Markets

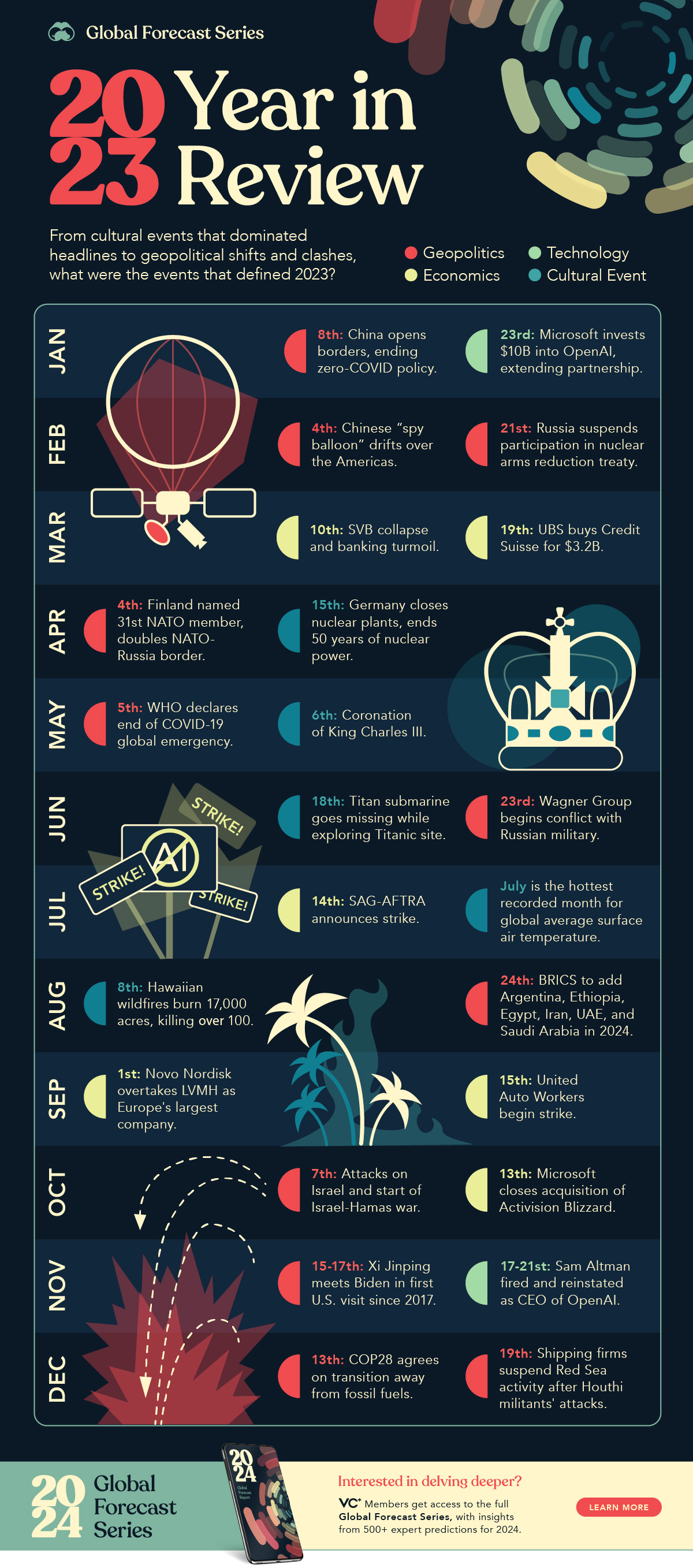

The Events that Defined 2023: Visualized

This visual is part of our 2024 Global Forecast Series. For full access to the series, learn more here.

Visualizing the Major Events of 2023

Looking back at 2023, the year was defined by various international geopolitical events while the tech and business world kept a close eye on artificial intelligence’s advances in the first full year of the technology hitting its stride.

This graphic from our upcoming 2024 Global Forecast Report looks back at the major events that dominated the headlines and captured the world’s attention in 2023.

