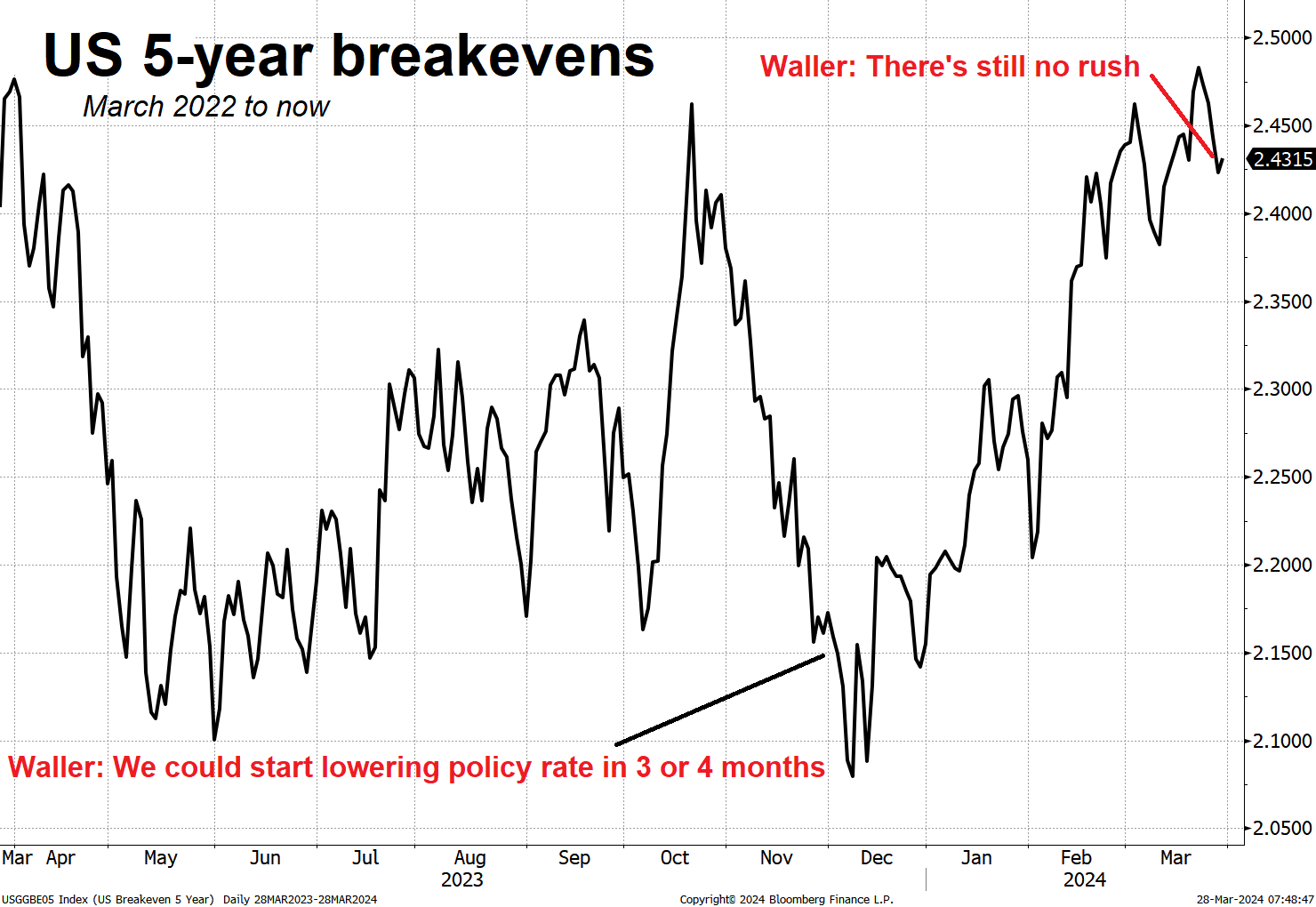

Waller

There are times when central bank communication feels a bit like Wall Street S&P forecasts. That is, they are not really forecasts but more like a constantly updating series where the real-time data and spot levels of various variables leads to an ongoing mark-to-market that contains very little forecasting value. Or like when a central bank tees up a rate cut at the next meeting and all the analysts update their forecasts for a cut. Or when a company goes bankrupt, so an analyst downgrades it.

