Social Trading: 6 questions that need answering – Guest Editorial

Mike Read, CEO of London’s Pelican Trading looks at the validity and value of social trading in today’s vastly evolved retail brokerage industry

By Mike Read, CEO of Pelican Trading which is an FCA regulated social trading platform based in London, UK

1: What is social trading?

Social trading is used to reference a host of different trading features. These features include auto-copy trading, signal provision and even managed accounts. If a broker refers to their social platform – one is never quite sure what’s on offer.

In its simplest form social trading is logical; if you allow traders to interact, profitability should eventually align with best. If you wanted to get better at tennis, training with an expert will deliver better results than training alone. This logic however has struggled to find a product offering technically capable of delivering profitable results.

The original social trading platform – Bloomberg – was designed around the idea that financiers will make better informed decisions if connected to other experts. It succeeded. However this success has never been replicated in the retail trading space.

Why? Any social trading offering needs to be near perfect to gain traction. It also needs to be regulated. While sophisticated investors and bankers can opt out of regulatory protections, retail traders can’t. While this conundrum remained, even the most well funded brokers choose not to tackle this regulatory minefield.

However a number of companies gave it a go. The largest social system (although numbers are difficult to come by) is eToro. They have been effective at using the social concept primarily as an acquisition tool and point-of-difference. eToro is a broker just like IG, but it has blended a social experience with it’s own execution offering, and here lies the conflict.

Bloomberg is not a broker – which is why it’s been so effective at refining a world-class product. Retail social systems are muddled – failing to be effective brokers as well as providing untransparent ‘social’ experiences. Despite this, the impact of having a half decent social system has made eToro one of the largest brokers globally.

2.Why do traders want a social system?

This is hotly debated, but initial statistics since the new ESMA disclosure rules came into play reveal that traders on social platforms are 40% more profitable. This is significant because speed to profitability is far more important now than it used to be. Certainly within Europe, new accounts are looking for a precision tool rather than a platform to ‘punt’.

Margin restrictions mean that traders don’t have the capacity to learn through mistakes. The large volume of low deposit accounts are under far more pressure to turn a profit in their first few trades. Any trading experience that increases this likelihood will gain traction against traditional single purpose execution terminals.

3.Why do brokers need to offer a social system?

Social trading is now viewed as the silver bullet that transforms platforms into successful entities. Why? If we take a look at the building blocks of a successful platform; high volumes of trades, low client cost of acquisition, longer life-time value and large accounts.

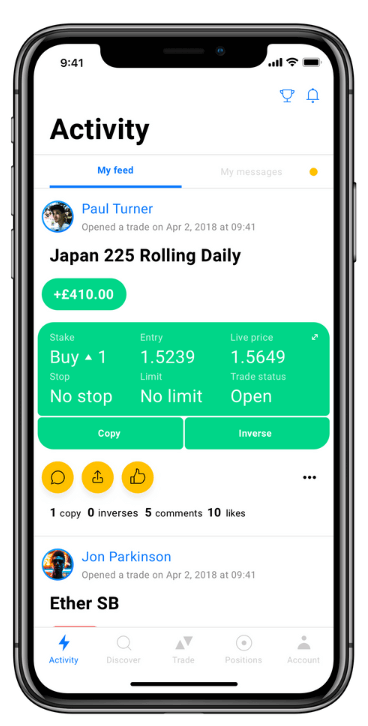

Social = Higher volumes of trades

Social systems either encourage trading or physically enable it. An auto-copying account will be trading in line with the master account.

Simply, if the master account is a frequent trader with a 100 copiers, you’re not waiting for 100’s of users to have a trader idea – you just need the master account to trade – the rest follow. By their nature master accounts are typically professional traders that trade regularly – which means their copiers replicate.

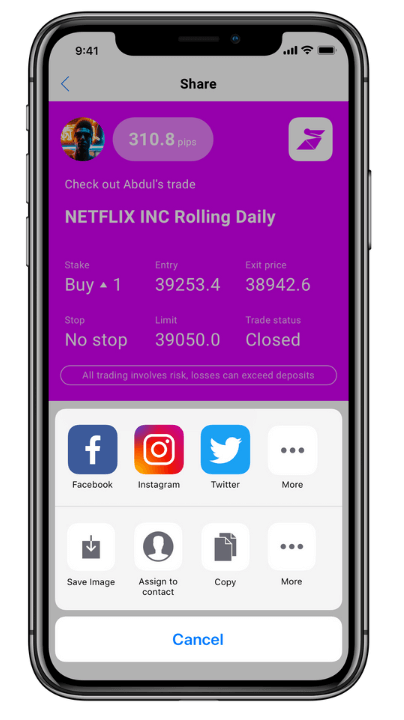

Social = Low client cost of acquisition

Social systems enable users to access their own list of contacts. That means one new client might actually be 1.5 clients assuming every other person invites a friend.

By providing a social offering you are making your existing client base work as your platforms marketeer. A recommendation from a friend carries more gravitas than a Facebook campaign.

The most effective networks aim for a viral coefficient of 0.6 – that mean’s 60% of your clients invite friends – which means your marketing budget falls by 60%.

Social = Longer lifetime value

There are a number of ways a social system lengthens a client’s life-time value. Firstly exposure to friends or experts that are trading well continually pulls users back into trading, even if their accounts have fizzled out.

