Markets

All of the World’s Exports by Country, in One Chart

All of the World’s Exports by Country, in One Chart

In 2022, the total export value of global goods reached nearly $25 trillion.

With the evolution of international trade, the effects of globalization, and progress in technology, global trade has increased by around 300% over the last 20 years.

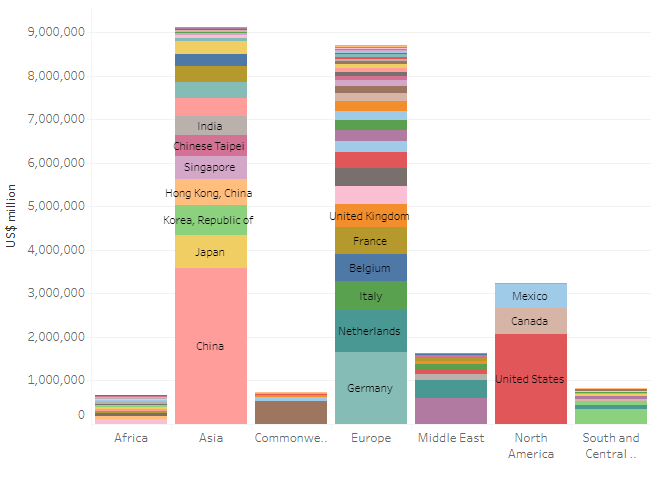

This visualization by Truman Du uses data from the World Trade Organization (WTO) to chart the world’s top exporters by country.

China is Still the “World’s Factory”

The world’s largest 11 exporters shipped out $12.8 trillion of goods in 2022, more than the rest of the world combined ($12.1 trillion).

The list is headed by China, with $3.6 trillion or 14% of total exports. The country has been the largest exporter of goods in the world since 2009.

| Top 11 | Country | Exports (USD) |

|---|---|---|

| 1 | 🇨🇳 China | $3.6T |

| 2 | 🇺🇸 U.S. | $2.1T |

| 3 | 🇩🇪 Germany | $1.7T |

| 4 | 🇳🇱 Netherlands | $965.5B |

| 5 | 🇯🇵 Japan | $746.9B |

| 6 | 🇰🇷 South Korea | $683.6B |

| 7 | 🇮🇹 Italy | $656.9B |

| 8 | 🇧🇪 Belgium | $632.9B |

| 9 | 🇫🇷 France | $617.8B |

| 10 | 🇭🇰 Hong Kong | $609.9B |

| 11 | 🇦🇪 United Arab Emirates | $598.5B |

In 2022, the top products exported from China by value were phones (including smartphones), computers, optical readers, integrated circuits, solar power diodes, and semiconductors.

Two of China’s primary trading partners are neighboring countries Japan and South Korea.

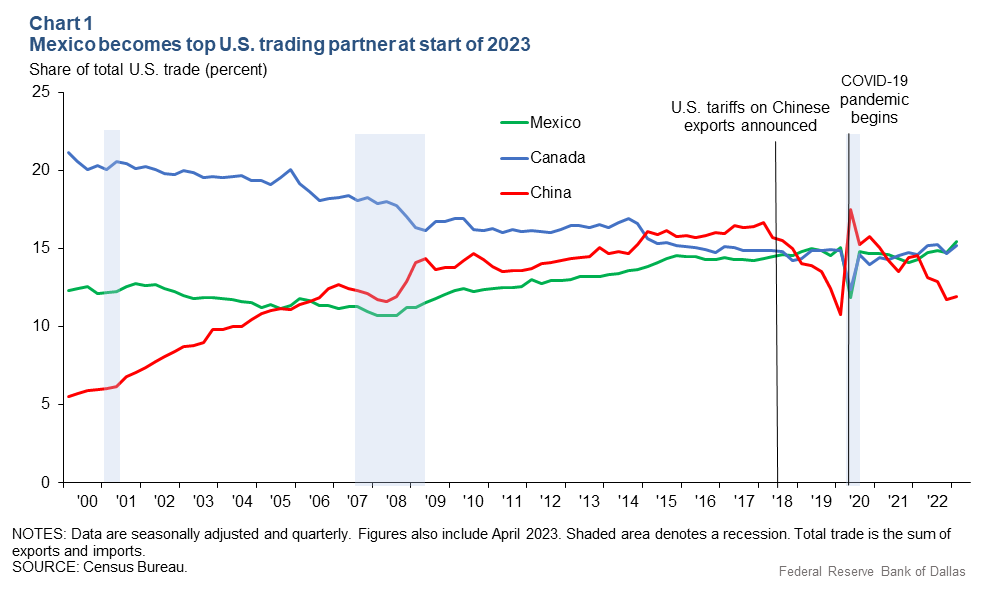

Mexico Surpasses China as America’s Largest Trading Partner

China has built up significant trade relations with the European Union and the United States, two of the world’s largest markets for goods.

