Hi Everyone,

This will be my very first trade journal. All the future posts will primarily be my thoughts and it is not meant for you guys to trade upon. If you should do so, it would be at your own risk. I must also say that I currently only have about 3 years of live trading experience. I am currently being mentored by a really nice lady, but until I become consistently profitable, I would not mention her so as not to shame her or dishonor her skills and belief in me.

For anyone that wishes to share their thoughts with me, please do so and I will gladly share my views with you. But at the same time, I do recognize that we may, more often than not, agree to disagree. Yet, I will defend your right and mine to express our own views and opinions. My trading details are below for anyone that also wishes to compare their trading calls and ideas with mine:

Broker: Oanda Asia Pacific

Timezone: +8Hrs GMT (Singapore)

Asset Class Traded: CFDs and FX - Hopefully get into futures full time too

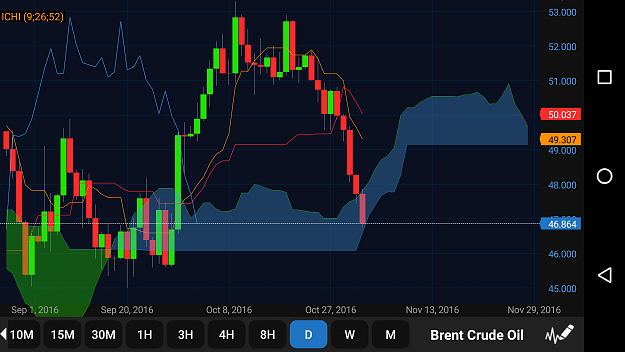

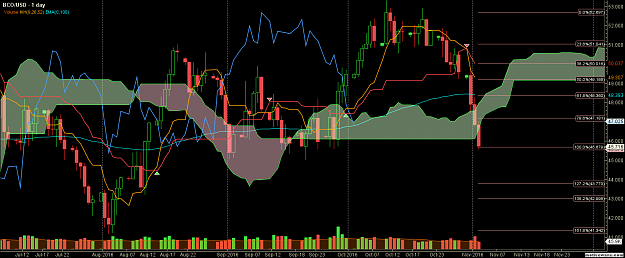

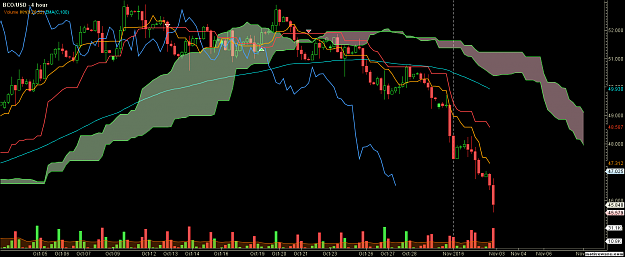

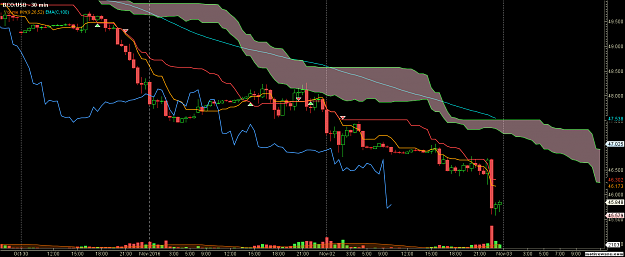

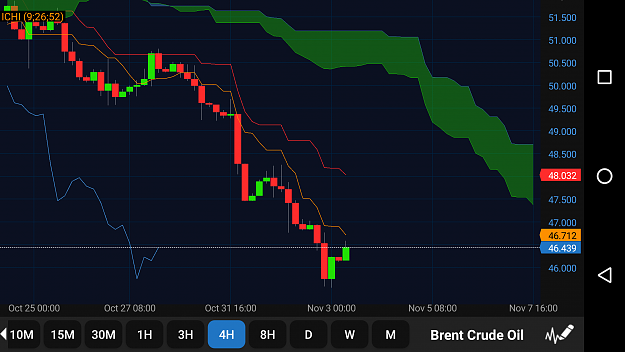

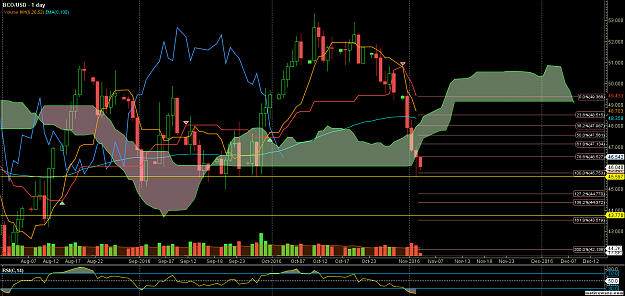

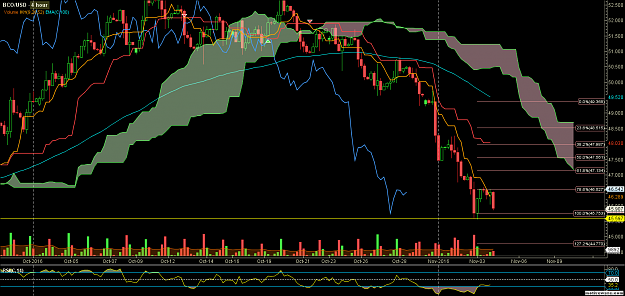

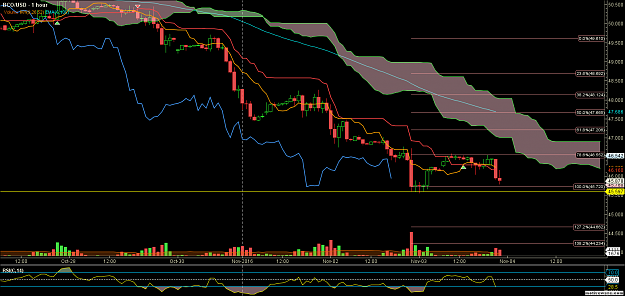

Instruments Currently Traded: Brent Crude Oil, Major FX pairs

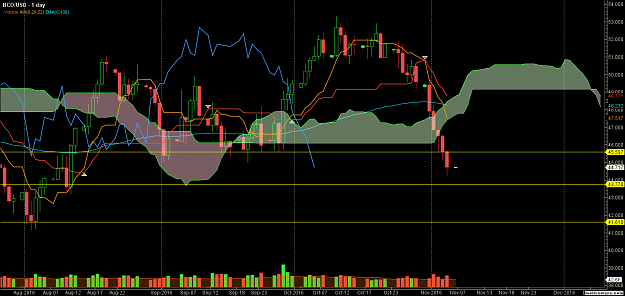

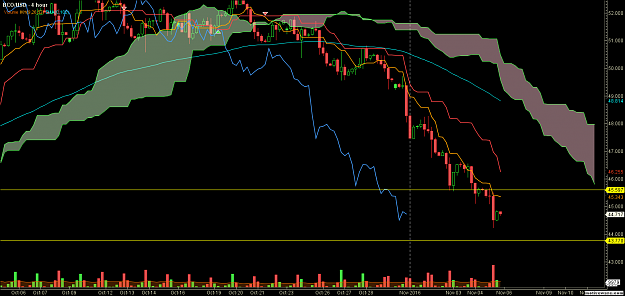

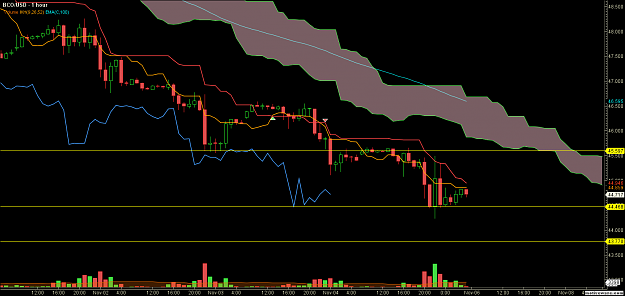

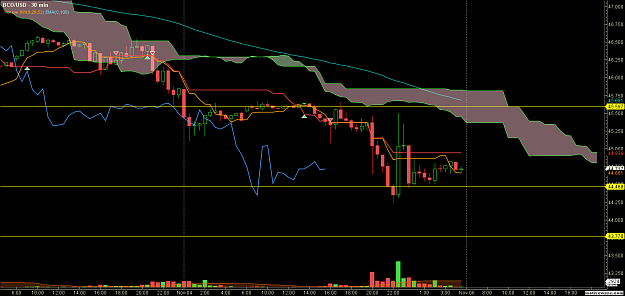

Timeframe: Mainly Daily, 4H, 1H, 30M. Sometimes 15M.

Note: Charts may sometimes look different as I trade on my Mobile (Oanda's mobile platform) and Desktop (Motivewave).

Legend:

Immediate Support level => Support 1 (S1)

Subsequent Support level => Support 2 (S2)

Immediate Resistance level => Resistance 1 (R1)