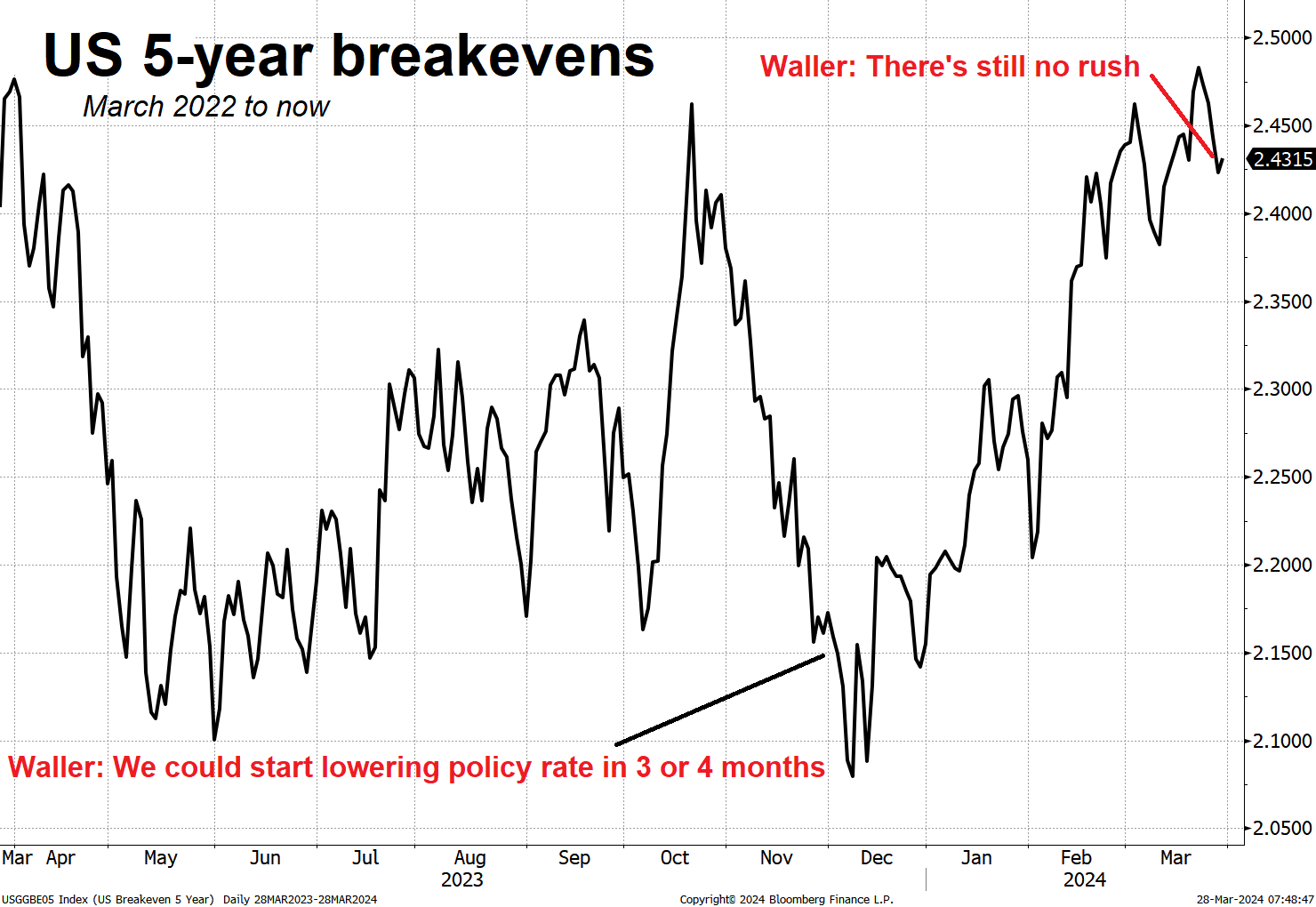

We saw this with Waller last night as he validated the idea that there could be cuts on the horizon but that horizon is constantly receding as you move towards it, like one of those weird shimmering heat mirages on a hot highway.

