The Commodities Feed: Tariff man strikes again

Your daily roundup of commodity news and ING views

Energy

It was a day of two halves for the oil market yesterday, with strength earlier in the day driven by strong macro data out of China, along with suggestions of the potential for deeper cuts from OPEC+ when they meet later this week. However as the day progressed, the market did give back quite a bit of these gains. A decision from the US to reintroduce tariffs on aluminium and steel imported from Brazil and Argentina did little to help sentiment while manufacturing data out of the US was also fairly disappointing. Meanwhile, the latest CFTC data (which was delayed due to Thanksgiving) shows that speculators increased their net long in NYMEX WTI by 64,475 lots over the last reporting week, leaving them with a net long of 198,056 lots as of last Tuesday - the largest position they have held since September. This larger positioning does leave the market more vulnerable to the downside, as we head into the OPEC+ meeting, particularly if the market is disappointed with the outcome of the meeting. Obviously this data does not factor in the large sell-off we saw in the market on Friday, for that we will have to wait for the next release on Friday.

Meanwhile, OPEC production estimates for November are starting to come through, and the latest Bloomberg survey shows that the group’s output fell by 110Mbbls/d to 29.7MMbbls/d for the month. Looking at our balance sheet, this suggests that OPEC is currently producing 800Mbbls/d above the level they need to in order to balance the market next year. The declines were mostly not voluntary, with Angola and Iran seeing reductions of 60Mbbls/d and 40Mbbls/d respectively. For Angola, ageing fields continue to weigh on output. Production in November was estimated at 1.28MMbbls/d, well below their output quota level of 1.48MMbbls/d. For Iran, the declines continue to reflect the effectiveness of US sanctions, as the country is exempt from the ongoing production cut deal. Moving on to Russia, and latest data shows that oil output over November remained unchanged at 11.24MMbbls/d, which means that Russia has had another month where they have not complied with the current output cut deal.

Turning to Saudi Arabia, and Aramco increased its official selling price for its Arab Light to Asia by US$0.30/bbl to US$3.70/bbl for January- the highest level seen since January 2014. This increase does appear to reflect a tighter physical market, and this is also supported by the strength that we have seen in the prompt ICE Brent time spreads, which remain well backwardated. Obviously moving forward, the outlook for official selling prices, and the time spreads will depend on what action OPEC+ take later this week.

Finally on the energy side, moving away from oil, and turning to the gas market. Yesterday, the Power of Siberia gas pipeline from Russia to China started operating. Once fully operational, the pipeline is expected to pipe as much as 38bcm of natural gas to China annually, although full capacity is only expected to be reached by 2025. In the meantime, Gazprom expects that minimum flows via the pipeline will be 5bcm in 2020, 10bcm in 2021 and 15bcm in 2022. Moving forward, it will be interesting to watch what impact the ramping up of the pipeline has on LNG imports into China. China has been the key growth market for LNG demand in recent years, however with increasing pipeline capacity coming online, this could weigh on Chinese LNG demand growth moving forward.