However, recent trade tensions have led to China losing its status as the United States’ biggest trading partner in 2023.

Mexico has now overtaken China as the largest seller to the United States. This shift in trade dynamics is part of a broader effort by the U.S. to import goods from closer to home and reduce its dependence on geopolitical rivals.

The U.S. itself is the world’s second largest goods exporter, with over $2 trillion annually.

Canada was the largest purchaser of U.S. exports in 2022, accounting for 17% of total exports, followed by Mexico, China, Japan, and the United Kingdom.

The top exports of the United States are refined petroleum, petroleum gas, crude petroleum, cars, and integrated circuits.

The Regional View of Exports by Country

From a regional perspective, it’s clear Asia dominates the trading market with over 36% of the total exports, followed by Europe with 34%.

Source: World Trade Organization

While Asian, European, and North American countries have manufactured and technology products among their main exports, African and South American countries mostly export commodities such as oil, gold, diamonds, cocoa, timber, and precious metals.

A New Era of Deglobalization?

International trade grew immensely at the beginning of the 21st century, from $15.6 trillion in 2001 to $40.7 trillion in 2008.

Since then, protectionist trade policies such as taxes on foreign goods and import quotas have increased by 663%. Similarly, global trade as a percent of GDP has also stalled out, peaking in 2008 and going sideways ever since.

Despite many countries reducing their interdependence and integration in the post-COVID era, global exports are still set to grow by 70% between 2020 and 2030, reaching $29.7 trillion by 2030, according to Standard Chartered.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Energy

