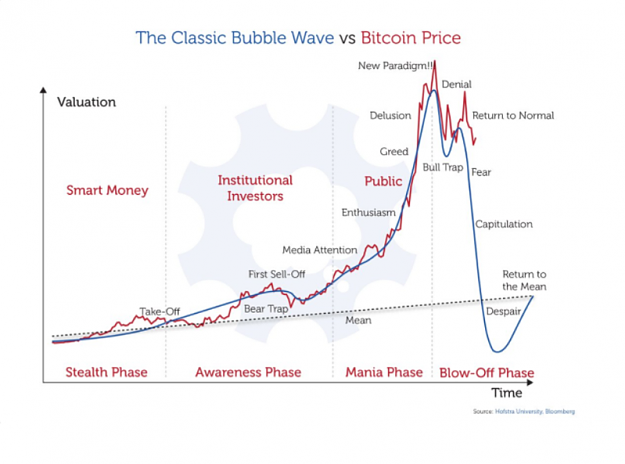

DislikedIt reminds me of Bitcoin in mid 2020, a time when I was insanely bullish but the market wasn't there yet. I had to keep askingIgnored

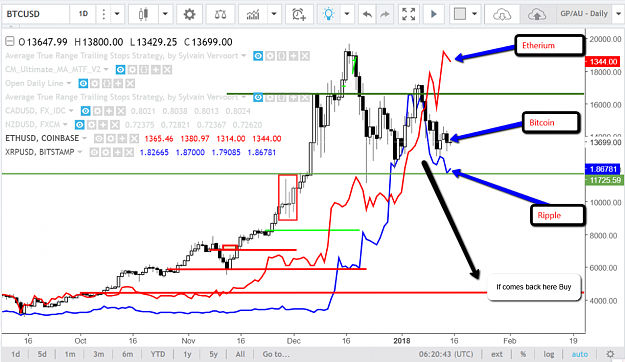

Bought in based on the pullback of last bull at around 4200 then stopped out just before it sky rocketed.

1