Guy on Rocks: This multi-million ounce gold play could double its share price in the next 18 months

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

A tough week for precious metals with a strong USD (closing at 104.2) and rising US 10-year treasuries up 11 basis points on the week to close at 3.81%.

Gold closed at US$1,947/oz, down 1.5% for the week or around US$125 lower than its highs from a few weeks ago. Short covering has seen a bounce in the gold price to around US$1,957/ounce mid-week.

Silver finished at US$23.23/oz, down 2.2% by the Friday close. Platinum closed down 3.9% to US$1,022/oz while palladium was off 6.2% to US$1,396/oz for the week.

The big winner on the markets last week was the NASDAQ, up 2.5%, while volatility as measured by the VIX Index remains relatively subdued at 18.2.

The impasse over the debt ceiling was no doubt a contributor, however late in the week it appears that US President Joe Biden and Republican Kevin McCarthy reached some sort of in principle agreement to raise the federal government’s $31.4 trillion debt ceiling.

A default was always unlikely however the US Government has defaulted twice previously, once in 1933 and again in 1971. It is worth noting the US debt is about the same as its GDP!

The deal will still need to pass through Congress however the compromise appears to be a cap on government spending over the next two years and some additional work requirements for programs for the poor. It appears this will go for a vote on Wednesday by which time this commentary may be a little out of date.

Given the stronger US economic news out last week which included durable goods and personal spending, together with higher inflation at 4.7% for April, it appears that a 25 point lift in interest rates for the June Federal Reserve meeting is almost a certainty.

Plenty of economic news out next week including consumer confidence (Tuesday), jobless claims (Thursday) and non-farm payrolls (Friday).

Copper has been down six weeks in a row and was off 4 cents to US$3.67/lb although the three-month futures is still trading at a slight contango. Not surprisingly, given the soft economic data from China, hedge funds are now net short copper.

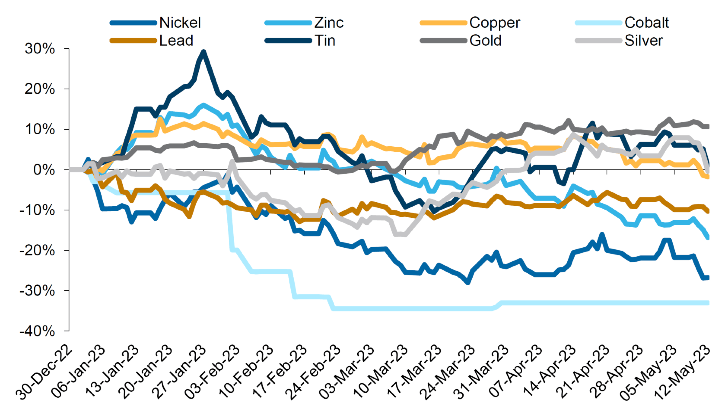

Nickel (down 27%), cobalt (down 33%), zinc (down 30%) and lead (down 10%) have also poorly performed this calendar year (figure 1) on the back of continuing soft economic news in China.

Despite the poor commodity price performance this year, Macquarie have highlighted that operating margins (figure 2) in the sector remain robust.