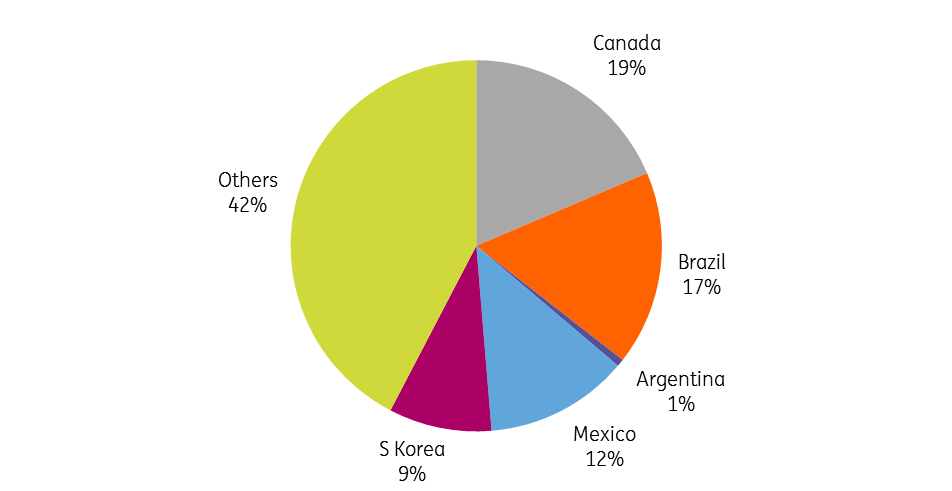

US steel imports by origin- 2019 YTD

Metals

The copper market faced quite a day of conflicting macro data yesterday. Stronger than expected PMI data out of China over the weekend, saw LME copper open higher on the day. However, US ISM manufacturing data released later in the day was fairly disappointing, which weighed on the market. On the trade side, fears have risen as US Commerce Secretary Wilbur Ross told Fox Business that President Trump would hike tariffs on China if there was no deal by the 15th December. Meanwhile, the surprise reintroduction of aluminium and steel tariffs on Brazil and Argentina has done little to help sentiment. These tariffs come into force immediately, with President Trump not happy about the devaluation in their respective currencies, and the impact this is having on US farmers. Weaker currencies and growing output in grains and oilseeds from the region has led to significantly more competition over export markets for US farmers.

New tariffs are likely to tighten the US steel market, with Brazil supplying nearly 17% of total US steel imports over the first 10 months of 2019. On the other hand, the move will not have much of impact on aluminium, as supply from both of these countries is very low at around 3% only.

For aluminium, the divergent trends between the LME and ShFE inventories continue, with the LME continuing to see inflows into Malaysian warehouses. There does appear to be somewhat of a disconnect between LME aluminium reportable stocks, and the broader supply & demand dynamics. Yesterday Norsk Hydro proposed reducing operating rates at its 175ktpa Slovalco smelter in Slovakia by around 20% starting next year, as profitability at the smelter remains poor. According to a Bloomberg report, this proposal is still pending approval. While certainly not a significant capacity cut, the announcement does reflect the growing pain for the aluminium smelting industry.

In China, aluminium social inventories continue to decline, beating market expectations. This has been interpreted by the market that demand within the country is not as bad as macro indicators suggest. But in fact, we understand that there are also other technical factors at play, and as a result, there has been reduced deliverable primary aluminium in the form of ingots in the market. A continuation of this trend means that ShFE aluminium is likely to remain well supported in the near term.

Agriculture

Finally finishing with grains, and the latest USDA export inspection report shows that over the last week just 429kt of US corn was inspected for export, this compares to 1.06mt in the same week last year, and takes cumulative inspections so far this marketing year to just 6.04mt, down 58% YoY. These significant declines do partly reflect the increased competition that we are seeing from Brazil, with the country having had a record corn harvest in 2018/19, while a weaker BRL has also helped. These factors have led to record Brazilian exports this year- corn flows from Brazil over the first 11 months of this year totalled 40.6mt, up 105% YoY.

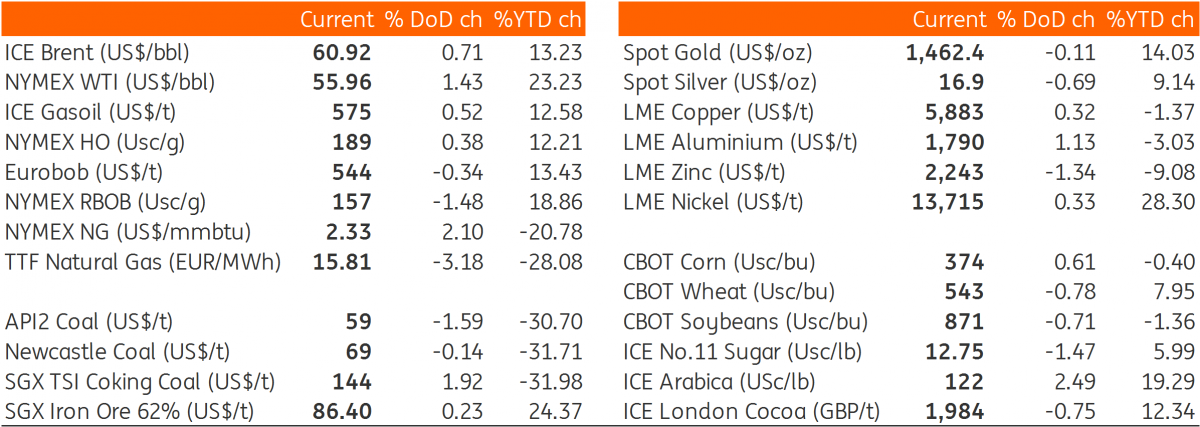

Daily price update

Download

Download snap