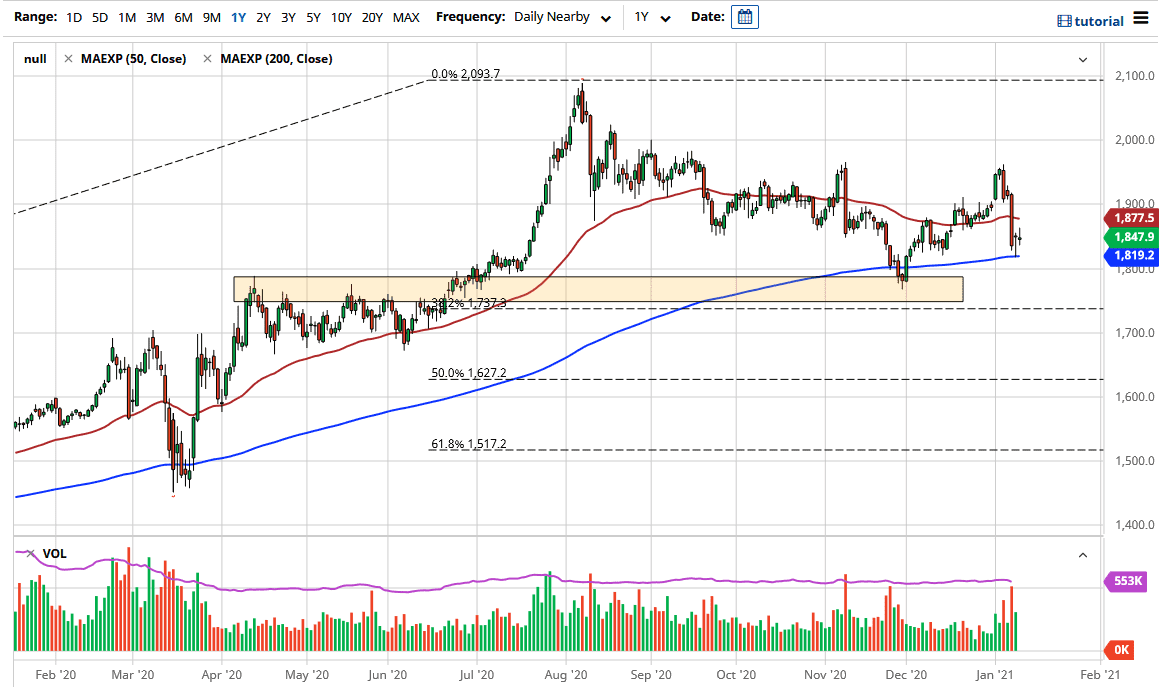

Gold markets fluctuated during the trading session on Tuesday as we mimick what happened on Monday. After all, we had completely collapsed before, but it seems as if the market is trying to figure out what to do with itself just above the 200-day EMA. The 200-day EMA is quite often used by long-term traders to determine where the trend is going. As long as we can stay above the 200-day EMA, there is going to be a certain amount of buying based upon that alone.

The gold market is highly sensitive to the US dollar, which has been sold off rather drastically in general. However, recently, we have seen the yields in the 10-year note spike, which tends to work against the value of gold in general. Most people are willing to simply collect interest instead of risking money on something as volatile as precious metals. Another significant driver of gold to go lower is the fact that the US dollar has gained right along with it. Nonetheless, the writing is on the wall for the greenback, so it makes sense that gold would continue to be a bullish market.

The hammer on Monday was the first hint that perhaps we are getting closer to the end of selling, and the fact that we have had a couple of days of sitting just above the 200-day EMA suggests that there is a bit more to the stability. In that case, I think you will hear a lot of noise more than anything else, but this is the beginning of exactly what is needed to restore confidence to the gold markets, which are in a long-term bull market due to the Federal Reserve looking to destroy the US dollar, just as many other central banks are trying to bring down the value of their own currencies. Because of this, I think that buying on the dips will probably work out, but I would do so slowly, due to the fact that there is a lot of noise out there that could cause issues not only in this market, but commodities in general. However, the first half of the year is going to be all about commodities, gold included.