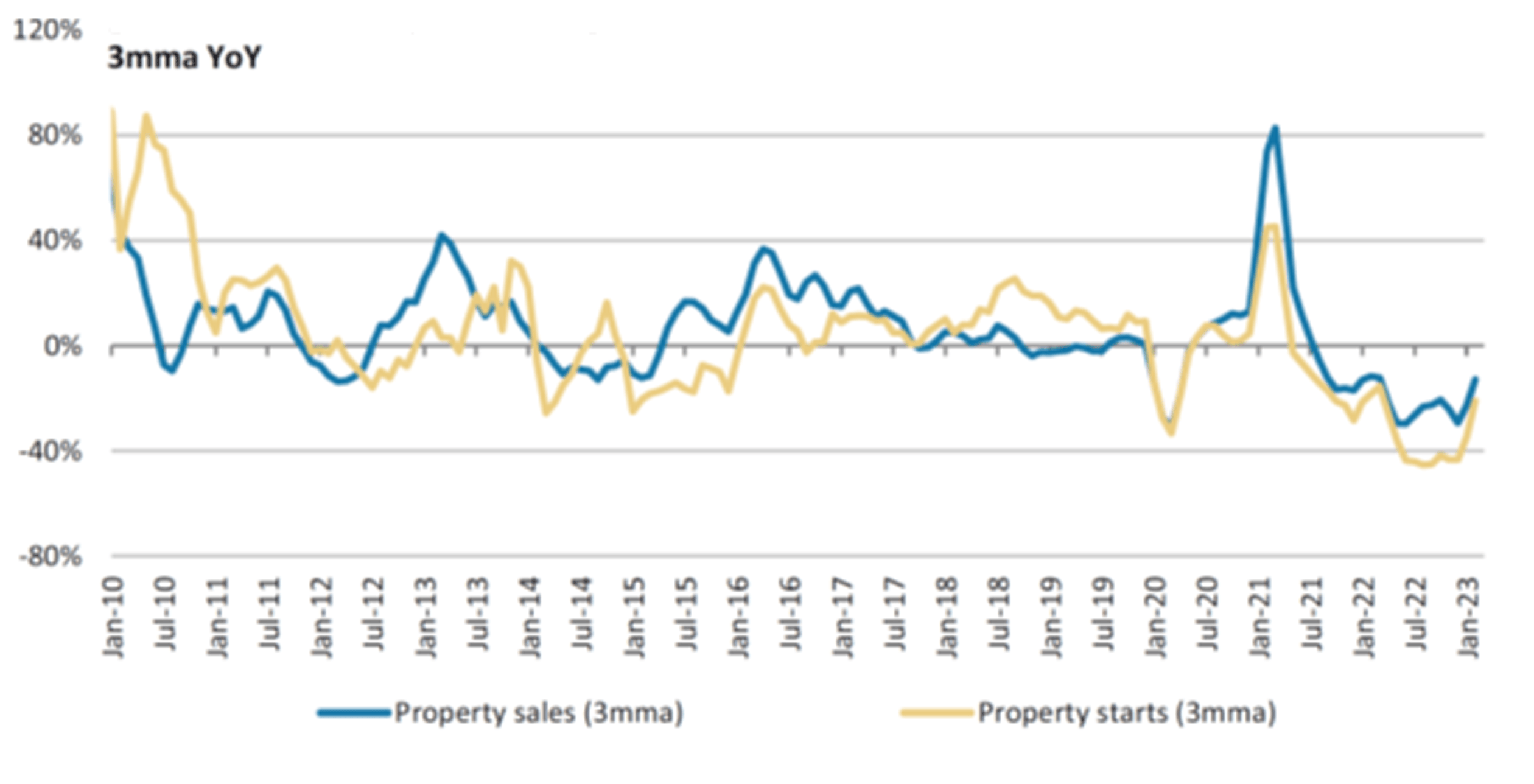

In April new property new starts in China (figure 3) fell 27.3% YoY in April (March: -29% YoY) however Morgan Stanley (May 2023) believe that government stimuli should see this improve over 2H 2023.

Steel apparent consumption dropped 1.5% YoY in April (Mar: +5.0% YoY) with crude steel output also likely to decline over the balance of CY 2023 with declining exports and weak domestic demand.

In line with the soft market for steel, China iron ore imports were also down 10% in April to 90Mt.