Perhaps these overly frequent communications from the Fed are not meant to be perceived as forecasts, but that’s usually how they are interpreted.

Anyway, as usual the data is what matters, not the communications, but the market trades off the communications, so it’s this strange circular dance where the Fed makes tremendous progress on inflation (whether that was luck or skill) and then Waller lights a fire under animal spirits in November 2023 and triggers an inflationary and speculative rebound which eventually makes inflation and inflation breakevens go back up and then he has to douse it. Obviously Waller was not the only factor in the inflationary rebound, but the “We did it!” Fed Pivot surely had a big impact.

Bigger picture, the data drives the bus.

USDCNH

The USDCNH breakout continues and in an FX market where things are not particularly interesting, this qualifies as mildly interesting? We were in that narrowing consolidation all year and we ripped through the top and then retested it perfectly and held.

Old resistance is now support and you could say it’s a bit of a NewsPivot as well because that blast up came on what looked like a relaxing of the fixing regime by the PBoC. While the fix came back down, USDCNH held the NewsPivot so far. Bullish.

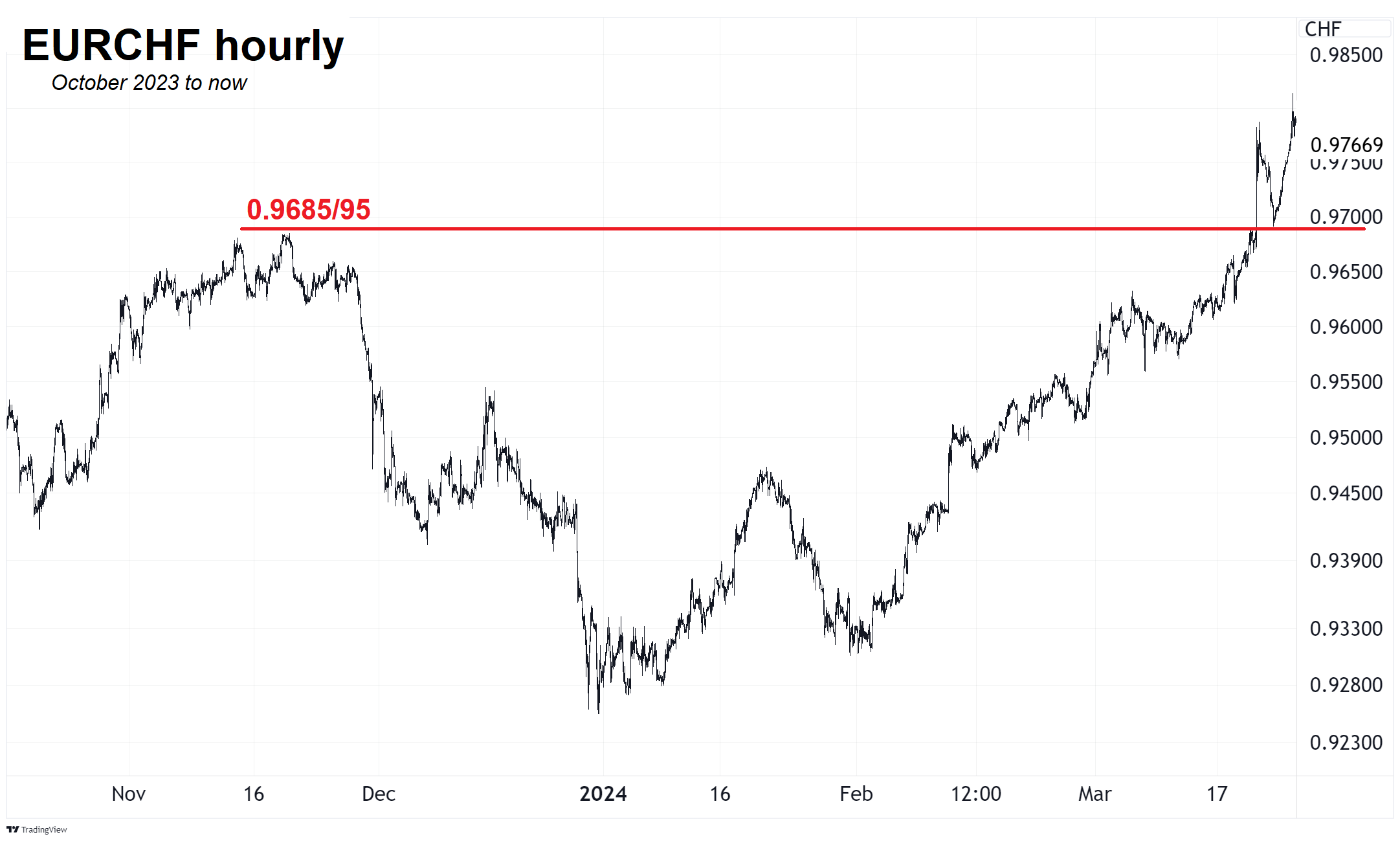

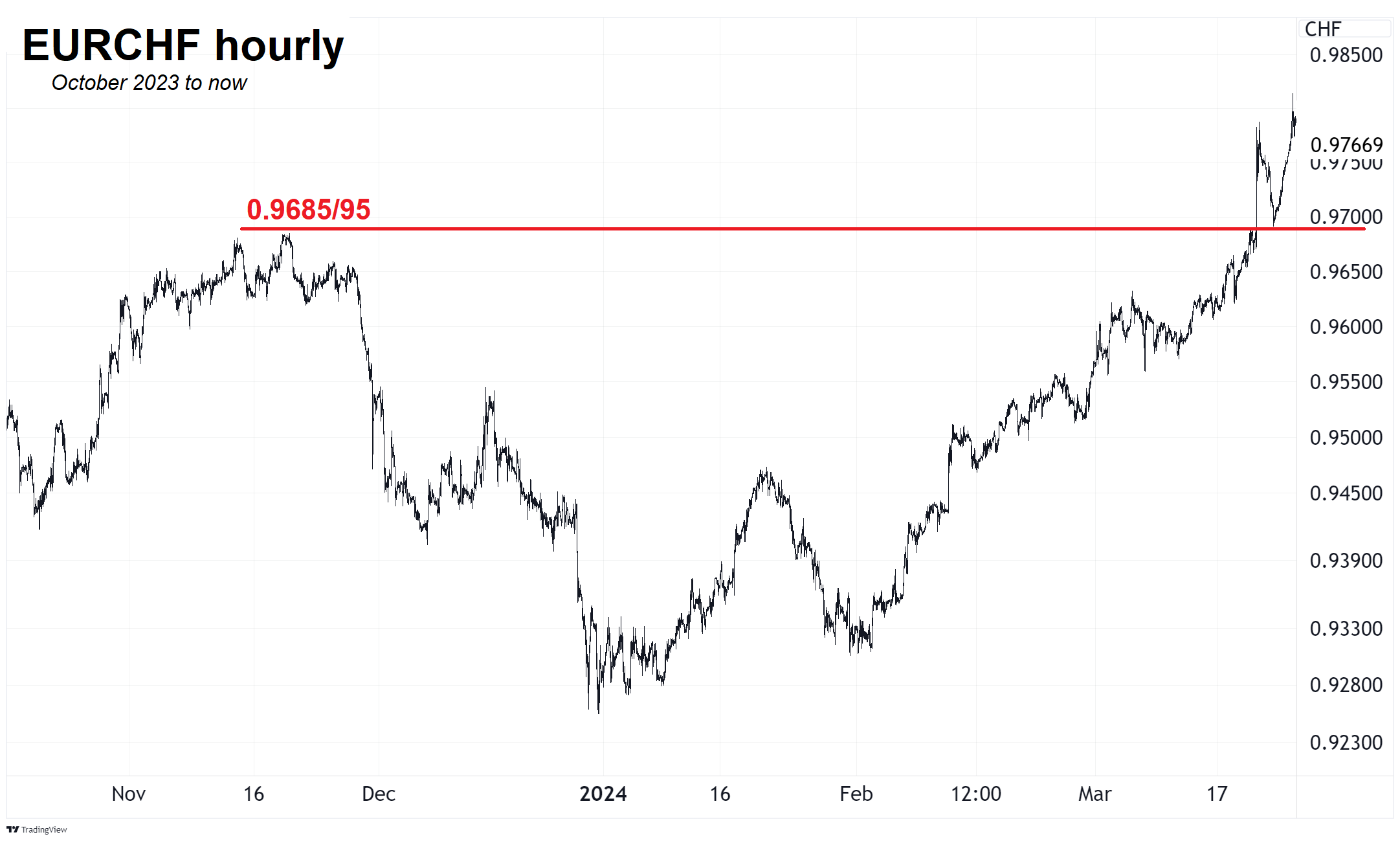

