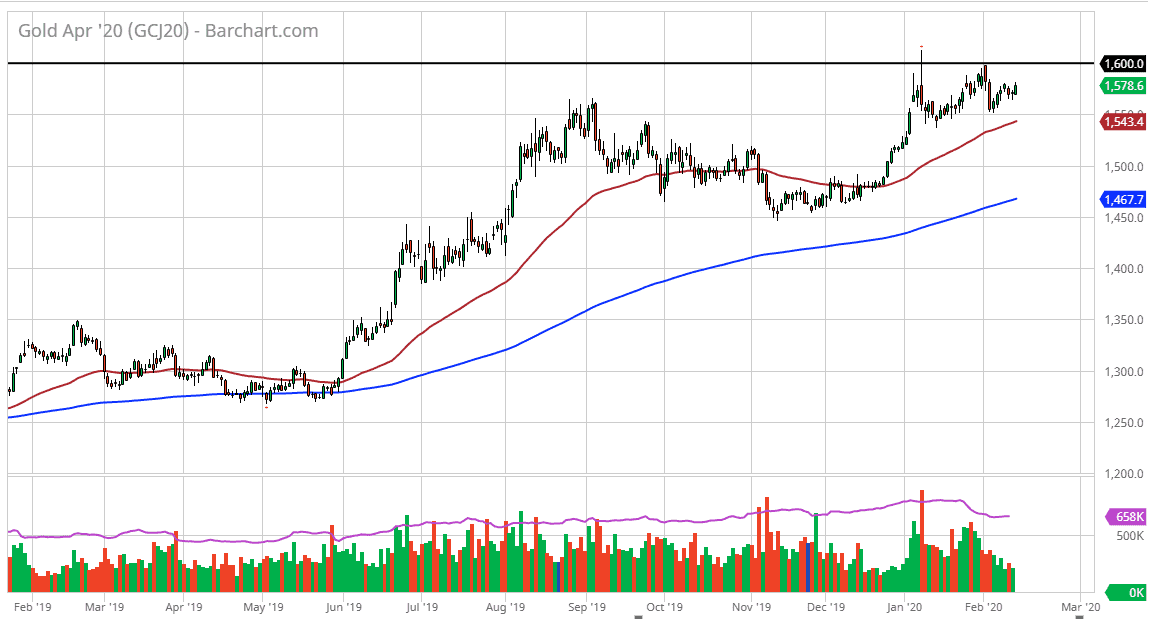

The gold markets rallied a bit during the trading session on Thursday, but then found the area above the $1580 level to be a bit too resistive. The area between there and the $1600 level should continue to cause some issues, so I would not be surprised at all to see a short-term pullback. The pullback should offer value, especially if we get closer to the $1550 level. The 50 day EMA is starting to race towards that area as well, so it’s only a matter of time before the buyers would jump back in and push higher. A move below their opens up the door down to the $1500 level but right now I do not anticipate seeing that.

If it does happen, then I think it’s a value opportunity that we can take advantage of. The $1500 level could very well attract a lot of people, as it is a large, round, psychologically significant figure. The downside is somewhat limited though, and I would be surprised if we breakdown through there. At this point, the market breaking through the $1500 level would mean that we would see a sudden “risk on” type of situation where everything was perfectly fine. I don’t see that happening in the short term, and then of course we also have the issue of loose monetary policy coming from multiple central banks around the world. Central banks around the world keeping monetary policy loose is a bit of a lift to gold over the longer term anyway, so therefore I have an upward bias and have no interest in shorting.

The $1600 level above is a significant amount of resistance, so if we were to reach above that level it’s very likely that the market would kick off the next move higher, reaching towards the $1800 level. At this point, the market is likely to struggle to get above there, but breaking that level then opens up the door to the 2000 level. All things being equal though, it is the long game if you are looking for those numbers. It would take some type of massive serious “risk off” type of situation see gold rocket to the upside. I think the overall attitude of the market is going to be one of grinding higher, not massive breakouts. I do like gold, but I prefer building up a position over time.