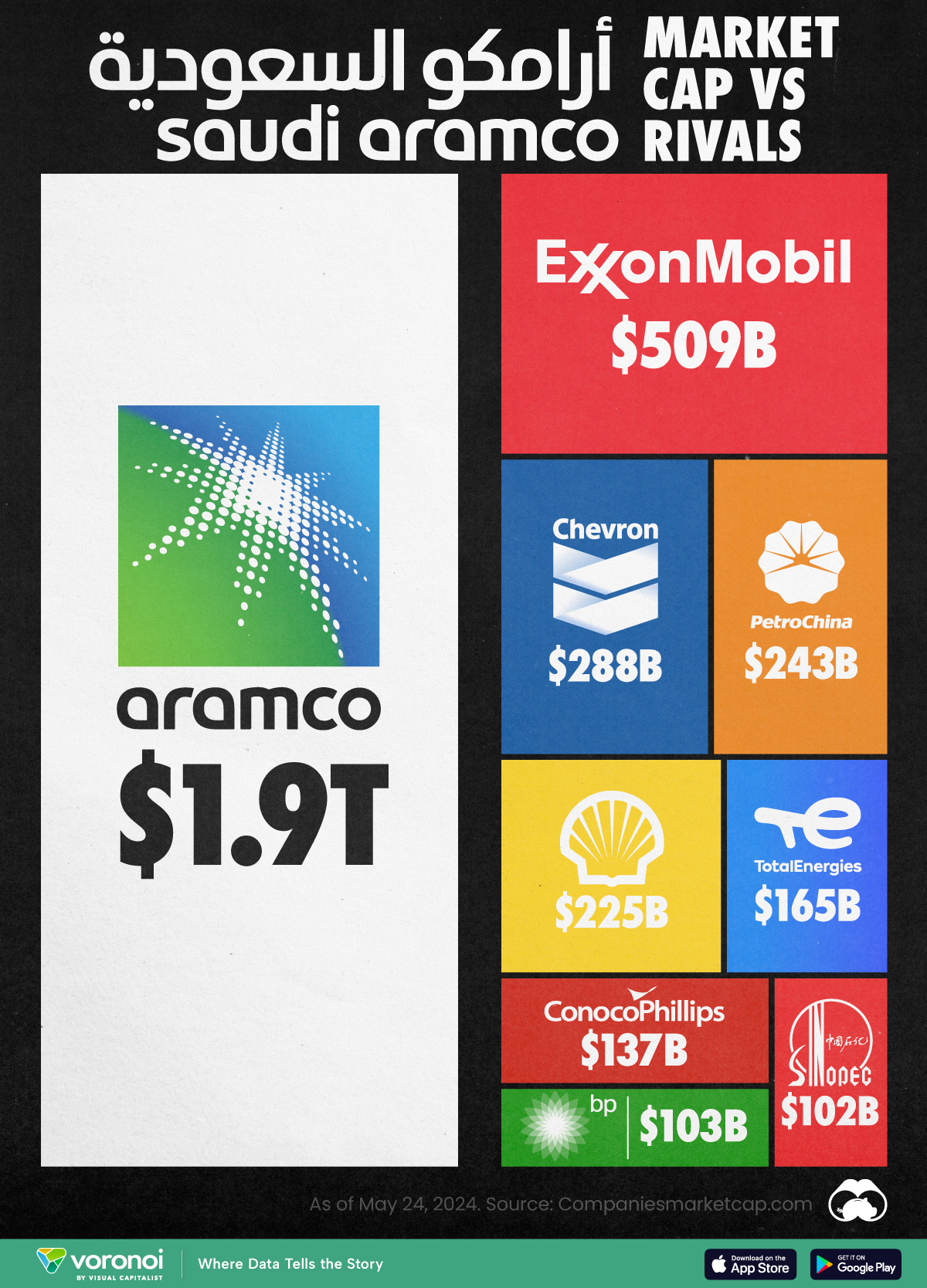

Comparing Saudi Aramco’s $1.9T Valuation to Its Rivals

See how much larger Saudi Aramco’s market cap is compared to rivals like Chevron, ExxonMobil, and Shell.

Putting Saudi Aramco’s Market Cap Into Perspective

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

As of May 2024, there are just six trillion-dollar companies in the world, and only one of them is an oil company.

In this graphic, we put Saudi Aramco’s market cap into perspective by comparing it to the rest of the world’s largest oil companies. Numbers were sourced from Companiesmarketcap.com, and are as of May 24, 2024.

Data and Takeaways

The data we used to create this graphic are listed in the table below.

| Company | Market Cap (as of May 24, 2024) |

|---|---|

| 🇸🇦 Saudi Aramco | $1,914B |

| 🇺🇸 Exxon Mobil | $509B |

| 🇺🇸 Chevron | $288B |

| 🇨🇳 Petro China | $243B |

| 🇳🇱 Shell | $225B |

| 🇫🇷 TotalEnergies | $165B |

| 🇺🇸 ConocoPhillips | $137B |

| 🇬🇧 BP | $103B |

| 🇨🇳 Sinopec | $102B |

Saudi Aramco launched its initial public offering (IPO) on December 11, 2019. It remains the largest IPO in history, raising $25.6 billion and valuing the company at $1.7 trillion. Aramco is also the only trillion-dollar company that isn’t based in the United States.

As of 2022, Aramco had proven reserves equal to 259 billion barrels of oil equivalent, which is massively greater than rivals like ExxonMobil (17.7 billion) and Chevron (11.2 billion).

$1.9T*

It should be noted that the Saudi government directly owns 90% of the company, while another 8% is held by the country’s sovereign wealth fund. With only 2% of shares available to the public, some believe that the company’s current valuation carries little weight.

For example, a Bloomberg op-ed from 2023 described Aramco’s valuation as an “illusion” due to its very low trading volume. Over a one year period, Aramco’s average daily turnover was just $51 million, compared to $1.9 billion for ExxonMobil and $1.4 billion for Chevron.

See More Market Cap Comparisons from Visual Capitalist

If you enjoyed this graphic, be sure to check out our similar graphic covering Nvidia.

-

Healthcare1 week ago

Healthcare1 week agoVisualizing Daily Protein Sources by Region

-

Globalization2 weeks ago

Globalization2 weeks agoMapped: The Top Exports in Asian Countries

-

Finance2 weeks ago

Finance2 weeks agoRanked: The World’s 50 Largest Private Equity Firms

-

Markets2 weeks ago

Markets2 weeks agoMapped: The 10 U.S. States With the Lowest Real GDP Growth

-

Economy2 weeks ago

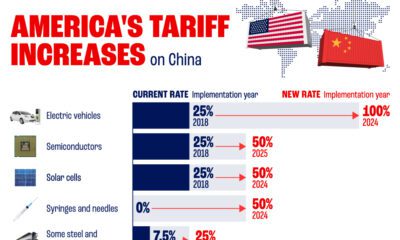

Economy2 weeks agoComparing New and Current U.S. Tariffs on Chinese Imports

-

China2 weeks ago

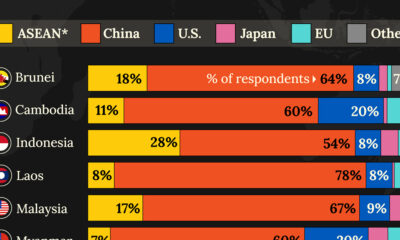

China2 weeks agoWhich Countries Have the Most Economic Influence in Southeast Asia?

-

United States2 weeks ago

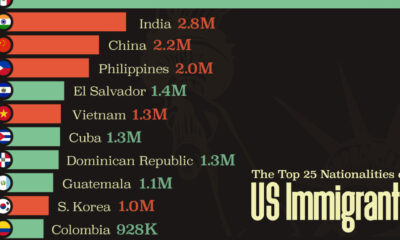

United States2 weeks agoThe Top 25 Nationalities of U.S. Immigrants

-

Countries2 weeks ago

Countries2 weeks agoRanked: Countries Where Youth are the Most Unhappy, Relative to Older Generations