From the AI tech boom to the various hot and cold conflicts around the world, many of this past year’s pivotal events will have continuing aftershocks and developments to track in 2024.

The Major Geopolitical Events of 2023

Geopolitics were in the spotlight in 2023 after Russia’s invasion of Ukraine shifted global power dynamics and international relations towards a multipolar environment.

As a result, tensions remained high between the U.S. and China throughout the year while various conflicts continued and sprung up in other regions.

China’s COVID Reopening and Spy Balloon Amidst Russia-NATO entrenchment

In the first two months of the year China dominated news headlines as the country reopened its borders and business, ending its highly restrictive zero-COVID measures and policy. The world’s manufacturing powerhouse was one of the last nations to loosen restrictions, and many anticipated it would kickstart the final leg of the world’s post-pandemic recovery.

However, in early February the discovery of what was dubbed a “spy balloon” floating over the U.S. and Canada quickly put China-U.S. relations on edge while Russia also suspended its participation in New START, a nuclear arms reduction treaty that would’ve allowed U.S. and NATO inspections of the country’s nuclear facilities.

Finland’s acceptance into NATO in April then doubled the alliance’s border with Russia, making it a key area to watch in 2024 as a senior Russian diplomat was quoted, saying that in the event of an escalation Finland would be the first to suffer.

BRICS Expansion and Xi Jinping’s Visit to the U.S.

June brought an unexpected internal clash in Russia as the Wagner Group briefly turned against the Russian military, with the mercenary group’s leader Yevgeny Prigozhin dying a couple months later in an airplane crash.

August also brought the BRICS bloc’s announcement of the addition of six new members starting in 2024, marking a key shift in geopolitical relations as the group added major oil producers Saudi Arabia, Iran, and the United Arab Emirates, along with Egypt, Ethiopia, and Argentina.

After nearly a year of further entrenchment in the newly fractured geopolitical landscape, November saw U.S.-China relations thaw as Xi Jinping met with Joe Biden in his first visit to the U.S. since 2017.

Israel-Hamas War and Red Sea Shipping Attacks

While relations between U.S. and China improved in the last quarter of 2023, new conflicts sprung up in other parts of the world.

Hamas’ attacks on Israel on October 7th kicked off Israel’s war against Hamas, which has been followed by Houthi rebel attacks on shipping lines in the Bab el-Mandeb Strait of the Red Sea.

The low-cost drone attacks have resulted in many major shipping firms redirecting their container-ships around all of Africa (extending their journeys by as much as 25%), while the U.S. has grappled with the advent of low-cost drone warfare costing the country millions in missiles as they’ve looked to protect ships in the strait.

Both the Israel-Hamas war and rebel attacks in the Red Sea remain two of the largest question marks around global tensions and affecting supply chains going into 2024.

OpenAI’s Roller Coaster Year

It would be impossible to talk about 2023 without mentioning the roller coaster year OpenAI has had in the spotlight of the AI gold rush.

The year started with Microsoft extending its investment and partnership with OpenAI by $10 billion, as Sam Altman’s company went on to launch its more powerful GPT-4 model along with other key features throughout the year like image recognition, image generation, and deeper custom model instructions with custom GPTs.

While the year seemed to be progressing perfectly for OpenAI at the forefront of the AI hype wave, the end of November saw Sam Altman fired as CEO of the company in one of the most shocking board decisions in recent business history. Sam Altman was reinstated as CEO within 72 hours, giving the tech world just a few days of pause to reflect on the issues of governance and leadership in one of the fastest growing industries.