Subsequent Resistance level => Resistance 2 (R2)

Very Bullish => ++

Bullish => +

Neutral => NA

Bearish => -

Very Bearish => --

Thanks everyone for reading. I hope I can help you guys in any small ways.

God Bless.

Talent Trader

This will be my very first trade journal. All the future posts will primarily be my thoughts and it is not meant for you guys to trade upon. If you should do so, it would be at your own risk. I must also say that I currently only have about 3 years of live trading experience. I am currently being mentored by a really nice lady, but until I become consistently profitable, I would not mention her so as not to shame her or dishonor her skills and belief in me.

For anyone that wishes to share their thoughts with me, please do so and I will gladly share my views with you. But at the same time, I do recognize that we may, more often than not, agree to disagree. Yet, I will defend your right and mine to express our own views and opinions. My trading details are below for anyone that also wishes to compare their trading calls and ideas with mine:

Broker: Oanda Asia Pacific

Timezone: +8Hrs GMT (Singapore)

Asset Class Traded: CFDs and FX - Hopefully get into futures full time too

Instruments Currently Traded: Brent Crude Oil, Major FX pairs

Timeframe: Mainly Daily, 4H, 1H, 30M. Sometimes 15M.

Note: Charts may sometimes look different as I trade on my Mobile (Oanda's mobile platform) and Desktop (Motivewave).

Legend:

Immediate Support level => Support 1 (S1)

Subsequent Support level => Support 2 (S2)

Immediate Resistance level => Resistance 1 (R1)

Subsequent Resistance level => Resistance 2 (R2)

Very Bullish => ++

Bullish => +

Neutral => NA

Bearish => -

Very Bearish => --

Thanks everyone for reading. I hope I can help you guys in any small ways.

God Bless.

Talent Trader