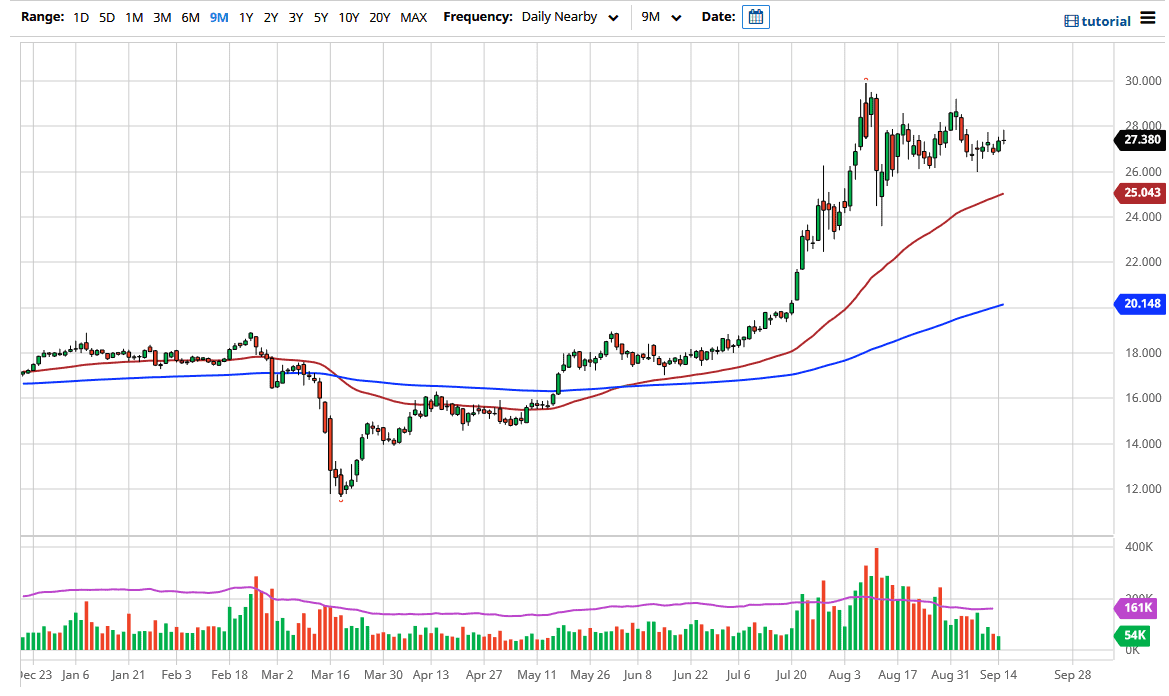

Silver markets rallied after gapping slightly higher at the open on Tuesday again. However, we continue to see a lot of resistance above near the $28 level. Because of this, the market rolled over and started to sell off again. The $28 level continues to be a sticking point for the market, so I think it is difficult to get above there. If we were to break above the $20 level, it is likely that the market could go looking towards the $29 level. Above there, the market then goes looking towards the $30 level.

Looking at the candlestick, it is a shooting star which is a negative sign but when you look at the several days previously, there has been a lot of back and forth and I think that continues to be the main take away here: that the silver market is likely to grind in a bit of a range. This makes quite a bit of sense considering that the US dollar might be turning around and if it is in fact going to show strength, it is very possible that will work against silver. Furthermore, the question now has to be asked whether or not the economy is slowing down? If it is, that could bring questions about whether or not there is going to be enough demand for silver.

Looking at the downside, I think there is plenty of support near the $26 level, so I would be looking for a buying opportunity somewhere near there. This is a market that also is supported by the 50 day EMA underneath there near the $25 level. That is not only a technically important level due to the moving average, but it is also a large, round, psychologically important figure that will more than likely cause some issues. Because of this, I think that anything near that level will end up being a buying opportunity assuming that we get a bit of a bounce. In the meantime, I believe we drift back towards the $26 level but if we were to break above the $20 level, that would be a very strong move indeed, especially as the shooting star being broken to the upside shows a very resilient bullish trend. Looking at the overall choppy behavior, you should have plenty of time to get involved.