Energy

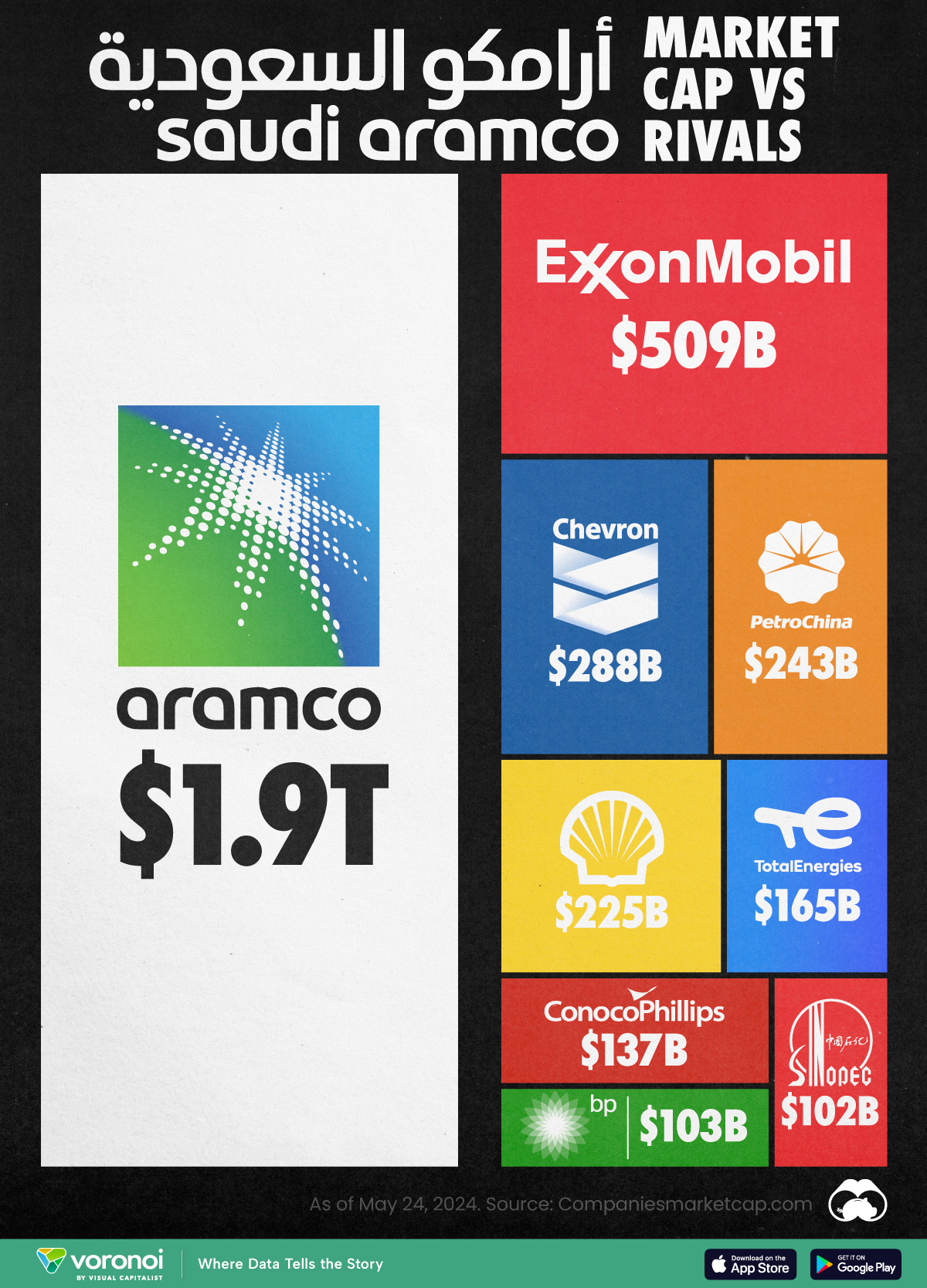

Comparing Saudi Aramco’s $1.9T Valuation to Its Rivals

See how much larger Saudi Aramco’s market cap is compared to rivals like Chevron, ExxonMobil, and Shell.

Putting Saudi Aramco’s Market Cap Into Perspective

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

As of May 2024, there are just six trillion-dollar companies in the world, and only one of them is an oil company.

In this graphic, we put Saudi Aramco’s market cap into perspective by comparing it to the rest of the world’s largest oil companies. Numbers were sourced from Companiesmarketcap.com, and are as of May 24, 2024.

