LBMA Needs Reform to Serve Physical Precious Metals Market

Among the wider precious metals community, it would be fair to say that the London Bullion Market Association (LBMA) has always been looked upon with a degree of suspicion. The reasons for the suspicion include:

- That the LBMA banks created and unleashed on to the world the concept of fractional-reserve bullion banking, unallocated precious metal accounts, and synthetic cash-settled paper gold products unbacked or fractionally-backed by physical metal.

- That the founding members of the LBMA were a group of powerful bullion banks and brokers.

- That the LBMA was founded “at the behest” of the Bank of England.

- That the LBMA operates at the nexus of secretive central bank gold lending transactions where transparency is, to say the least, non-existent.

All of these reasons would be valid concerns, but they are not getting to the heart of the issue. The heart of the issue is that the LBMA does not represent the physical gold and silver markets nor does it champion the interests of physical precious metals savers and investors.

Rather, the LBMA promotes and protects and paper gold and silver markets and works on behalf of the bullion banks which operate and control these derivative paper markets through OTC precious metals trading, the London daily price fixings, and COMEX precious metals futures trading. All the while the LBMA with a straight face claims to be the “global authority for precious metals” and “the fulcrum for the global OTC precious metals markets“. A global authority appointed by who you might ask? Well, the banks of course!

It’s a Bullion Bank Club and You Ain’t in It!

The LBMA is an association so dominated by bullion banks that it might be more correctly called the London Bullion Bank Market Association. These banks position themselves as intermediaries in the flow of everything in the precious metal markets from trading to clearing, and from securitizing to lending and borrowing, all within a fractional reserve system which creates derivative paper gold and paper silver out of thin air using a leveraged system of unallocated precious metal accounts unconnected to the physical delivery of real gold or real silver.

Bullion banks and their trading of synthetic gold and silver are so integral and entrenched to the LBMA system that the LBMA even has a special category of membership for its ‘top tier’ bullion banks which are known as the LBMA ‘Market Making Members’. These market making members are so important to the LBMA that they are entitled to 50% of the electable seats on the LBMA board, and a LBMA Annual General Meeting (AGM) cannot even be convened without a quorum of eight members at least five of which need to be Market Making Members, i.e. banks.

Including these privileged ‘Market Making Members’, there are an astounding 41 banks that are ‘Full Members’ of the LBMA and a few additional banks in the dealer category. Contrast this to precious metals refiners, where there are only 9 precious metals refiners worldwide which are full members of the LBMA. And shockingly, not even one mining company is a full LBMA member.

LBMA Market Making Members include such familiar bullion banking names as HSBC, Goldman Sachs, JP Morgan Chase, UBS, Citibank, Bank of Nova Scotia (Scotiabank), Toronto Dominion Bank, and ICBC Standard Bank. Many of these same bullion bank names also dominant the LBMA Gold Price and LBMA Silver Price auctions as “Accredited Price Participants” for the daily benchmark prices of gold and silver, reference prices which are also based on unallocated positions but which perversely are used by the bullion industry worldwide as a reference point for pricing physical precious metals. It is also the LBMA which acts as gatekeeper and authorizes these bullion banks to directly participate in the auctions, i.e. LBMA-authorized bullion banks and market makers.

As many readers will know, the LBMA Gold Price and LBMA Silver Price auctions supersede the previous London Gold Fixing and London Silver Fixing which were exclusively, until they imploded in 2014, the playground of, you guessed it, bullion banks.

For the gold fix – these banks most recently were HSBC, Deutsche Bank, Barclays, Scotia, and SocGen operating under a company called The London Gold Market Fixing Limited, a company which was established at Rothschild’s offices in New Court, St Swithin’s Lane, London. For the silver fix, HSBC, Deutsche and Scotia operating using a company called The London Silver Market Fixing Limited.

Do you see the trend? Another spoke in the LBMA wheel is the paper precious metals clearing company, London Precious Metals Clearing Limited (LPMCL), a shadowy but critical company whose corporate secretary is the LBMA, and whose registered office is the LBMA’s offices in London at 1-2 Royal Exchange Buildings, Royal Exchange, across the road from the bank of England and Rothschild’s offices in the City of London. The original registered office of LPMCL when it was established in 2001 was yet again, Rothschilds offices in New Court, St Swithin’s Lane. London.