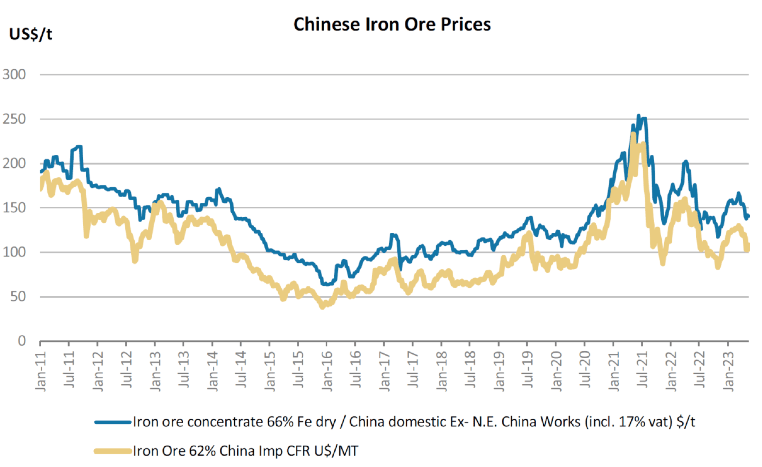

Iron ore prices (figure 4) have continued to however around US$100/tonne (CFR China, 62% fines).

Uranium hit a 52-week high closing at US$54.38/lb, up 50 cents on the week, while lithium prices in China have stabilised and rebounded to above RMB200K/tonne in response to the improving demand outlook, restocking by downstream cathode producers and failed negotiations with spodumene producers which were unsuccessful in achieving lower prices.

Macquarie (May 2023) are confident of a rebound in lithium carbonate prices to RMB250-300K/t.

Cathode material production schedules in China also appear to be back on track according to Morgan Stanley in terms of monthly actual production/production schedules of cathode materials which were around ~50% of capacity in 1Q23, 50-60% in April, and forecast to be 70-80% in May and 100% in June when compared with average levels seen in 4Q22.

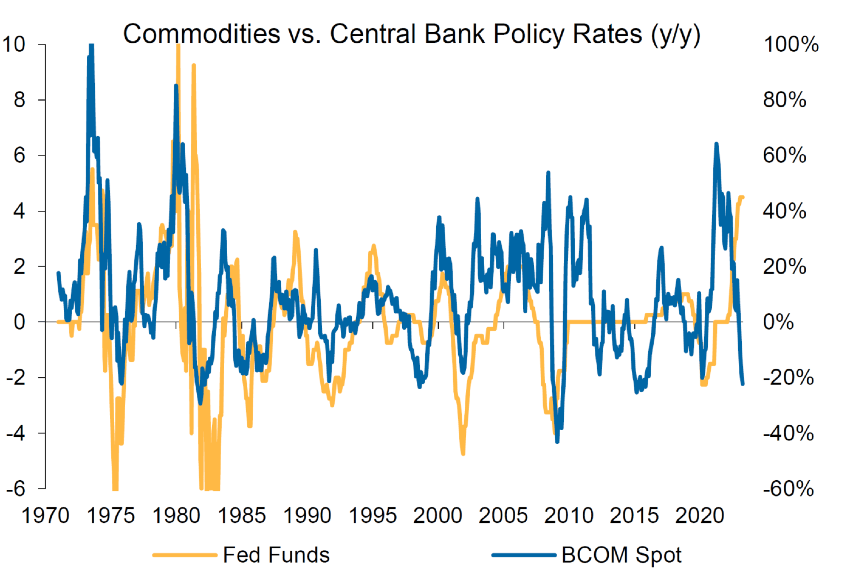

So, the important question is can we see a correlation between interest rate policy and commodity price performance? According to Macquarie (25 May 2023), there is an inconsistent relationship between the two (figure 5).

While Macquarie does concede that rate cuts will ultimately be positive for commodities, they appear some way off given the underlying strength of the US economy together with persistently high inflation.

So those looking for some short-term reassurance might be wise to find a bottle of Balvenie 14-year-old double wood scotch or a 2017 Henschke Keyneton Estate Shiraz/Cabernet (for those lacking a strong constitution) in one hand and a large Nicaraguan or Dominican cigar in the other to ease the pain.

I think I might reach for a Davidoff Churchill around mid-week.