Data and Takeaways

The data we used to create this graphic are listed in the table below.

| Company | Market Cap (as of May 24, 2024) |

|---|---|

| 🇸🇦 Saudi Aramco | $1,914B |

| 🇺🇸 Exxon Mobil | $509B |

| 🇺🇸 Chevron | $288B |

| 🇨🇳 Petro China | $243B |

| 🇳🇱 Shell | $225B |

| 🇫🇷 TotalEnergies | $165B |

| 🇺🇸 ConocoPhillips | $137B |

| 🇬🇧 BP | $103B |

| 🇨🇳 Sinopec | $102B |

Saudi Aramco launched its initial public offering (IPO) on December 11, 2019. It remains the largest IPO in history, raising $25.6 billion and valuing the company at $1.7 trillion. Aramco is also the only trillion-dollar company that isn’t based in the United States.

As of 2022, Aramco had proven reserves equal to 259 billion barrels of oil equivalent, which is massively greater than rivals like ExxonMobil (17.7 billion) and Chevron (11.2 billion).

$1.9T*

It should be noted that the Saudi government directly owns 90% of the company, while another 8% is held by the country’s sovereign wealth fund. With only 2% of shares available to the public, some believe that the company’s current valuation carries little weight.

For example, a Bloomberg op-ed from 2023 described Aramco’s valuation as an “illusion” due to its very low trading volume. Over a one year period, Aramco’s average daily turnover was just $51 million, compared to $1.9 billion for ExxonMobil and $1.4 billion for Chevron.

See More Market Cap Comparisons from Visual Capitalist

If you enjoyed this graphic, be sure to check out our similar graphic covering Nvidia.

-

Energy1 week ago

Energy1 week agoRanked: The World’s Largest Lithium Producers in 2023

-

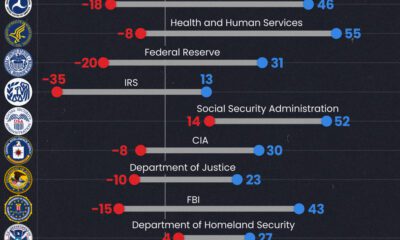

Public Opinion2 weeks ago

Public Opinion2 weeks agoCharted: How Democrats and Republicans View Government Agencies

-

Globalization2 weeks ago

Globalization2 weeks agoMapped: The Top Exports in Asian Countries

-

Finance2 weeks ago

Finance2 weeks agoRanked: The World’s 50 Largest Private Equity Firms

-

United States2 weeks ago

United States2 weeks agoMapped: The 10 U.S. States With the Lowest Real GDP Growth

-

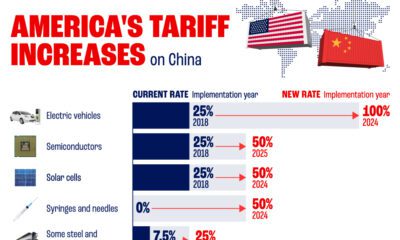

China2 weeks ago

China2 weeks agoComparing New and Current U.S. Tariffs on Chinese Imports

-

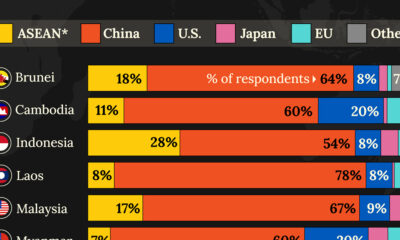

Politics2 weeks ago

Politics2 weeks agoWhich Countries Have the Most Economic Influence in Southeast Asia?

-

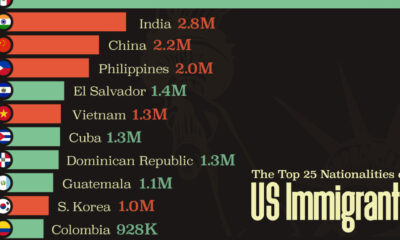

population2 weeks ago

population2 weeks agoThe Top 25 Nationalities of U.S. Immigrants