Global Precious MMI: Platinum-Palladium Price Spread Widens

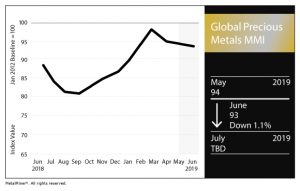

The Global Precious Monthly Metals Index (MMI) fell one point for a June MMI reading of 93, marking the third consecutive month of decline for the MMI.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

The Platinum-Palladium Spread

Contrary to historical trends, the palladium price has soared past the platinum price for approximately a year and a half now.

Last month, however, MetalMiner’s Taras Berezowsky noted a short-term shift against that trend, as the spread between the two metals narrowed to $479 (palladium fell 2.6%, while platinum rose 4.5%). As Berezowky noted, a recent poll forecast the platinum-palladium price spread to average $485 per ounce this year.

This month, however, both platinum and palladium dipped; the spread rose in the process to $489 per ounce.

According to consultancy Metals Focus, palladium will post a supply deficit this year while platinum will be in surplus, which will continue to maintain the premium palladium has obtained over the last 18 months.

The interplay between high palladium prices and depressed platinum prices can be seen in South Africa, where miners are reaping the benefits of the former but struggling with the latter, Reuters reported. Per the report, miners in the country are faced with ore that produces twice as much platinum as palladium.

As MetalMiner’s Belinda Fuller recently explained in an analysis of palladium and platinum prices, platinum likely won’t stay this down for long.

“Platinum prices, however, remain somewhat low historically,” she wrote. “The recent performance against the DXY does not necessarily suggest the metal is undervalued. However, given that platinum can serve as a substitute, it’s doubtful the price will stay suppressed long term, as high palladium prices will drive a push toward substitution.”

Gold Star

Elsewhere in the Global Precious MMI basket, gold is outperforming other commodities, MetalMiner’s Stuart Burns noted.

“The price of gold hit a three-month high Tuesday, at $1,327.9 per troy ounce as investors continued to buy into exchange-traded and physical gold. Inflows into the world’s largest gold ETF, the SPDR Gold Trust, rose by 2% Monday,” Burns wrote last week. “That marked its biggest one-day gain since 2016, the Financial Times reported, part of a wider inflow that bought holdings in gold-backed ETFs to their highest in a year.”

Given global economic uncertainty stemming from trade, it’s no surprise investors are turning to the safe-haven asset.

But how much further can the gold price go? Can it surge past the $1,400 per troy ounce threshold?

Pump the brakes on that thought — at least for now, Burns argues.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

“Global political and economic developments would have to take a dire turning for the worse to stimulate a rise above the mid $1,300s,” Burns argues.

Actual Metal Prices and Trends

The U.S. silver price fell from $14.93/ounce to $14.77/ounce as of June 1.

The U.S. platinum price fell 7.4% month over month to $820/ounce, while the U.S. palladium price fell 4.1% to $1,309/ounce.

Chinese gold bullion rose 3.1% to $42.92/gram. U.S. gold bullion rose 3.2% to $1,324.80/ounce.

Leave a Reply