The instability is the most prominent support for the gold prices performance in recent times. Since the beginning of this week's trading, the price of gold has moved between the $1456 support and the $1479 resistance, and is stable around 1474 dollars at the time of writing. The yellow metal was largely unaffected by the release of the US Federal Reserve last meeting’s content.

At this meeting The Federal Reserve voted 8-2 to cut interest rates by a quarter of a point. This was the third consecutive meeting to cut the rate to bring the interest rate between 1.5% -1.75%.

As expected, there was widespread support among Fed officials to maintain the current policy to give officials time to assess the impact of easing the policy. Federal Reserve Chairman Jerome Powell referred to the bank's position at its press conference after the meeting, after which officials endorsed the idea.

The minutes stress that the Fed will be watching the data closely and that the policy was not on a predetermined path. Powell told Congress last week that “if there were developments that caused a material reassessment of our expectations, we would respond accordingly.” According to the minutes of the meeting, only two officials wanted more clarity. They asked the committee to tell investors that further easing is unlikely in the near term unless the data received are consistent with a significant slowdown in economic activity.

The Fed is scheduled to hold its next monetary policy meeting from Dec. 10 to 11 and, according to expectations, there is a 99.3 percent chance that the central bank will leave interest rates unchanged after three consecutive rate cuts.

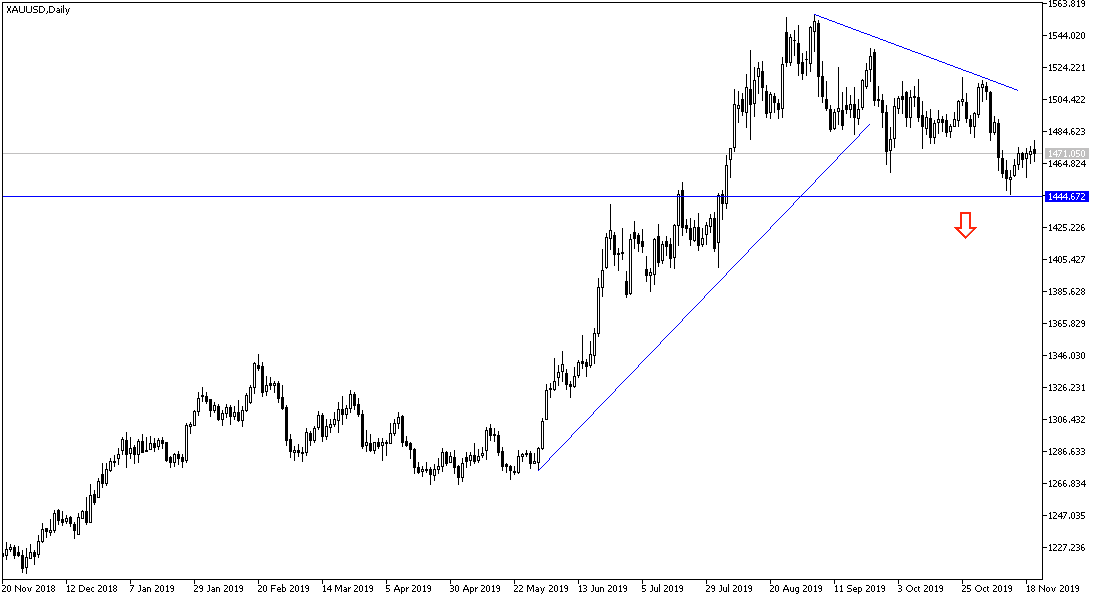

According to the technical analysis of gold: The bullish correction of gold still needs to move towards $1485 resistance and the $1500 psychological resistance to confirm the strength of the change of direction. At the same time, technical indicators are preparing for a change of direction, which was downward before the middle of this month, which pushed the price towards the support of $1446, the lowest for more than three months. In contrast, support levels at 1468, 1455 and 1440 are a strong and direct threat to these expectations. Gold is watching the dollar and renewed global trade and geopolitical tensions to determine the right course.

As for the economic calendar data today: Gold will react today with the release of the ECB minutes, and from the US, data on the Fed Industrial Index, jobless claims and existing home sales.