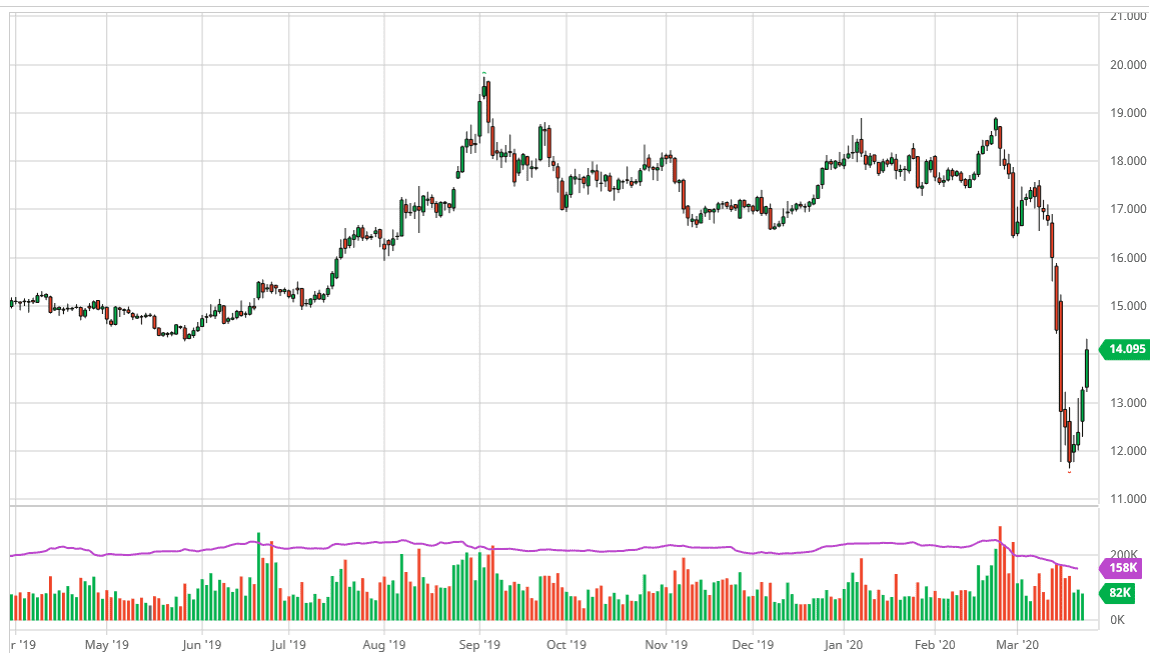

Silver markets got a bit of a boost during the trading session on Tuesday, breaking above the $14.00 level as traders look at the Federal Reserve jumping into the market with liquidity as an opportunity to pick up precious metals. That being said though, the market has sold off quite drastically before then, and therefore I think this is probably more or less going to be a “relief rally”, which can last for a short amount of time. At this point, I think that sellers will probably come back in near the $15.00 level, but I don’t necessarily think that we revisit the lows either.

In the typical structure of an oversold condition that changes its attitude, you will see a massive surge lower followed by a bounce that then sells off again to somewhat retest the lows. The real tell would be if the market could not make a fresh, new low. A “higher low” would confirm that there is in fact support underneath that should keep this market afloat. The market looks very oversold, but at the first signs of exhaustion after this short-term rally, I will be a seller as there should be plenty of resistance above. However, the market was to break above the $15.00 level without pulling back, it would show that we are about to get a monstrous rip higher.

The biggest problem with trading silver sometimes is that although it is a precious metal, it is also an industrial one. This means that while the market takes off to the upside, it may lag gold as industrial demand for silver is certainly going to be very thin to say the least. With the entire global economy slowing down, it’s hard to imagine that silver will be in much demand other than to function as a precious metal. If you are going to buy a precious metal, you are probably going to be better off with gold than anything else. This isn’t to say that you can’t profit from silver going higher, just that you may wish to look for some type of pullback in order to find enough value to get involved. Silver is going to continue to be very volatile as it typically is, even more so than gold as the contract is somewhat thinner than the yellow metal. All things being equal, I am bullish, but I want to buy silver closer to $13.