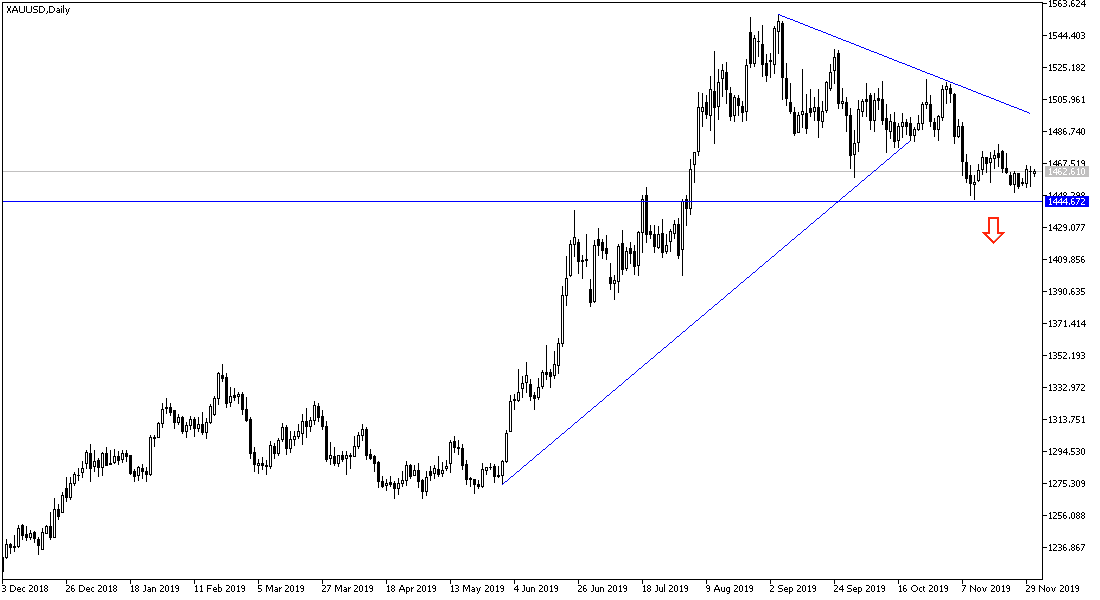

For eight consecutive trading sessions, the price of gold is moving in a limited range between the $1450 support and the $1466 resistance in a cautious wait until the announcement of the deadline for the formal signing of the “Phase 1” trade agreement between the United States and China. Failure of the agreement will be a strong supporter of gold to return to the vicinity of $1500 psychological resistance as soon as possible. But the deal, if satisfactory to the markets, could be a major pressure on the price of gold to test stronger support areas. A limited agreement means the stability of gold prices. The future of Britain's upcoming elections on Dec. 12 will have an impact on the direction of gold investors as well.

During November. Global equity markets were bullish. The MSCI index of equities in developed countries rose more than 2% for the second month in a row, and its index of emerging market stocks rose slightly after a 4% jump in October. This means that investors are ready for more risk. On global central bank policy, the monetary policy of both the US Federal Reserve as well as during the first meeting of the new ECB governor Christine Lagarde, is expected to be maintained. There is a strong sense that she will continue Mario Draghi's stimulus policy until the Eurozone’s economy is revived. The Bank of Japan has quietly reduced its equity purchases and systematically reduced bond purchases. Nothing is expected soon. There were two opponents on the Bank of England's Monetary Policy Committee in October and the chance of a UK rate cut at the MPC meeting a week after the election is possible.

It was hoped that the United States and China would sign the "Phase 1" trade agreement in November after the Trump administration claimed an agreement had been reached in principle in mid-October. However, this has proved to be elusive and an agreement is unlikely to be reached until the first quarter of 2020 at the earliest. President Trump has threatened to increase tariffs if there is no agreement. However, by the end of November, there was talk of a 15% duty on about $ 160 billion of Chinese imports scheduled for December 15 and likely to be suspended like October tariffs.

According to the technical analysis of gold: the return of global trade and geopolitical tensions will favor the return of gold gains, and the nearest gain levels are currently at 1467, 1485 and 1500 respectively. The last level will strengthen the uptrend again. The surprise announcement of the details of a US-China trade agreement increases the downward pressure on gold to move towards support levels 1452, 1445 and 1430 respectively. We still prefer to buy gold from every bearish level.

Today's economic calendar has no significant US economic data.