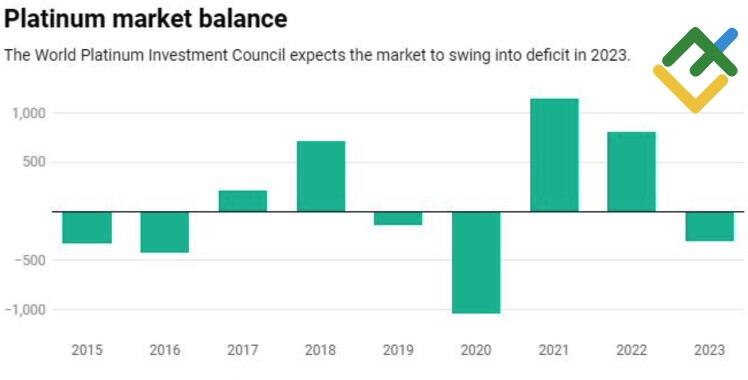

After two surplus years, the platinum market has swung into deficit, a landmark event for the XPTUSD. Even more so because the world economy may turn out to be in a better-than-expected state. Let's discuss that and make a trading plan.

Six-month fundamental forecast for platinum

Platinum is the only publicly traded precious metal that has fully clawed back the losses of 2022. And that's the last month's success for most commodity assets owed to the greenback's weakening amid the Fed's slowing down its monetary policy tightening. The first blow is half the battle! The swing in the Fed's mood can be the springboard for XPTUSD in 2023 as the platinum market risks running into deficit after two surplus years, the World Platinum Investment Council concludes.

The Council downgraded its forecast for platinum surplus from 974 to 804 thousand ounces in 2022. However, it asserts that the market will face a deficit of 303 thousand ounces next year as the demand grows by 19% to 7.77 million ounces. Producers won't fully satisfy that demand because of the power cuts in South Africa, affecting platinum mines. Neither will China's platinum reserves help the market out due to tough export control measures.

Platinum market's balance

Source: Reuters.

The WPIC sees investors’ and industrial interests as the main reason for the growing demand. From January to September 2022, the outflows from some platinum ETFs after their liquidation amounted to 235 thousand ounces. Investment demand is forecast to reduce by 525 thousand ounces by the end of 2022. However, the situation will turn upside down in 2023. The interest in platinum bars will grow by 49%, whereas the net investment volume will grow by 212 thousand ounces.

Growing car sales and the substitution of expensive palladium with cheaper platinum in the production of autocatalysts will increase industrial demand for platinum. The WPIC estimates that the automobile sector will consume 324 thousand ounces in 2023, 11% more than in 2022. Europe is the main platinum consumer, so the correlation between XPTUSD and EURUSD looks appropriate.

Platinum and euro

Source: Trading Economics.

The euro is the optimist's currency. The euro buyers hope that the Fed will achieve a soft landing for the economy using soft monetary policy, the eurozone's energy crisis-driven recession won't be long and deep, and, finally, China will defeat COVID-19 and fully reopen its economy in 2023. So, the WPIC's forecasts for platinum will come true if the regions that produce three-quarters of the world's GDP feel OK.

Six-month trading plan for the XPTUSD

Thus, the XPTUSD's long-term prospects look bullish, but no one knows when the metal will start showing stable growth. Will that happen in Q2 of 2023, or has the rally already started? Even if consolidation happens in the nearest time, we should seize the moment to buy platinum at a lower price, for example, on a breakout of resistance at $1,000 an ounce. My next prediction is that the metal will grow to $1,060 and $1,135 in 3 and 6 months.

Price chart of XPTUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.