Astute readers might be thinking: “Hey, that looks like what happened with EURCHF!” Correct! EURCHF ripped through its old ceiling on the SNB, retested perfectly, and continued higher too.

Final Thoughts

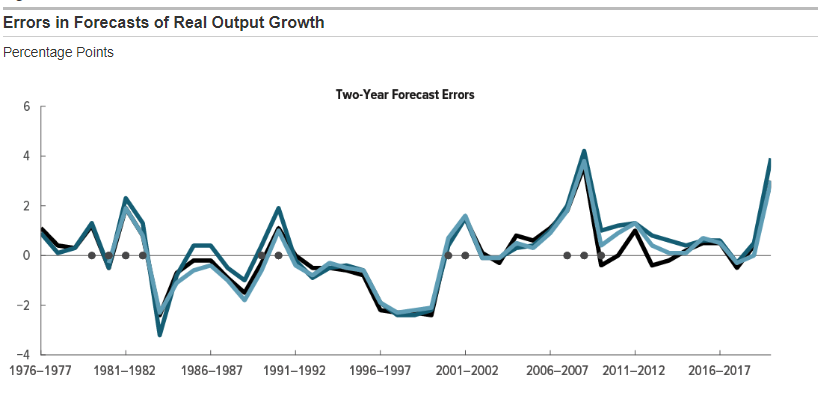

Here is a good piece on humility in economics from venerable economist Angus Deaton (via Mike Green). If there’s one thing I have learned from studying economics in university and then practicing some sort of macroeconomics for almost 30 years, it’s that we don’t really understand how things work. We can understand and explain how things work today, but we cannot predict how regimes will change or evolve and thus we have very little visibility on how things will work, the further out we look. Most economic forecasting is more extrapolation than prediction.