LPMCL uses an electronic clearing platform known as AURUM to net and clear the paper trades of gold, silver, platinum and palladium churned out in London by the staggeringly large unallocated paper positions generated by the bullion banks, with HSBC and JP Morgan clearing the majority of LPMCL trades. For all about AURUM see here.

As the LMPCL website explains:

“Initial exploratory work on the LPMCL [electronic matching system] was undertaken by The London Bullion Market Association (“LBMA”) Physical Committee, which comprised the clearing members."

The clearing members of the LBMA (at the time Rothschild, JP Morgan, UBS, HSBC, Scotia, Deutsche, and Credit Suisse) then formed the LMPCL company in April 2001. LPMCL is currently operated by 5 of the largest bullion banks in the LBMA system, namely HSBC, JP Morgan, Scotia Bank, UBS and ICBC Standard Bank, all of which are Market Making Members of the LBMA. The Board of Directors of LMPCL (i.e. the LPMCL directors from HSBC, JP Morgan, Scotia, UBS and ICBC Standard) even holds its board meetings at the offices of the LBMA in the Royal Exchange. While LPMCL is a paper clearing platform, it interfaces into the twilight world between paper gold and real bullion with three of the LMPCL members operating precious metals vaults in London, JP Morgan, HSBC, and ICBC Standard Bank, and all five LPMCL members having gold accounts at the Bank of England. But with no transparency between LPMCL clearing transactions, London gold vaults stocks, and gold lending transactions out of the Bank of England, and no independent physical audits of any bullion bank gold holdings, LPMCL is a game of musical chairs keeping London’s unallocated precious metals pyramid spinning.

Fractionally Reserved Bullion Banking

LBMA banks are not in the business of contributing to real price discovery for precious metals. On the contrary, they are in the business of moving prices up and down at will to generate as much volume and activity as they so choose, creating “unlimited credit” into the system by expanding unallocated positions (their liabilities) at the stroke of a keyboard. If this sounds like fiat currency fractional-reserve banking, it’s because it is, just with the units of credit being synthetic gold and synthetic silver rather than fiat currency units.

By not only allowing, but actively facilitating the operation of these paper and synthetic precious metals markets, which are essentially a giant Ponzi scheme detached from the reality of gold supply and gold demand, the LBMA is overseeing a system in which gold and silver price discovery is determined not by real supply and demand, but by the trading of cash-settled derivatives. It is this that is detrimental to savers and investors in real precious metals and it is this that is detrimental to the world’s gold and silver producers, i.e. the mining companies.

Rothschild, Morgan Guaranty, and Goldman

For an entity dominated by banks, it’s perhaps not surprising that the very creation of the London Bullion Market Association was guided by the hidden hand of one of the world’s most powerful central banks, the Bank of England, which worked behind the scenes in 1987 to bring six powerful bullion banks together in London to form the actual Association. Those banks were N.M. Rothschild & Sons, Morgan Guaranty Trust Company of New York (part of JP Morgan), J.Aron & Company (now part of Goldman Sachs), Mocatta & Goldsmid, the old Sharps Pixley (which was acquired by Deutsche Bank), and Rudolf Wolff & Company. The original registered office of the LBMA when it was established in December 1987 was, wait for it, Rothschilds offices in New Court, St Swithin’s Lane. London. Do you see the trend?

The Bank of England’s embedded connections with the LBMA have, not surprisingly, also persisted down to years from 1987 to the present in everything from central bank gold lending, to trading on the gold fixing, to a Bank of England ‘observer’ sitting on the LBMA Executive Committee / Board of directors. And in 2016, the Bank of England’s hidden hand in the LBMA became not so hidden when the LBMA had the audacity to appoint former head of the Bank of England Foreign exchange Division, Paul Fisher, as the ‘independent‘ chairman of the LBMA Board. How’s that for independence?

Paper Price Discovery

It’s an acknowledged empirical finding that international gold price discovery is driven by trading in the London Over-the-Counter (OTC) spot gold market and via COMEX gold futures. The same is true of silver. The reason this golds true is that these trading venues and markets have the highest trading volume and “liquidity”, and sheer trading volume drives price discovery.

