You Can Always Trust the Fed

…to print more money!

We have to take issue with most Americans. They don’t trust the Federal Reserve.

Two Ipsos polls this year, commissioned by Axios, show that a majority of the people, ranging from 53 percent to 60 percent, don’t trust the Fed.

The numbers might have been higher, but the polling was done before all the stories broke about possible insider trading at the Fed.

After the failures of Bears Stearns and Lehman Brothers in 2008, the Federal Reserve secretly committed the American people and the US government to $29 trillion in bailout commitments. No debate, no legislation, to authorization. $29 trillion! Wall Street on Parade notes that with the Fed has gone to court for three years to keep the American people learning the details of these crony deals, it has lost all credible claims to the trust of the American people.

But there is one thing you can trust the Fed to do: print more money. That is the sole source of its power. That is why it was created. That is what it does. And frankly, that is all it does. Oh sure, it has a couple of other functions like running the check clearing operations between banks. But that could easily be done, and probably at much less cost, by private companies.

None of this should be a surprise. You can learn more about the Fed and money printing in my new book REAL MONEY FOR FREE PEOPLE: The American Gold Story. Stop by our offices and pick up a copy. There is no cost and no obligation. We just think that the more people who know what is happening to our money, the better off we will all be when the crisis comes!

So with the American people getting the idea that inflation, now at a 30 year high, is going to be with us for a while, the Fed delivered a long-awaited announcement last week explaining what it was going to do about it.

It turned out to be a big, fat nothing burger.

Did the Fed announce it was going to stop inflating? No. But it says it will slow down. At least for now. Although it might change its mind. But it certainly isn’t going to raise interest rates.

So the Fed will still enter 2o23 printing about $3 billion a day!

As we said, the big announcement responding to unacceptable inflation amounted to a big, fat nothing burger. The markets yawned.

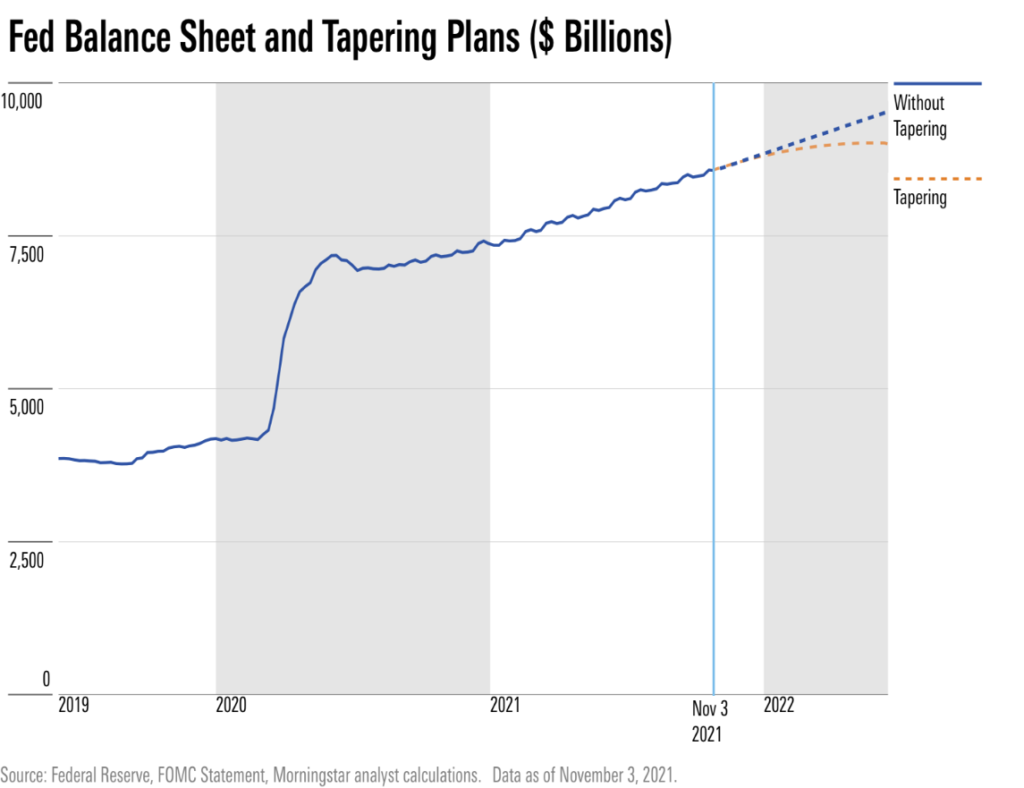

If the Fed tapers its money printing at the schedule the Fed suggested, here is what happens to the Fed’s assets, all the money that it has printed to buy things like government debt and mortgage bonds:

It remains bloated beyond belief. As we reminded you recently, Nobel-prize winning economist Milton Friedman pointed out that there is a time lag between increases in the money supply and it showing up in rising consumer prices. Some economists now believe that time lag can last a year or two. The incredible amount of money the Fed has printed since 2020 will be showing up in rising prices for a long time to come.

And at the first sign of trouble on Wall Street, the Fed will crank the digital printing presses right back up.

Because you can always trust the Fed.

To print more money.