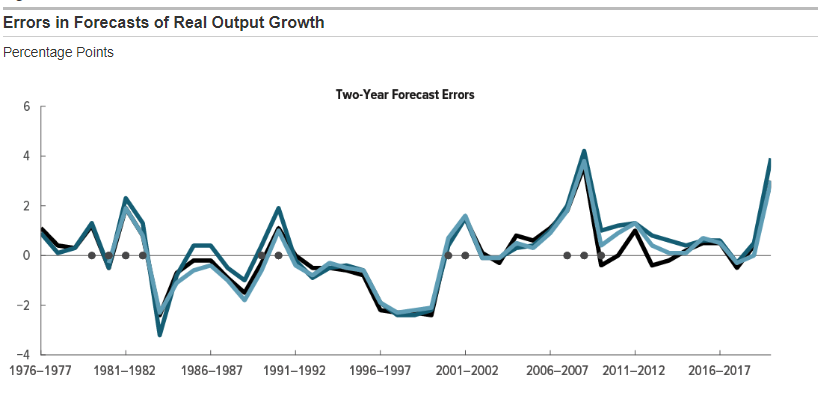

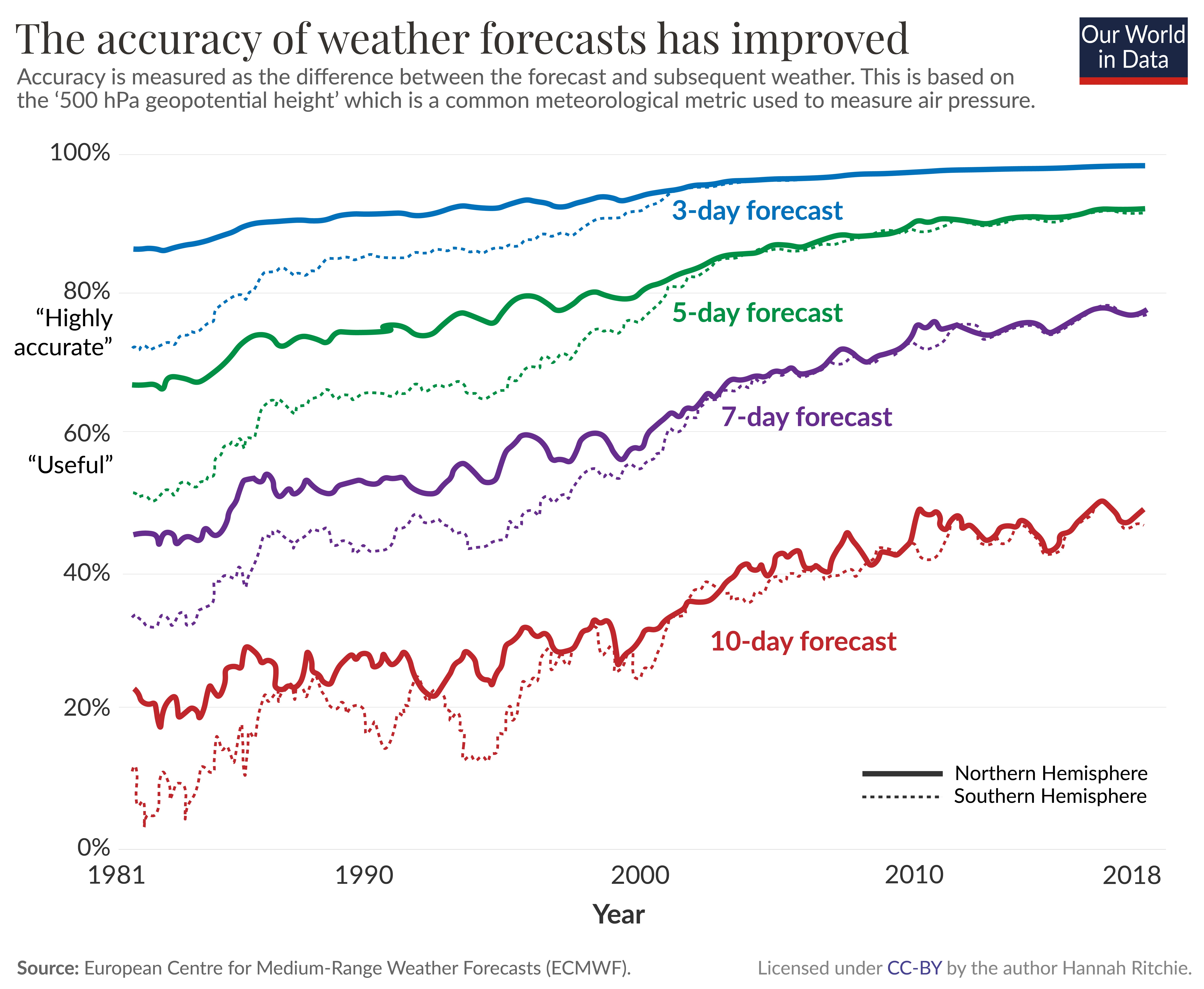

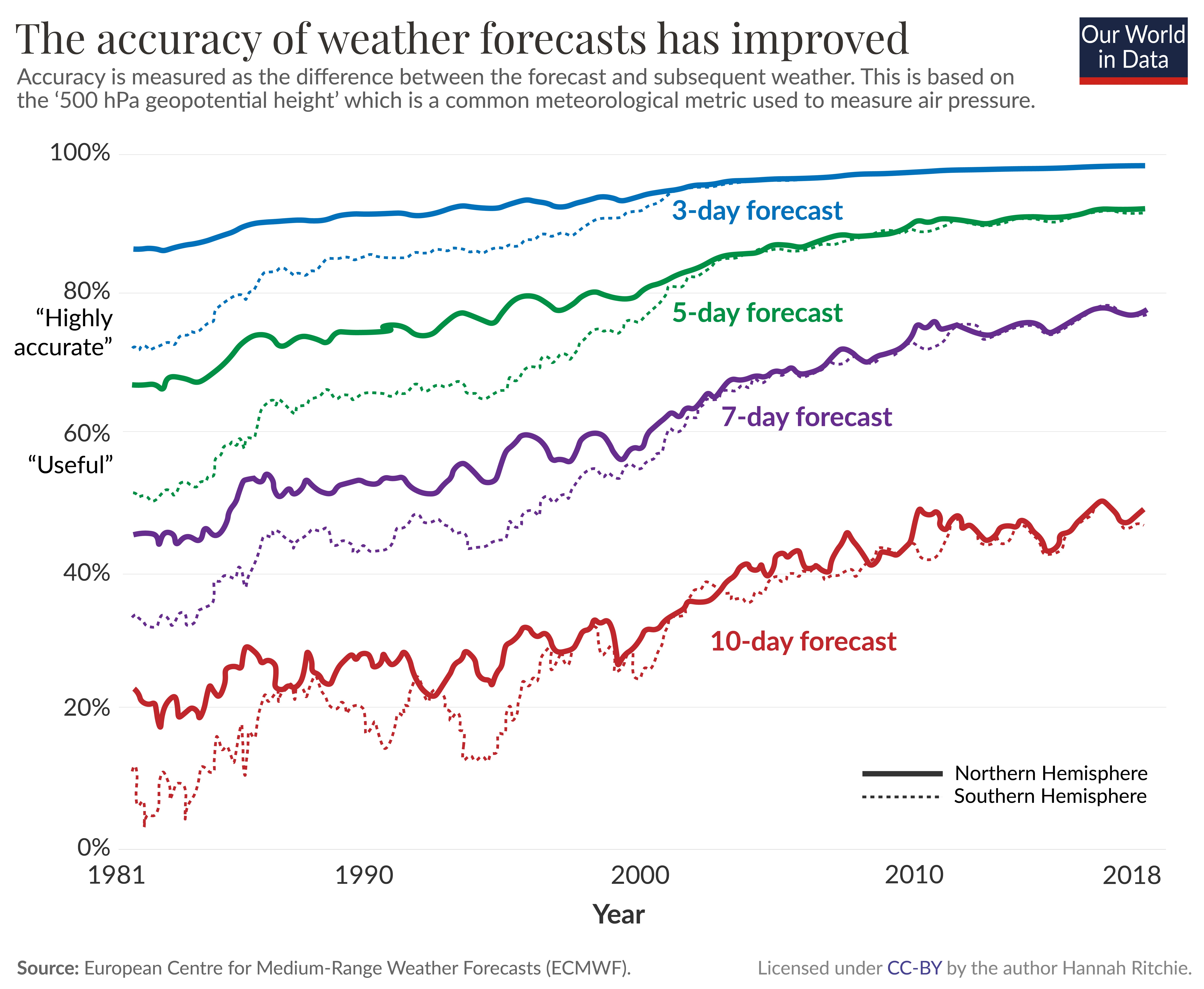

In weather forecasting, which attempts to model a different, but similarly dynamic and complex system, there is continuous improvement in forecasts, suggesting weather forecasting is mostly science. Economic forecasting never improves. It’s a pseudoscience. The CBO is a good proxy for private forecasters; here’s the error in their 2-year forecasts over time.

I think the next chart of improving weather forecasts and the similarity between weather and economic systems is a pretty good argument for the idea that it’s easier to forecast the next 5 days in FX than it is to make a 3-month or 1-year forecast. Starting conditions can be estimated pretty accurately and the events and variables that will matter over the next week or two can be identified.

