Gold Under Pressure on Monday

Gold prices are slipping on Monday, putting a pause on the more than 10% rally we’ve seen in gold over the last month. The selling comes despite news of Israel stepping up its invasion of Gaza this weekend through intensified land and air attacks. For now, the main focus seems to be on the fact that the conflict isn’t spilling over into a wide Middle East war. However, while that is the case for now, the risk of such an outcome remains very present and gold prices are subject to plenty of upside risks in coming weeks and months as the conflict continues.

Will Powell Push Gold Lower?

The FOMC will also be closely watched this week. With recent US data surprising on the upside, traders are wary of hawkish risks. In particular, the market will be assessing the Fed’s latest outlook and whether further tightening will be needed. Powell recently remarked on the impact rising bond yields were having on financial conditions, making the need for further Fed tightening less urgent. If Powell reiterates this message, USD is likely to come off through the back end of the week, allowing gold prices to recover. However, if Powell is seen taking a more hawkish view in light of recent data strength, this will likely weigh on gold prices near-term.

Technical Views

Gold

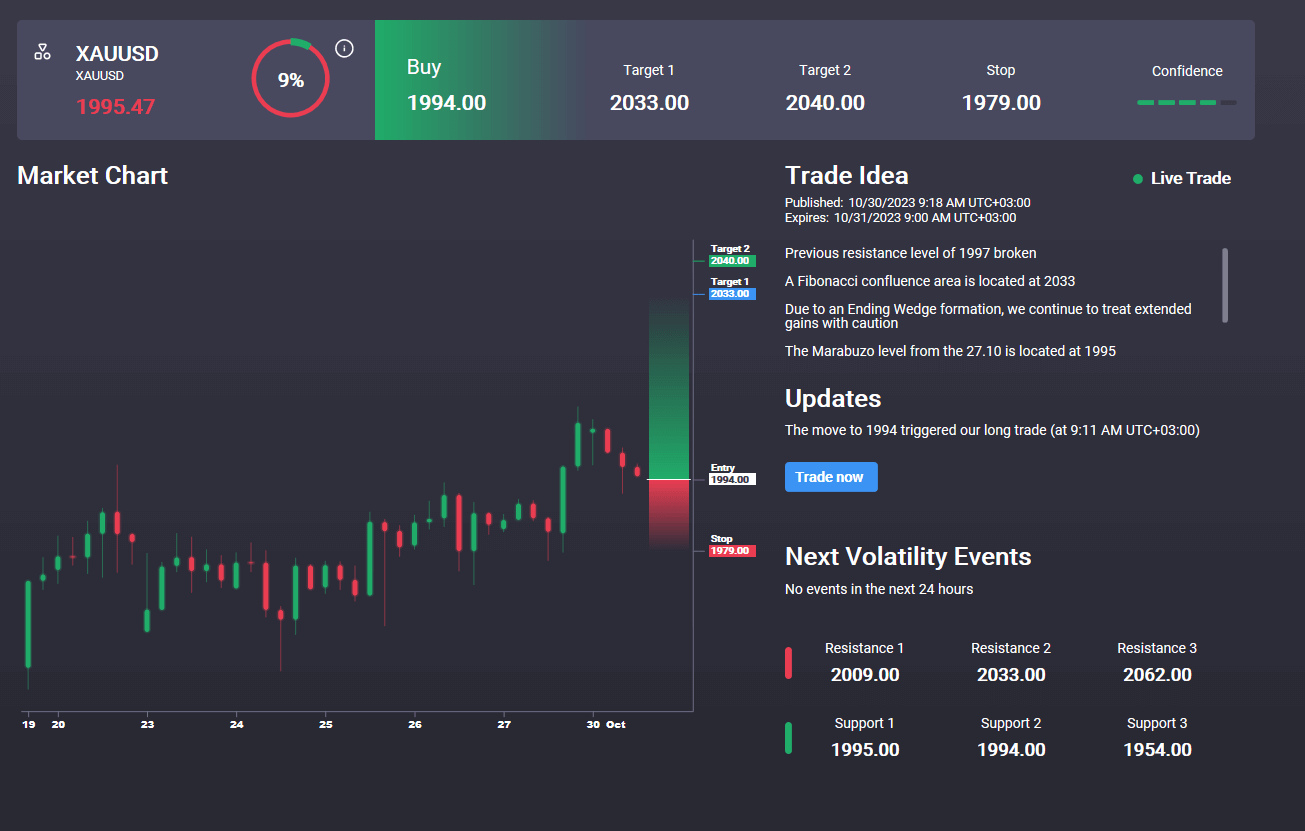

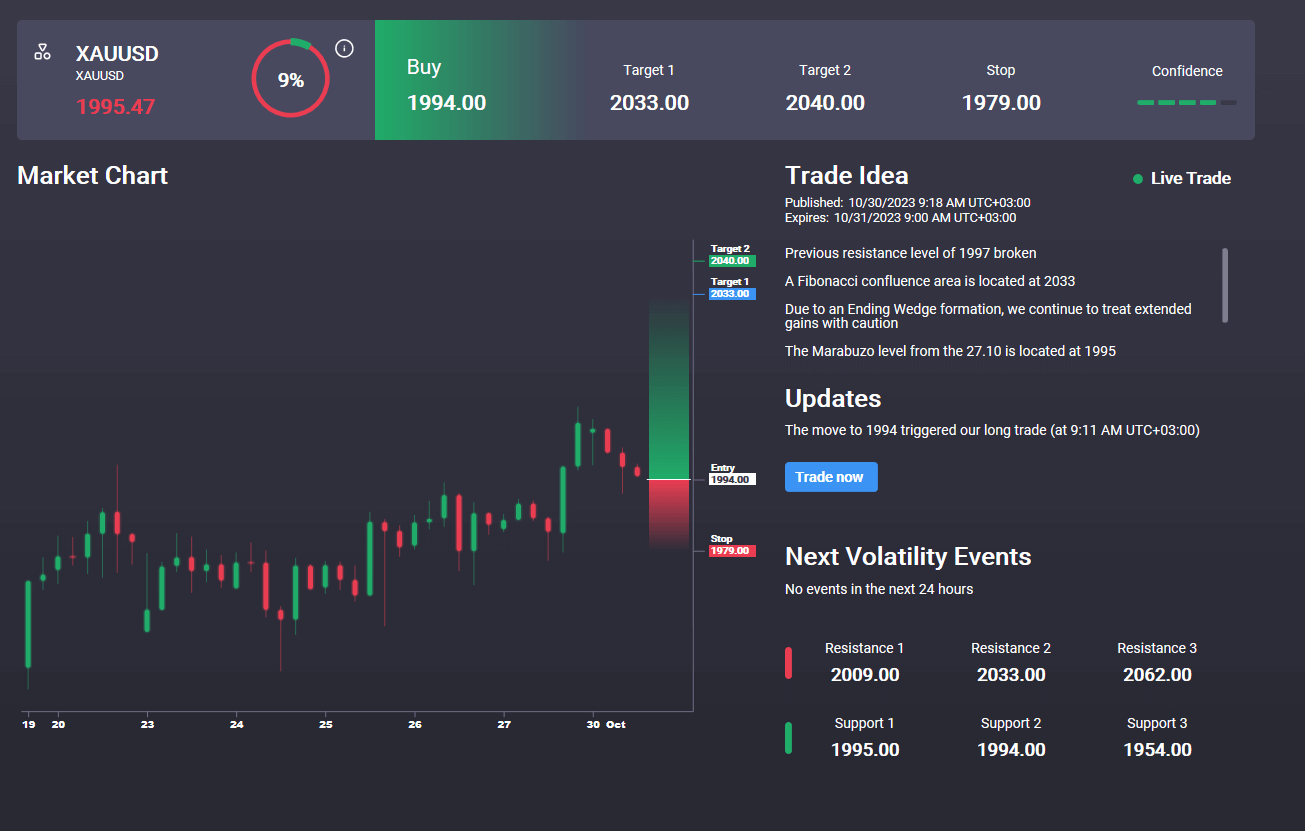

The rally in gold prices has stalled for now on the break above 1973.51. While this level holds below as support, the focus is on a continuation higher in line with 2069.41 the next objective for bulls. We are seeing some bearish divergence in momentum studies, however, suggesting risk of a deeper pullback. Only a break below the 1973.51 level will negate the bearish view. Worth noting too that we have an active buy signal in the Signal Centre today set at 1994 targeting a move back up through 2033.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.