- XAU/USD gold prices rose after the US Federal Reserve raised interest rates by 75 basis points for the third time in a row, a widely expected move that wiped out some predictions that the central bank was making a more aggressive hike.

- The price of gold witnessed fluctuation, instability and collapsed to the support level of $ 1654 an ounce, before quickly recovering to the resistance level of $ 1688 an ounce.

- The price of gold XAU/USD settled around the level of $ 1672 in the beginning of trading today, Thursday.

Gold Falls 0.7%

The Fed said it expects ongoing interest rate increases to be appropriate, while the Fed's median forecast shows rates at 4.6% in 2023. Accordingly, Robert Haberkorn, chief market analyst at RJ O'Brien & Associates, said: “Some were expecting They might make a full point, and the fact that they held it as expected made gold catch bid here and make a rally.” And “the market was expecting a 0.75 rate hike, and there weren’t big surprises from what the market was pricing in.”

Overall, the XAU/USD gold price is down 7.8% this year as the highest inflation rate in decades prompted central banks from Europe to the US to raise interest rates at the strongest pace in recent memory. Higher rates reduce the attractiveness of gold, which is not an interest bearing asset.

After raising the US interest rate, as expected, the updated forecast showed the US unemployment rate rising to 4.4 percent by the end of next year and the same at the end of 2024 - up from 3.9 percent and 4.1 percent, respectively, in the June forecast. The Fed's quarterly outlook, which showed a steeper rate trajectory than officials announced in June, underscores the Fed's determination to cool inflation despite the risk that higher borrowing costs could push the US into recession. Interest rate futures showed that investors betting on interest rates would peak around 4.6 percent in early 2023.

Powell and his colleagues, who criticized the initial slow response to escalating price pressures, have turned aggressively to catch up and are now introducing the tightest policy since the Fed under Volcker four decades ago. Estimates of economic growth in 2023 were lowered to 1.2 percent and 1.7 percent in 2024, reflecting a greater impact from monetary tightening.

US inflation peaked at 9.1 percent in June, as measured by the 12-month change in the US consumer price index. But it has failed to fall as quickly as Federal Reserve officials had hoped in recent months: In August, it was still 8.3 percent. Meanwhile, job growth has remained robust, and the unemployment rate, at 3.7 percent, remains below levels most Fed officials consider sustainable over the long term.

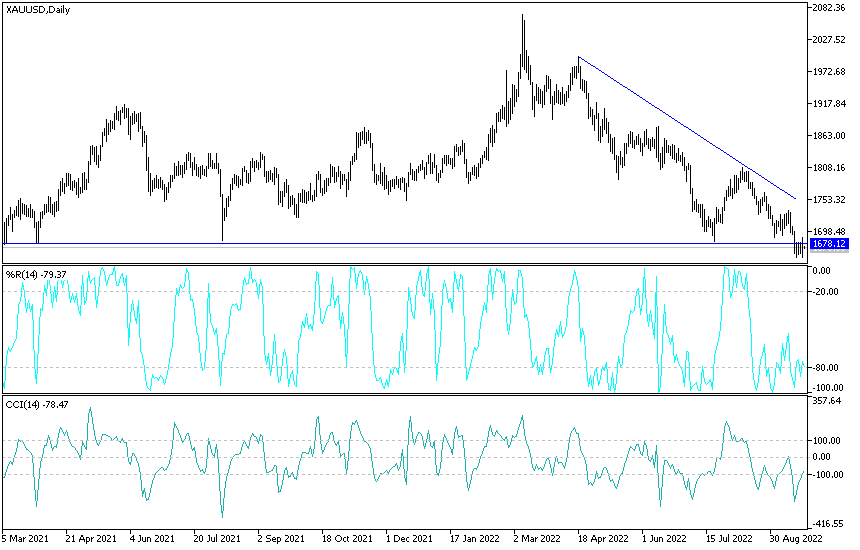

XAU/USD gold price forecast today:

According to the performance on the daily chart, the price of gold XAU/USD has returned to the neutral zone. The tendency will be upwards if it returns to stability above the level of 1700 dollars for an ounce. Currently, the bears’ control is stronger, and the move towards the support levels of 1658 and 1640 dollars supports the current trend. At the same time, it is possible to think of the last support level and less of it that happened, as some technical indicators moved towards oversold levels and increased global geopolitical tensions, which paves the way for the demand for gold.

The price of gold today will be affected by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction from the announcements of the global central banks, the Bank of Japan, the Bank of England and the Swiss Central Bank.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.