By the time you are looking even three months out, there will be so many changes to the system that trying to predict that far out feels nigh impossible. And I don’t think weather seasons are a good analogy for economic cycles because one is regular and the other is not.

At all.

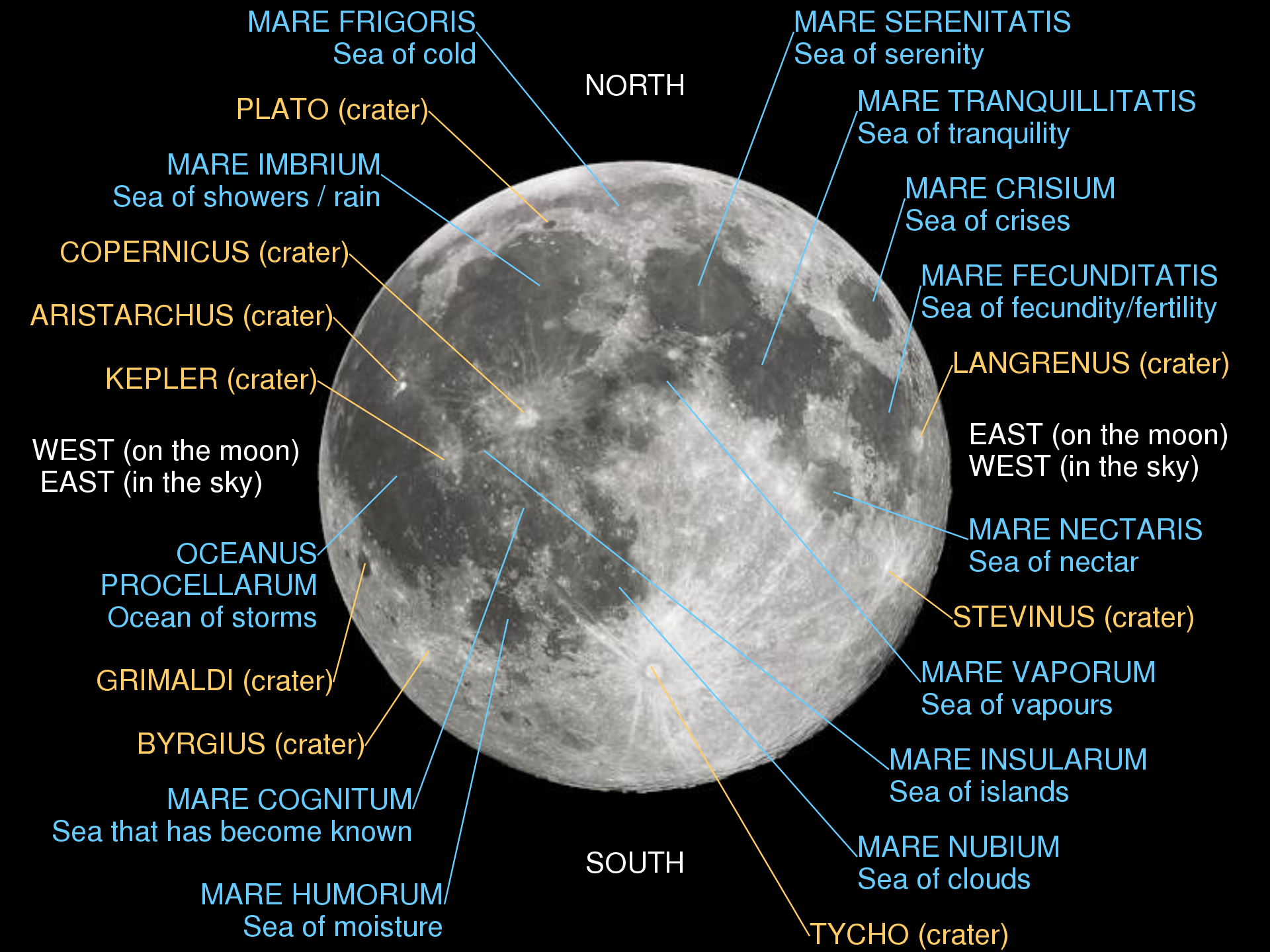

To the moon!