US inflation hasn’t been this high since the early 80s

US inflation pressures show no sign of easing with headline CPI now at 7% and core up at 5.5%. It hasn't been this high since the days of Thatcher and Reagan. We could be close to the peak but the risk is that inflation stays higher for longer and we could see a more aggressive response from the Fed

| 7% |

US inflationThe fastest rate since June 1982 |

Higher and higher

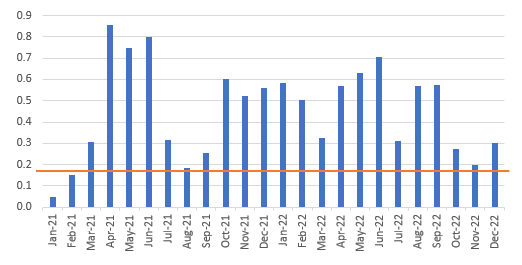

Who doesn't like a bit of nostalgia for the 1980s? But the inflation rates, like shoulder pads, are probably something we would prefer to do without. The Month-on-Month reading for US CPI is a little higher than expected taking the headline to 0.5%MoM, 7%YoY while core (ex-food & energy) is up 0.6%MoM, 5.5%YoY. The big upside was in clothing, posting a 1.7%MoM increase after a 1.3% increase in November. Used car prices were up another 3.5%YoY with new vehicles prices gaining 1%. Housing was also strong, posting another 0.4% increase. Food was up 0.5%. On the downside, there were price declines in recreation and fuel

US annual inflation (YoY%)

The breadth of price pressures is most alarming

The CPI report confirms the story told by yesterday's National Federation of Independent Business survey showing the proportion of companies raising prices are at the highest for 40 years. More concerningly, the NFIB reported a new all-time high for the proportion of firms expecting to raise their prices further in the next three months. It doesn't tell us how much they will raise them by, but the breadth of corporate pricing power must alarm the Federal Reserve, especially in an environment where labour costs are accelerating as firms desperately seek workers.

NFIB survey shows record proportion of firms able to raise their prices

Inflation should soon start to slow

As for the path for inflation, we expect it to gradually slow in the coming months but it will likely remain above 3% throughout the year. The assumption is that supply chain strains will start to ease from the summer onwards while the upside impetus from housing should fade as rising mortgage rates bite. Higher borrowing costs in general should start to take some of the steam out of the economy. Then there is the prospect of outright falls in some components, such as second-hand car prices, which are up by more than 50%. As the global chip shortages ease we should see more availability for new vehicles and second-hand car prices could fall sharply.

Housing components of CPI may start to peak in the summer as higher mortgage rates bite

Risks remain skewed towards higher for longer

That said, the risks are likely skewed towards higher for longer inflation with the Federal Reserve ending up responding more aggressively to keep it in check. After all, labour costs are accelerating, companies have pricing power, Asia lockdowns in response to a zero-Covid policy risk prolonging supply chain strains while inventory rebuilding could keep demand outstripping supply for a good while yet.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more