I was genuinely in need of some comfort this week after the Namibian Mines minister wrecked my train when he got out of bed on the wrong side, sending the Paladin Energy (ASX:PDN) share price down 20% in the process.

The minister indicated that the government was seeking equity in various mining and petroleum projects for nil consideration.

If any clear-thinking mining company director was considering sending the main man a case of the Barossa Valley’s finest cabernet/shiraz blends, now might be an opportune time.

There is every chance this would breach the $300 soft dollar benefit threshold, so I would recommend delegating the mother-in-law (or equivalent) to arrange this one. It seemed to work for Jordan Belfort…

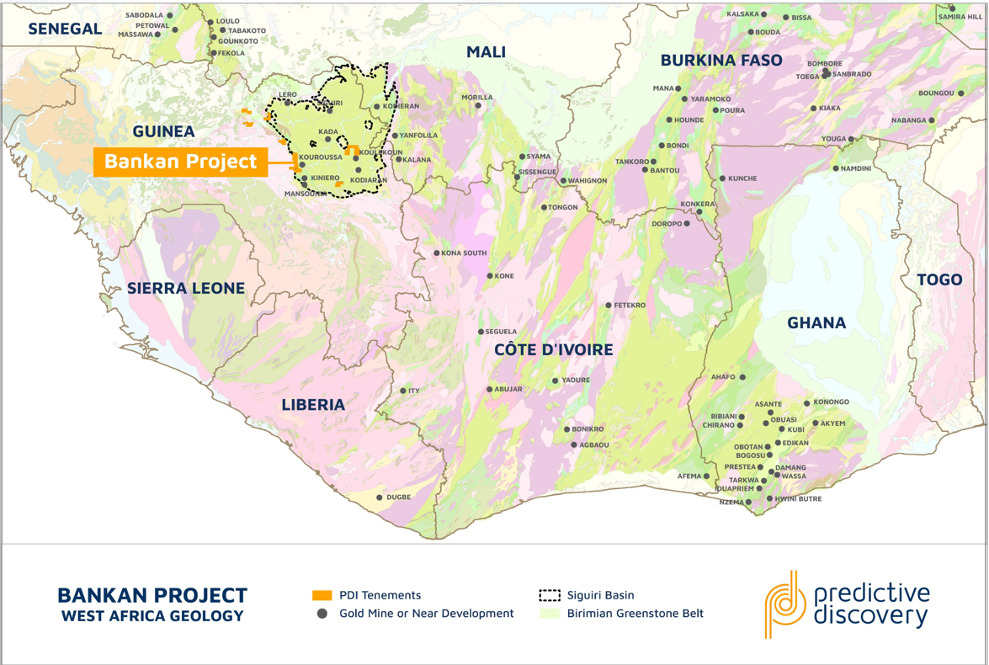

I first picked up West African gold developer Predictive Discovery (ASX: PDI) back in January 2022 and like many gold explorers/developers, the share price (figure 6) has drifted back and is now sitting at 15 cents despite kicking some serious goals at its Bankan Project (figure 7) which has included in excess of 80,000m of RC and diamond drilling over the preceding 12 months.

At some stage we should see a rotation of funds out of lithium and rare earth plays back into small and mid cap gold explorers/developers.

The company, led by former Centamin (LSE:CEY, TSX:CEE) CEO director Andrew Pardey, has just received commitments for a $40 million placement at 15 cents per share with the proceeds to be applied to its flagship Bankan Project.

Not a bad effort given the current sentiment towards the gold sector in general with the placement being undertaken at a modest 5% discount.