Secondly, social trading typically either leads to profitability or a slower loss of funds – both options lead to an account that sticks around for longer or is more likely to top their account up.

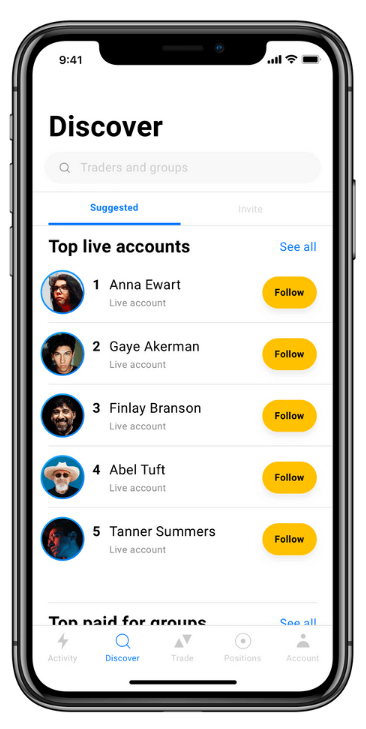

Social = higher value trades

This is more difficult to argue given the headline social platforms are not recognised as hosting the high value accounts. However, most brokerages have a number of MAM’s (Multi-Account-Manager) accounts, these are pooled accounts that are traded by an individual. These MAM’s are typically high value accounts.

Social trading replicates the MAM model. When a star trader hits form, social systems can attract large funds to be deposited by non-typical traders to be traded by the master account.

Social trading therefore is a very valuable tool for awakening dormant accounts.

Brokers spend a fortune acquiring clients. If the client account becomes dormant, brokers write off their initial investment.

Social allows brokers to go back to their dormant accounts with a new opportunity to mirror the performance of other profitable traders. Reawakening a dormant account further increases the life-time value of account already won.Does a Social platform require regulation?

4: Does a social trading platform require regulation?

That depends where you’re asking from? If your inside Europe yes. ESMA has told the regional regulators e.g. the FCA, that to operate a Social platform you need ‘Advice’ and ‘Investment Management’ permissions. To date only one Social platform has been approved by the FCA, several more have gone via CySec e.g. eToro – which has, until recently, been seen as Europe’s light-touch regulator.

Outside the EU – which is where the growth is, it’s a bit more ‘wild west’. Some regulators don’t recognise social trading (e.g. ASICS) and therefore no extra permissions are required. Currently global trading standards are typically set by Europe and more specifically London, what were finding is that even outside regulated markets trading technology is best received when adopting principles from within a regulated market e.g. clear, fair and not misleading. So wherever your brokerage operates, it’s always best to take the lead from a social platform that has been influenced by a regulator.

5: I am a broker, what are my options?

A social system needs tech (and possibly regulation). You have two options; build your own (DIY) or licence/white label someone else’s. I will take you through the arguments for both, but for 99.9% of all firms building your own is simply not sensible. Don’t forget you also need regulation.

DIY

This is a daunting task – it will require money, time and patience. You’ll need specialist development teams for both iOS and Android, as well as project managers.

More often brokers will look to cheaper off-shore development teams to build their tech. This is logical, but we have yet to see quality delivered off-shore. A really good social system needs the best developers. Good developers are expensive and are not easily recruited by off-shore dev teams.

License someone else’s tech and regulation

Historically there have been few options. But look hard enough and you can now find specialist social teams that can license and customise their tech at sensible prices.

Due diligence is simple, look for their ratings in the App store (and Play Store). If they’re 4 stars and above – it will be money very well spent. Other boxes to tick when sizing up a social platform:

A: Speed of set-up – don’t accept anything more than 2 weeks

B: Branding – ensure it’s fully branded (logo and colour palette)

C: Connect – does it connect to your technology (MT4, c.Trader, Star etc.)

D: Price – expect to pay for a set-up, minimum monthly retainer and a cost per trade. Pay a little bit more for premium quality and your returns will be exponential

E: Seamless relationship between desktop and mobile – exactly that!

6: How can Pelican help?

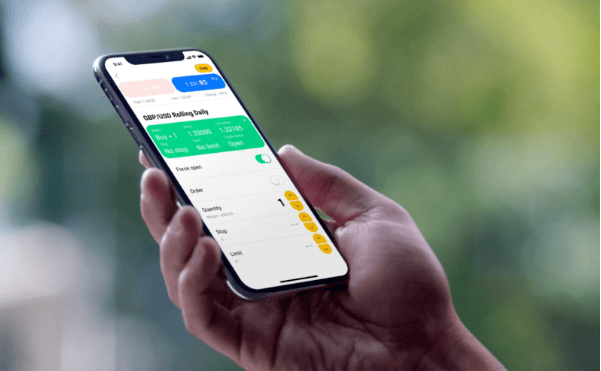

Pelican is an FCA regulated social trading platform. That means we cover all the bases; reg. and tech. Pelican is the only Firm to have been granted the complete retail licence for all forms of social trading by the FCA and we work with leading brokers to provide a complete customised social system for their platform.

Our tech connects with all platforms and our regulatory cover ensures that brokers don’t need their own and our social solutions include access to our own network of traders, gurus and mentors, so you don’t even have to seed your own network.