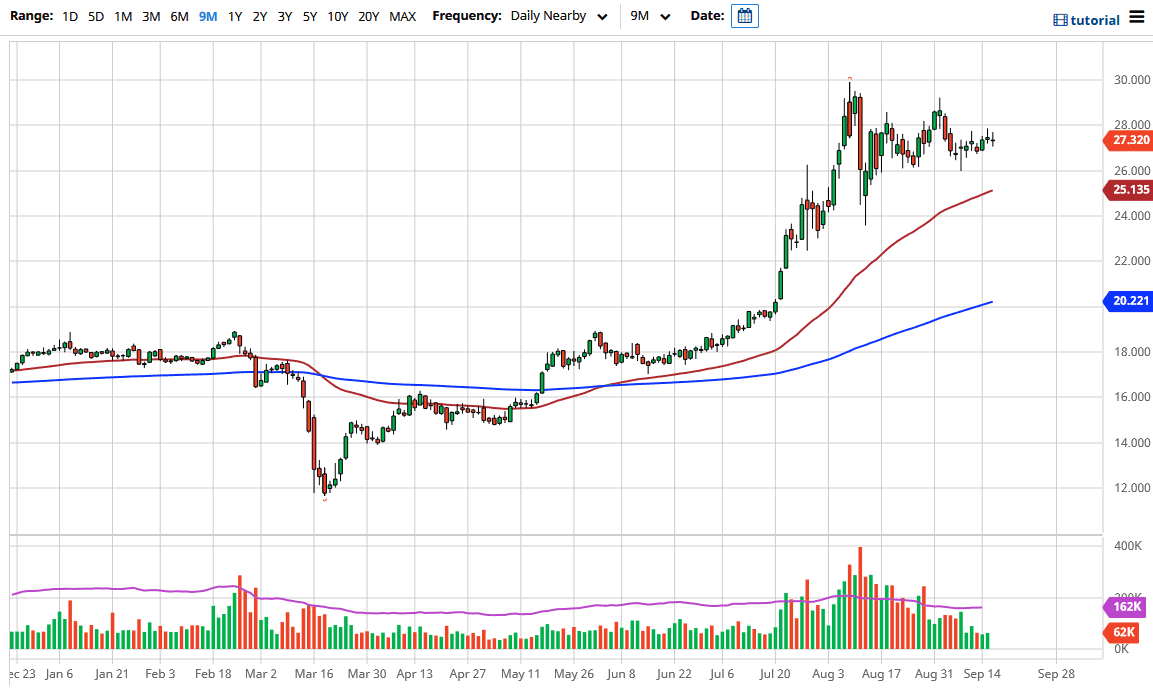

The silver markets have rallied again during the trading session on Wednesday but continue to struggle with the $28 handle. That is an area that has been difficult to deal with, and therefore I do think that it is only a matter of time before we see some type of selling pressure, and precious metals look a little bit soft at the end of the day. Whether or not it is a trend change is a completely different argument but at this point, it certainly looks as if we are going to continue to see a lot of volatility in choppiness.

Silver markets are moving in a perfectly inverse correlation to the US dollar, and as the US dollar picked up strength late in the day, we started to see more selling of precious metals. Again, I do not feel that this is a market that is going to suddenly break down, at least not without some other catalyst. Looking underneath, the $26 level continues to be massive support, just as the $25 level will be as the 50 day EMA is sitting in that same general vicinity. This is a market that continues to be very noisy, so I think we just simply go back and forth as we have done for some time.

To the upside, the $28 level could offer a bit of resistance, so that is worth paying attention to. If we can break above there, then obviously it would be very bullish for silver and could send it looking towards the $29 level, possibly even the $30 level if we can break above there. It is at the $30 level that we would see a massive amount of upward mobility in this market, as typically a break above the $30 level will send in massive amounts of money into this market yet again. We have seen the silver markets break above the $30 level couple of times, and that normally means that we are suddenly looking at a move towards the $50 level. Granted, that is a longer-term call, but it is possible. We need to see the US dollar weakens significantly in order for that to happen, and at this point, it looks like the silver market is trying to figure out where things are going to go with the greenback, as we are basing on the massive selloff.