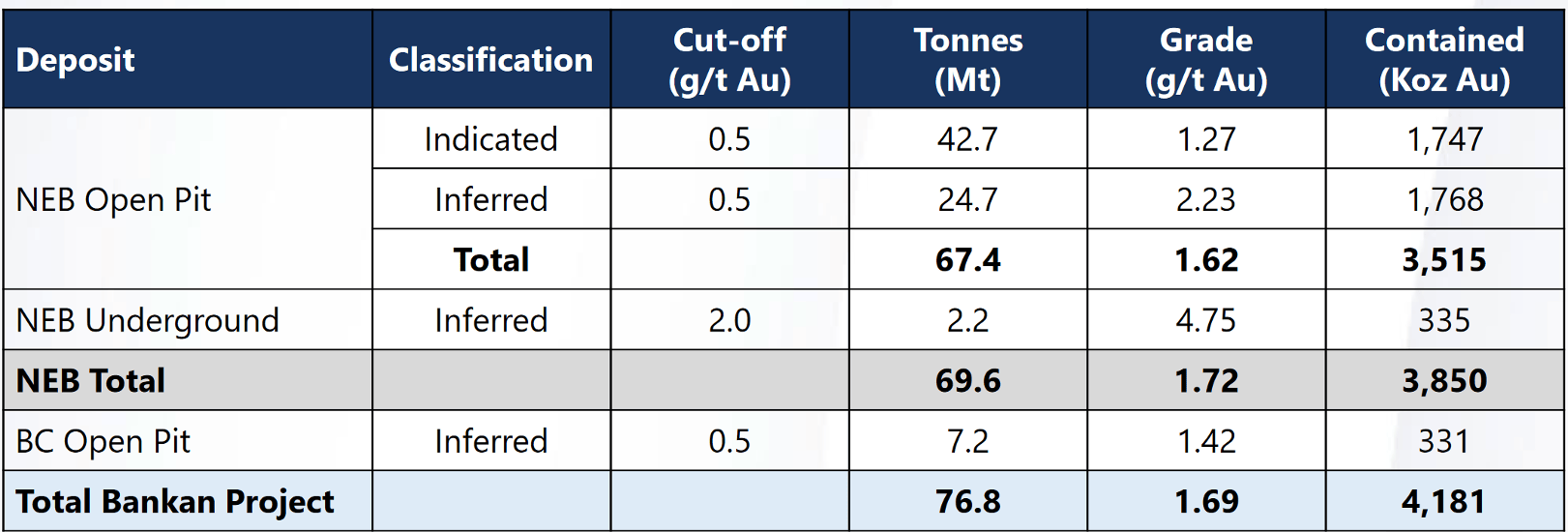

The placement proceeds will be applied to, among other things, further resource definition and is likely to result in an expansion to the existing JORC Resource of 4.2Moz of gold (table 1).

Notably, 50% of the contained gold sits in the NEB resource pit shell within the top 250m. Looking at table 1 it would be good to see if the company can bring in more of the higher grade (+2.2 g/t gold) inferred to the indicated category over the next few drill campaigns.

