- Gold meets resistance and there are prospects of a significant correction.

- US dollar pressured by falling US Treasury yields.

Gold prices were elevated again on Thursday as the US dollar dipped to a fresh low on the back of sliding US yields.

At the time of writing, XAU/USD is trading at $1,754.55 having popped from a low of $1,733.26 to a high of $1,758.72 on the day.

US Treasury yields were losing ground again due to the fresh dovish comments from Federal Reserve Chair Jerome Powell.

Also, worse-than-expected initial jobless claims that highlighted the economy's bumpy recovery from the pandemic threw cold water over the US dollar's bullish performance of late.

The data showed that initial claims for state unemployment benefits totalled a seasonally adjusted 744,000 for the week ended April 3, compared with 728,000 in the prior week. Continued unemployment claims though fell to 3.73 million for the week of March 27.

Meanwhile, at an International Monetary Fund event on Thursday, Fed's Powell said a surge in spending as the US economy reopens, along with bottlenecks in supply, will likely push prices higher this year, but would not result in the kind of yearly price increases that would constitute inflation.

The 10-year US Treasury yield dropped to a fresh low of 1.6280% and was ending on Wall Street down some 2.64%.

Fed's Powell's remarks followed the cautious Federal Open Market Committee minutes on the March policy meeting released on Wednesday whereby various participants noted that changes in the path of policy should be based primarily on observed outcomes rather than forecasts.

Gold technical analysis

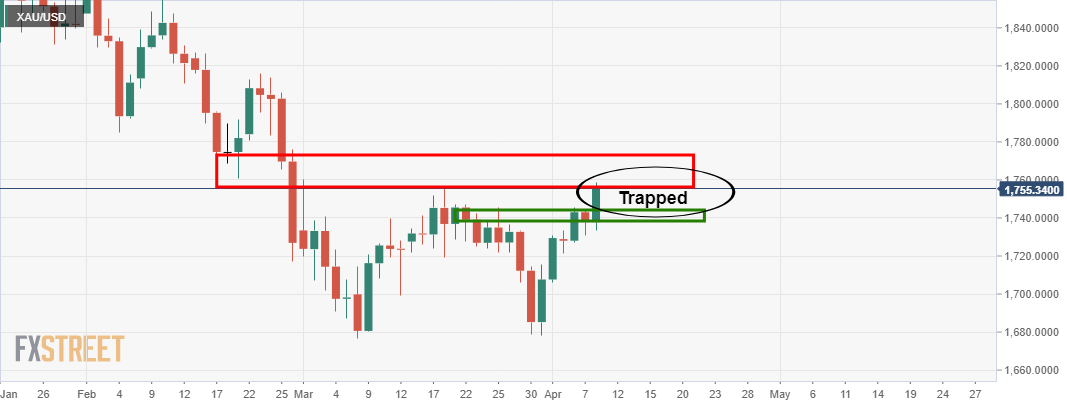

In the above daily chart, the price is now testing a critical resistance area and has developed a new support structure.

A close above the support today opens the prospects of a higher high, but the price could well find its self consolidating in coming sessions and trapped between resistance and support.

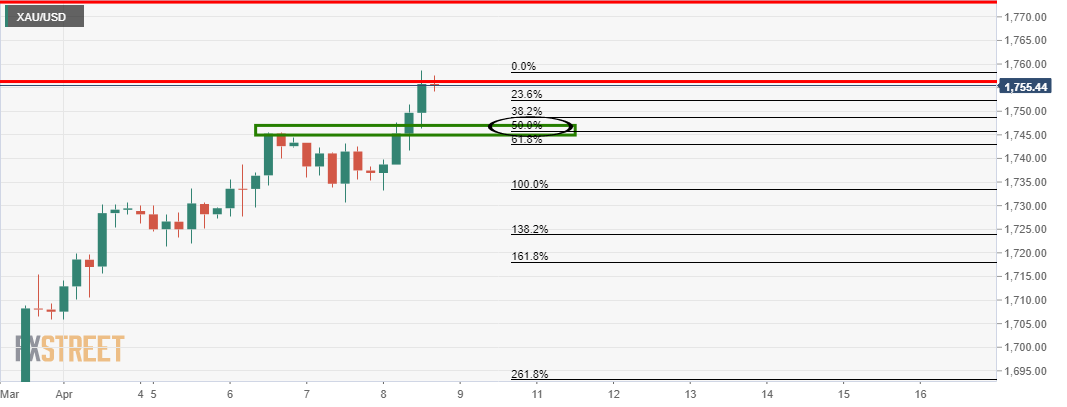

From a 4-hour perspective, there are prospects of a 50% mean reversion to prior resistance as follows:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price on the defensive, amid soft US Dollar

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.