But these trading venues only have the highest trading volumes because they trade huge amounts of synthetic gold and silver and precious metals derivatives, not real metal. Look at the trading volumes reported by the LBMA for its members in the OTC markets, predominantly in London. The latest figures claim that the weekly average gold trading by LBMA members was 184 million ounces, which equates to 36.8 million ounces of gold per day (1,144 tonnes of gold traded per day) and a staggering 286,158 tonnes of gold per year.

That’s more ‘gold’ traded in one year than exists above ground, more gold than has been mined throughout history, and over 90 times the annual gold mining supply. How can this be? Again, it is because this trading is trading of artificial gold supply, i.e. unallocated positions which have no or limited metal backing.

Leading commercial law firm Dentons explained it as follows:

“Although the terms of the unallocated bullion account usually provide for the account holder’s right to demand the physical delivery of gold, the reality of unallocated bullion trading is that buyers and sellers rarely intend for physical delivery to ever take place. “>Unallocated bullion is used as a means to have “synthetic" holdings of gold and so obtain exposure to the price of gold by reference to the London gold fixing.

If physical settlement and cash settlement are two mutually exclusive concepts (as they are in our view) and if cash settlement entails a derivatives transaction it follows that, if physical settlement does not take place in connection with unallocated bullion, then unallocated bullion is a form of derivatives transaction.’

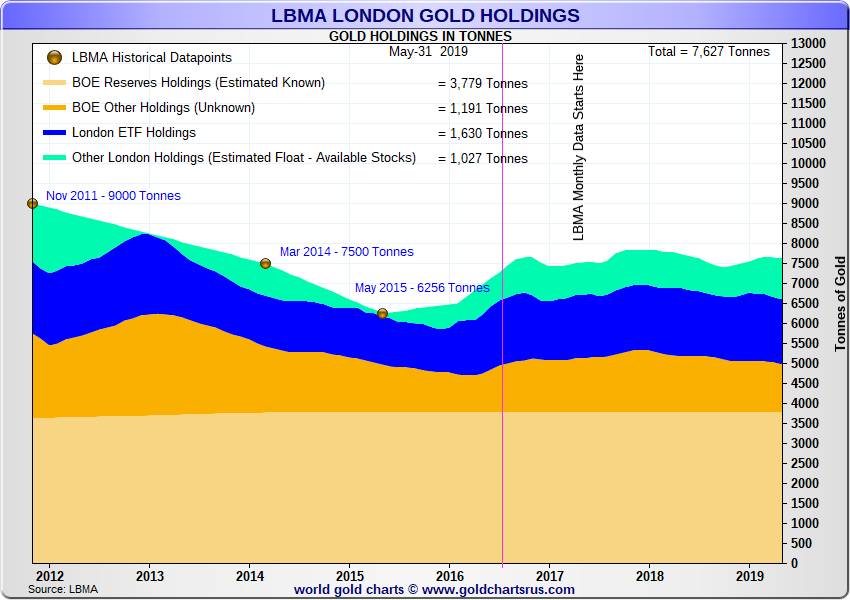

With just under 7,600 tonnes of gold in the LBMA system, of which about 5,000 tonnes is attributed to the Bank of England, and another 1,630 tonnes of which is attributed to ETFs storing gold in London, that leaves just under 1,000 tonnes of gold in the LBMA system propping up the entire LBMA fractional-reserve pyramid.

With the London OTC gold and silver markets trading synthetics, this channels away demand for real metal. All the while the LBMA actively supports and promotes this system as do its bullion banking members. By doing so, this warps price discovery to the detriment of savers and investors in precious metals and precious metals mining companies which is why criticism of the LBMA is justified. In effect, the London OTC precious metals markets presided over by LBMA and its bullion bank members is more of a casino than a real physical precious metals market.

