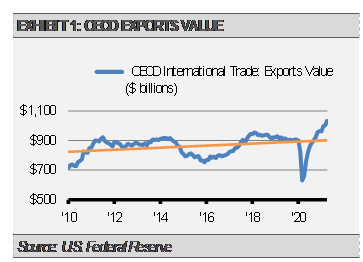

While shortages for all manner of goods have been a hallmark of this pandemic induced recession and recovery, it is important to understand what is driving these issues. As we look for the causes of these supply chain disruptions, we find a myriad of factors. While demand for certain goods, such as semi-conductors and steel, has overwhelmed supply, overall global exports are at an all-time high. Importantly, global industries are currently producing goods at a record pace in this globalized economy. As the following chart shows, global exports for OECD (Organization of Economic Cooperation and Development) countries collapsed with the COVID-19 induced lockdowns. However, exports quickly reversed and are now running at levels above the previous cycle trendline from 2010-2019.

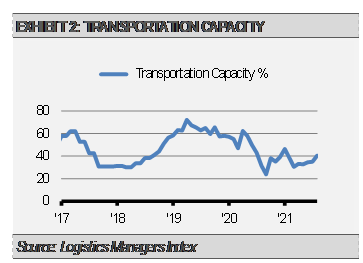

Global exports are booming, but the capacity to ship these goods has yet to recover from the losses incurred during the global economic lockdown. For example, according to The Logistics Managers Survey, which measures U.S. transport and warehousing capacity growth and contraction, the U.S. shipping industry continues to struggle to build capacity.

We can also see an example of this by looking at the number of container ships and tankers in port and at anchor awaiting space at the Port of Los Angeles and the Port of Long Beach. Ports on the U.S. west coast are the nearest point of entry for goods coming from Asia. According to the Marine Exchange of Southern California as of September 17th, there were a record 147 total vessels in port, at anchor, and in drift areas ships. As a result, many goods that are in demand are sitting on ships waiting to be offloaded and sent to market. This congestion may be attributed to increases in new orders and infrastructure bottlenecks, including a lack of transportation and qualified workers.

COVID-19 closures have also caused spending to deviate from services towards goods, which has intensified demand for a broad array of goods contributing to supply chain disruptions. In addition, we find that other factors, such as logistical and transport constraints, are also contributing. In effect, the record number of exports has overwhelmed transportation capacity. Eventually these issues will be worked out as demand normalizes and transport capacity increases. Until then, we expect supply chain disruptions to continue.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.