Gold and Silver: Strong bullish impulse and jump of 1.80%

- The price of gold continues its bullish trend after confirming support at $1750 twice yesterday.

- During the Asian trading session, the price of silver consolidated at around $20.00.

- Growing concerns about a global economic slowdown and heightened tensions between the US and China sparked by US House Speaker Nancy Pelosi’s trip to Taiwan continue to act as tailwinds for gold.

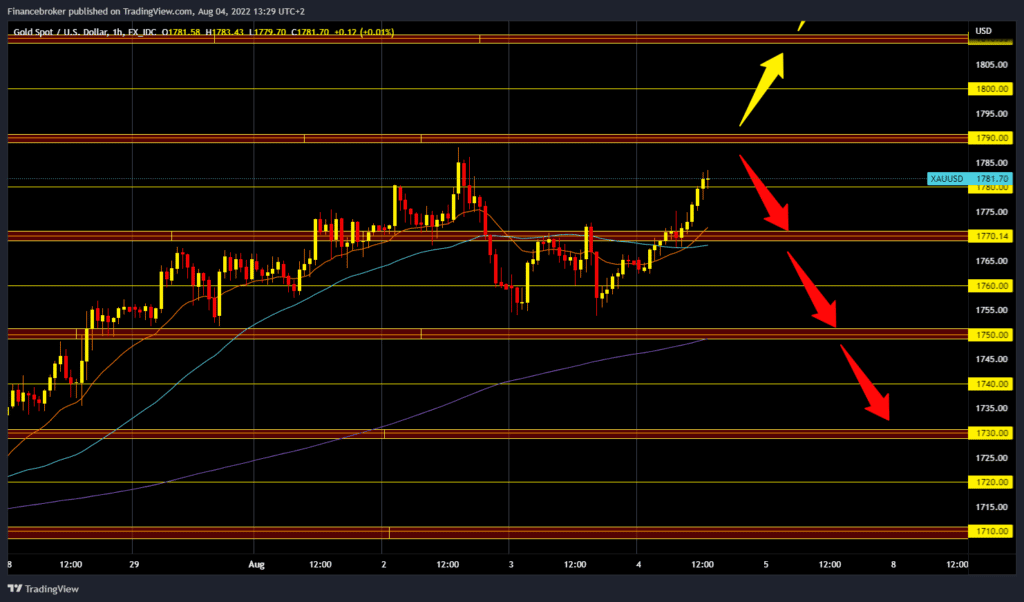

Gold chart analysis

The price of gold continues its bullish trend after confirming support at $1750 twice yesterday. During the Asian session, the price of gold was in a strong bullish impulse, and it continued during the European session. The current price of gold is $1781, which represents an increase of 0.95% since the start of trading last night. The next target is the $1790 resistance zone. The day before yesterday, we tried to make a break above, but we were unsuccessful, the price did not withstand too much pressure, and a pullback occurred. To continue the bullish option, we need a jump above $1790; after that, we could expect the price to continue to $1800. The last time we were at that level was a month ago. We need a negative consolidation and a pullback below the $1770 level for a bearish option. MA20 and MA50 then move to the bearish side and increase price pressure. Our next target is $1750 support from yesterday. And if a drop below occurs, the potential targets are the $1740 and $1730 levels.

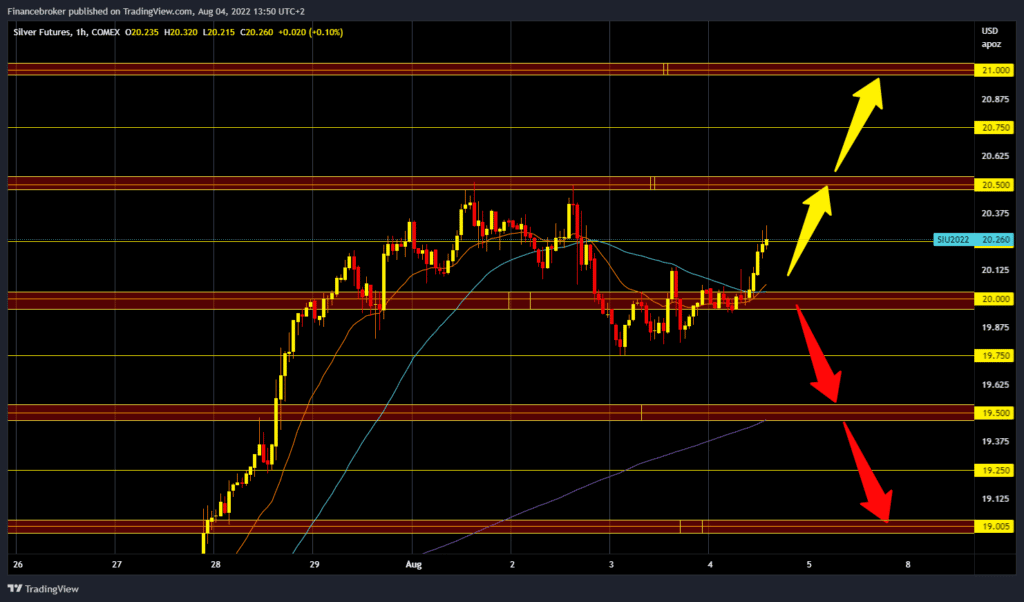

Silver chart analysis

During the Asian trading session, the price of silver consolidated at around $20.00. He finds support there, and the price continues to rise to $20.25 in European trading, representing a jump of 1.80% since the start of trading last night. The price must rise to the $20.50 level to continue on the bullish side. If it were to hold in that zone, it would have a chance to break above and continue towards $20.75 and the 21.004 level. A negative consolidation and pullback to the $20.00 level is needed for a bearish option. A price break below would increase the chances of a continuation of the decline. After that, potential lower targets are $19.75 and $19.50 levels.

Market overview

Growing concerns about a global economic slowdown and heightened tensions between the US and China sparked by US House Speaker Nancy Pelosi’s trip to Taiwan continue to act as tailwinds for gold. In addition, the appearance of some selling around the US dollar offers additional support to the price of gold. Several Federal Reserve officials hinted this week that interest rate hikes would be soon. This, along with the recent recovery in global equity markets, could limit gold price gains. The NFP report will be released on Friday and will play an important role in influencing dollar-denominated commodity price movements.