But there is more. LBMA bullion banks also dominate the trading of 100 oz gold futures contracts on the US based COMEX, another synthetic paper gold casino market. On the COMEX, gold futures contracts trade the equivalent of 27 million ounces per day. That’s equivalent to 260,000 tonnes of gold per year. That too is more gold than has been mined in history, and is a whopping 86 times annual gold mining supply. In 2018, COMEX gold deliveries were just 1.6 million ounces (51 tonnes). This means that 99.98% of COMEX gold futures do not result in physical delivery, with only 0.02% of the trades leading to metal delivery. Currently, COMEX registered gold stocks (those which are available for delivery) are only 735,000 ozs (22.85 tonnes), a tiny foundation underpinning a giant paper pyramid.

LBMA Transparency – Clear as Mud

The LBMA regrettably also undermines market efficiency. In an efficient market, asset prices reflect all available information. But this requires competition, low barriers to entry and informational efficiency, i.e. low costs of information gathering. The more transparency in a market, the more efficient that market. But there is little transparency in the London gold and silver markets, and without transparency there can be no market efficiency.

There is also no trade reporting in the London gold and silver markets and the LBMA’s so called trade reporting is nothing of the sort. While the LBMA has all the relevant trades data in its LBMA-i trades database and trade and clearing data in its AURUM database, it does not report trades other than in rolled up meaningless data which it then has the cheek to hide behind a subscription paywall. There are zero details of broker codes, trade types, transactions types, or counterparty types. If the LBMA wanted real transparency, it would report every single trade in detail and open up its databases to external developers, as other markets such as FX, fixed income and equities do.

If the LBMA wanted transparency it would furthermore report exact inventories of precious metals holdings which back its member banks unallocated trading positions and liabilities. If the LBMA wanted transparency it would also publish the locations of the LBMA London vaults and it would require its member banks and central banks to publish all their gold lending positions. Instead the LBMA is the apologist for central banks, stating that “the role of the central banks in the bullion market may preclude ‘total’ transparency, at least at the public level."

Efficient markets require a level playing field and symmetric information. Efficient markets are not those in which some market participants (i.e. the LBMA member bullion banks) possess far more information than others, banks which then have a trading advantage over others.

No Condemnation or Moves on Manipulation

The LBMA also continues to accept as members those banks which have been charged with manipulating precious metals prices. Take for example Barclays Bank which was fined £26 million in May 2014 by the UK’s Financial Conduct Authority for breaching the FCA’s Principles for Businesses in relation to the Gold Fixing. That didn’t stop the LBMA continuing to allow Barclays to be a LBMA member and even accrediting Barclays Bank to be an inaugural direct participant in the LBMA Gold Price auction (the Gold Fixing’s reincarnation) when it was launched on 20 March 2015, nor of the LBMA allowing a former Barclays precious metals director to be one of the chairmen in the LBMA Gold Price auction.

Similarly, an investigation into Swiss bank UBS AG by Switzerland’s financial regulator FINMA in 2014 found a “clear attempt to manipulate fixes in the precious metal market” including front running. UBS was and still is a Market Making member of the LBMA and a member of London Precious Metals Clearing Limited (LPMCL). Indeed some of the LBMA’s biggest banking banks and most powerful members that were involved in the London gold and silver fixings are still facing live class action suits in the US by disgruntled precious metals investors, including defendant banks such as Soc Gen, Scotia and HSBC.

Which brings us to JP Morgan, one of the most powerful members of the LBMA, where a few weeks ago on 16 September, LBMA Board member and head of JP Morgan’s global precious metals desk, Michael Nowak, was charged by the US Department of Justice with a “racketeering conspiracy and other federal crimes in connection with the manipulation of the markets for precious metals futures contracts’ in what the DoJ says was a “massive, multiyear scheme” where Nowak, co-defendants and co-conspirators “placed deceptive orders for gold, silver, platinum and palladium futures contracts traded on NYMEX and Commodity Exchange Inc. (COMEX)”. The background can be read here.

Simultaneously, a civil enforcement action against Nowak and co-defendants was also launched by the CFTC. The charges against Nowak claim that he wasn’t acting in isolation and and DoJ charges that the manipulation involved co-defendants at JP Morgan and co-conspirators.

On 20 September, four days after the DoJ indictment of JP Morgan’s Nowak was unsealed, the Financial Times (FT) questioned the LBMA as to why Nowak was still n LBMA board member in an article which called the DoJ indictment ”an embarrassment for the LBMA”. After a few hours, the LBMA removed JP Morgan’s Nowak from its board of directors.