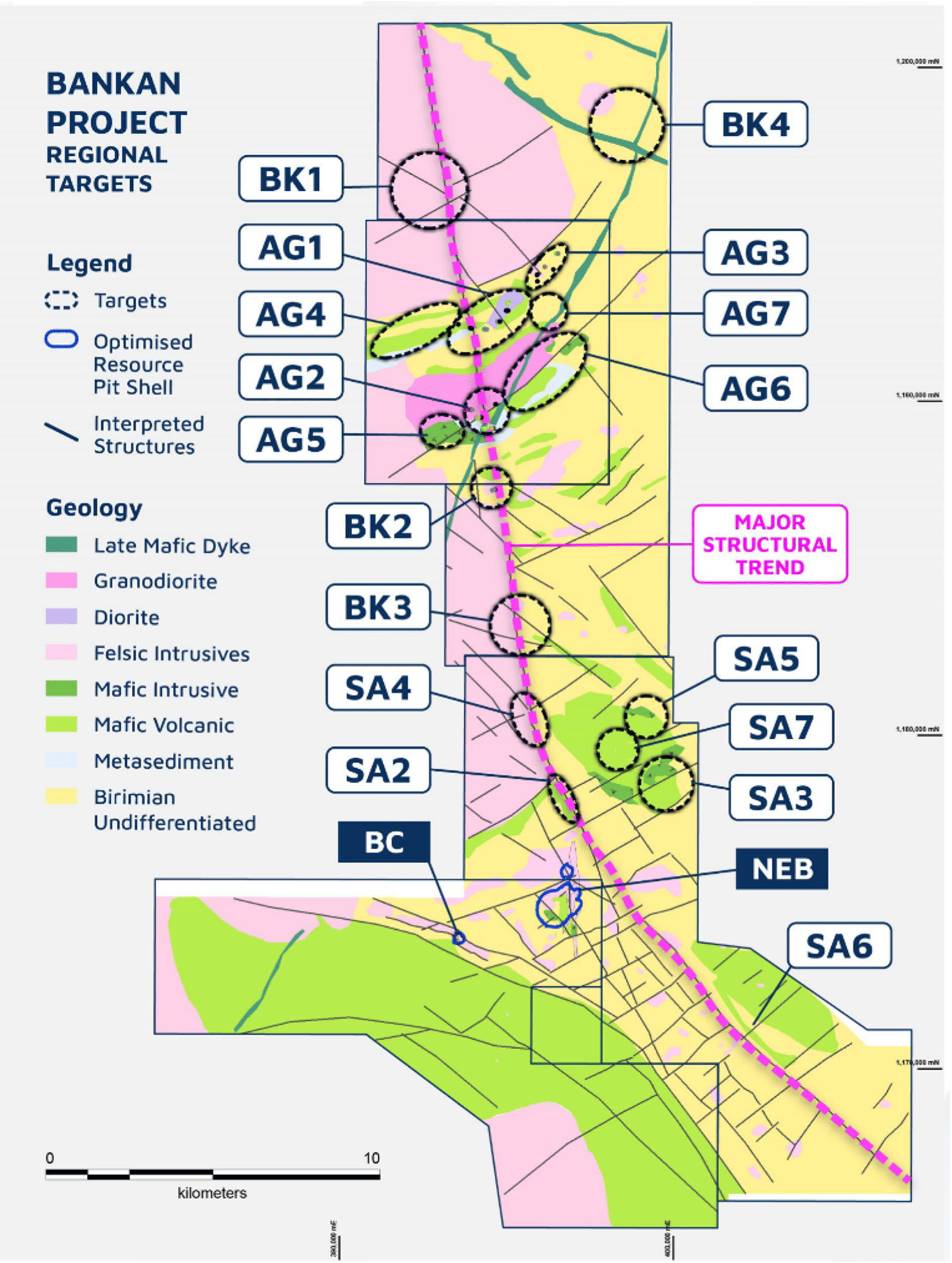

PDI will shortly be commencing an RC drill program on the Argo prospect situated north of the NEB deposit, one of a number of prospective targets along a 35km mineralised gold structure (figure 8).

Preliminary metallurgy looks reasonably positive with recoveries at +92% with just over half recoverable through the gravity circuit.

The company is also looking to complete a Scoping Study later in CY 2023 which could be a bit premature (from a technical perspective) given there remains significant resource potential along strike from NEB, and therefore further scope for optimisation of various production scenarios.

Having said that there is a drive to secure a mining permit in 1H 2024, hence the focus on completing this study.

The major gold producers such as AngloGold Ashanti (ASX: AGG) and Barrick Gold Corporation (GOLD: NYSE) are on the hunt for 5Moz JORC Resources with potential for 500,000 ounces of production per annum so this will no doubt be on their radar (along with a few of the mid tier producers as well).

One thing about Barrick and Anglo is they have an appetite for risk and aren’t afraid to pay up.

I like the bigger plays which can attract a takeover premium (typically 40-50% over the last five years or so) and this certainly fits the bill.

Cashed up with an enterprise value of just over $220 million (translating to an EV of around A$50/ounce) I think the stock has a reasonably good chance of doubling its price over the next 18 month to two years.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.