U.S. personal consumption expenditure (PCE) data and Fed Chair Powell's speech

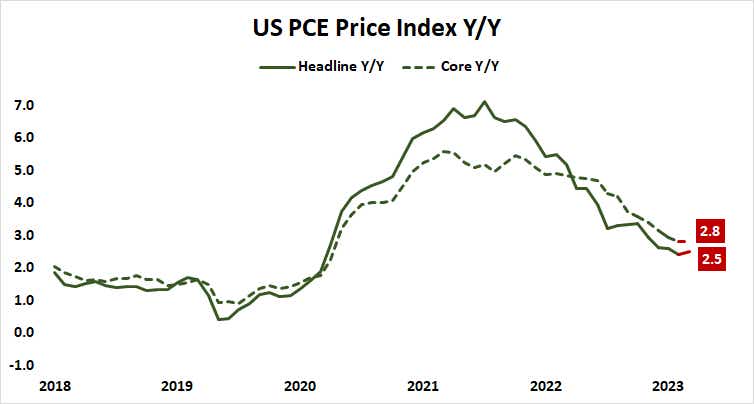

The Fed’s favored measure of inflation is expected to show that core price growth held steady at 2.8% year-on-year in February while the headline reading inched up from 2.4% to 2.5%. Fed Chair Jerome Powell will speak at the central bank’s San Francisco branch on the same day.

Gauging the markets’ reaction to what happens here will be challenging because U.S. markets will be closed for the Good Friday holiday. Over the counter (OTC) markets, like spot foreign exchange, will be nominally open, but liquidity is likely to be so thin and participation so limited that any trend development will be forced to wait until the following week.

China purchasing managers index (PMI) data

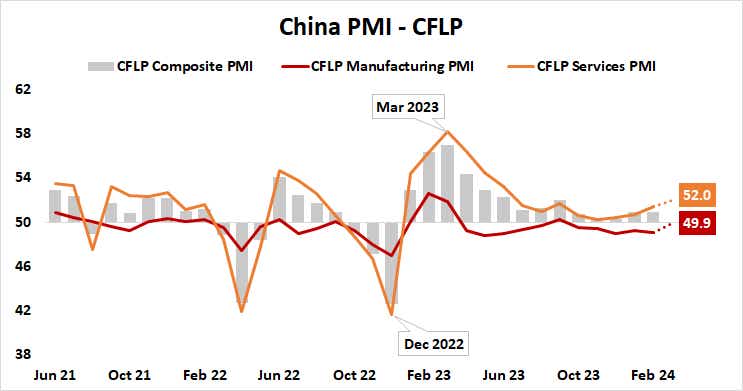

China is expected to report that service-sector activity growth accelerated in March while the manufacturing side has nearly arrested months of decline with a return to neutral. If the “dovish Fed” narrative has truly run aground, gauging whether a pickup in the world’s second-largest economy can uplift risk appetite may be broadly telling.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.