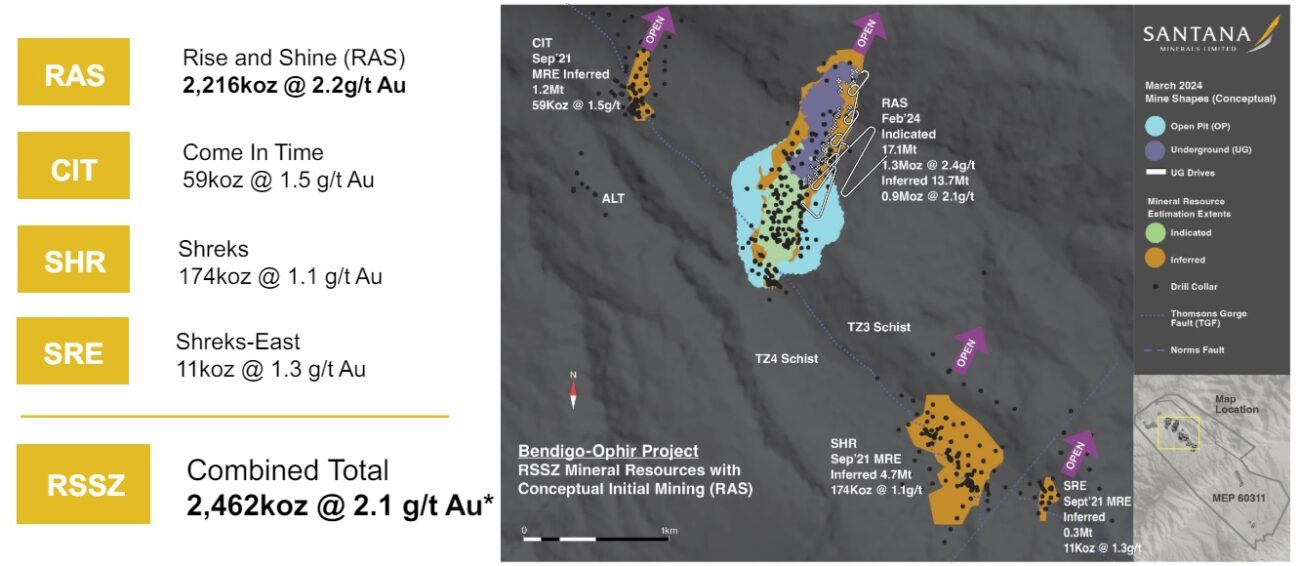

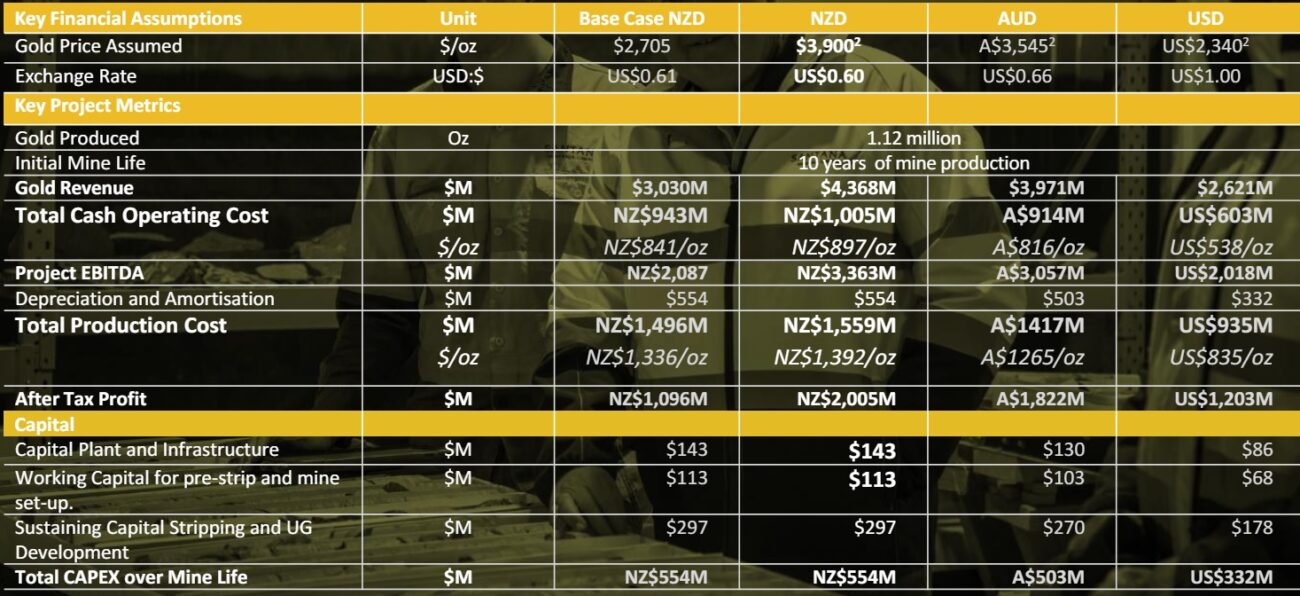

Santana Minerals (SMI.AX) published the results of a scoping study on its Rise And Shine (‘RAS’) gold deposit, part of its Bendigo-Ophir gold project in New Zealand. The base case scenario anticipates a total production of 1.12 million ounces of gold over a 10 year mine life using a plant with a capacity of 1.5 million tonnes per year, and anticipates an initial capex of just over US$150M (with a substantial portion earmarked for pre-stripping activities) with an additional $178M in sustaining capex.

Using the spot price for gold (the base case scenario used $2340/oz), the after-tax NPV10% is estimated at US$562M while the internal rate of return came in at 72%. Using $2340 gold in a base case scenario is pretty optimistic and looking at the sensitivity analysis, a 20% decrease in the gold price (which implies a gold price of $1872/oz) would reduce the after-tax NPV10% by approximately 42%.

As New Zealand recently introduced the Fast Track Bill which will reform the mine permitting process for projects of national significance, the country is definitely getting mining friendlier. The bill still has to be approved but if approved, it could shorten the permitting time to just six months rather than going through the hoops of a lengthier process.

Disclosure: The author has no position in Santana Minerals. Please read the disclaimer.