The LBMA has a Global Precious Metals Code which claims to “promote a fair effective and transparent market” to which all its members, including JP Morgan, have attested their conformance by signing a Statement of Commitment.

So the question is, why has the LBMA, which has seen fit to remove JP Morgan’s Nowak from its board of directors, not seen fit to remove the bank JP Morgan Chase from the membership of the LBMA? The same goes for the London Platinum and Palladium Market (LPPM), an organization under the administration of the LBMA and of which JP Morgan is also a member, since remember that Nowak and co-defendants are also accused of placing “deceptive orders for… platinum and palladium futures contracts" on NYMEX COMEX.

In the latest issue of ‘Crucible’, a trade publication of the Singapore Bullion Market Association (SBMA), an association which is modeled on the LBMA and which JP Morgan also co-founded, the LBMA CEO Ruth Crowell writes that:

“One of the key strengths of LBMA is establishing best practices and setting standards through its Responsible Sourcing Programmes, the Good Delivery List and the Global Precious Metals Code. These standards deliver integrity and credibility to the industry…”

So how does that statement gel with JP Morgan still being a member of the LBMA?

How can the LBMA Promote Physical Gold & Silver?

If the LBMA wants to really deliver integrity and credibility to the global precious metals industry, it needs to chose more wisely who it is supporting. On the one side are the LBMA bullion banks and central banks. The bullion banks trade cash-settled synthetics of precious metals which undermine price discovery and the central banks engage in secretive gold lending operations. On the other side is the physical precious metals industry, which mines, refines and extracts real precious metals, promotes trading of real tangible metal, and which encourages saving and investment in real physical precious metals.

If the LBMA is supportive of real transparency, fairness and efficiency in the precious metals markets, it needs to clean up the organisation both informationally and structurally and start to work for the benefit of the physical gold industry and gold investors globally, instead of working for manipulating banks.

If the LBMA really wants to support the physical precious metals markets, it must do the following:

– Call for and work for the removal of London OTC fractionally backed unallocated trading.

- – Establish price fixings auctions that trade physical precious metals that are open to all direct participants in the precious metals industry.

- – Support real price discovery in the precious metals markets, with trading of real physical precious metals.

- – Call for the obligatory publication of central bank gold lending positions, bullion bank gold lending exposures, bullion bank outstanding unallocated gold positions, and bullion bank vault inventories.

- – Allow access to the LBMA-I and AURUM databases for market feeds.

- – Publish real trade reporting of actual trades in the wholesale precious metals markets including central bank gold trades.

- – Penalize and remove LBMA member firms that have been fined for and charged with precious metals price manipulation and that breach the LBMA Global Precious Metals Code.

Questions to the LBMA for the Upcoming LBMA Conference

The upcoming LBMA / LPPM Precious Metals Conference this week in Shenzhen, China, whose theme this year is “let’s explore the future of gold” is a perfect opportunity for the LBMA to explain who it really works for, the large bullion banks and the Bank of England, or the world’s physical gold industry and gold investors globally.

Some questions that the LBMA can take the opportunity to answer during the conference include:

-

- – Will the LBMA remove JP Morgan as a member of the LBMA given that the US DoJ and CFTC have charged JP Morgan traders with precious metals market manipulation?

-

- – Will the LPPM do likewise and remove JP Morgan as a member of the London platinum and palladium market?

-

- – Will the LBMA recommend that JP Morgan be removed from London Precious Metals Clearing Limited (LPMCL) and from AURUM?

-

- – Why are there more than fourty banks that are members of the LBMA but only nine full members that are precious metals refiners and no full members that are gold mining companies?

-

- – Why does the LBMA support a system of fractionally-backed paper trading which is far removed from the trading of real precious metals?

- – Why does the LBMA agree with the central banks that central bank gold trading does not require full transparency?

If the LBMA wants to show that it’s committed to the future of gold, then it needs to be committed to the world of physical precious metals, and not merely be the mouthpiece for a bullion bank controlled shadowy world of unbacked paper promises.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 7 Comments

7 Comments