US GDP: Hopes for a ‘V’ are misplaced

We now know that the deepest ever quarterly contraction was -32.9% annualised. Financial markets are already priced for a vigorous recovery, but with virus fears on the rise, jobs being lost and incomes being squeezed as unemployment benefits are cut, we feel the recovery could be much bumpier

| -32.9% |

Annualised 2Q 2020 GDP contraction |

The largest decline on record

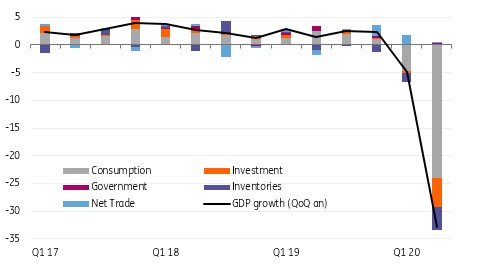

US GDP declined at an annualised rate of 32.9% in 2Q 2020, not quite as bad as feared (consensus -34.5%), but this is still the biggest decline on record. For those who prefer non-annualised numbers, it was a 9.5% quarter-on-quarter drop. The details show that consumer spending was the main drag, falling 34.6% annualised, while fixed investment fell by 29.9%, led by a 38.7% plunge in residential investment. Inventory drawdowns meant this component subtracted 4 percentage points from headline GDP. On the positive side, government spending rose 2.7%, while net exports were a net positive contributor, adding a rather paltry 0.7 percentage points to headline GDP.

When combined with the 5% annualised fall in 1Q GDP it means the US economy contracted 10.6% peak-to-trough in the first half of the year. The true decline between mid-March and the end of April when the lockdowns were at their most intense was likely much greater, possible even double the 10.6% figure, given evidence of a sharp bounce-back in consumer activity through May and June.

By way of international comparison, the 10.6% peak-to-trough fall in US GDP since 4Q 2019 is less bad than the European numbers we had earlier in the day. Germany saw an 11.9% decline in output with Austria experiencing a 12.8% fall and Belgium a 15.3% decline over the same period.

Contributions to US annualised GDP growth

Tougher times ahead

So we now know how deep the deepest ever contraction in US economic activity was, but this is old news given financial markets are priced for a very vigorous recovery. However, Covid-19 is far from beaten and while there is optimism about a vaccine, the timing and its efficacy are still unknown.

Meanwhile, a renewed spike in cases is forcing state Governors to backtrack on reopening plans, which is closing businesses, with workers losing their jobs. At the same time, the US$600 a week unemployment benefit boost to 30 million plus claimants has effectively ended and will likely be replaced with something much smaller in size.

With virus fears on the rise, jobs being lost and incomes squeezed, we feel the recovery could be much bumpier than markets seemingly do, and think we are in for some data disappointment over the next couple of months – starting with next week’s payrolls number.

Job worries mount

With regards to the labour market, the other major report today showed initial jobless claims rose for the second week in a row to 1.434 million while continuing jobless claims rose by 900k. The total number of US unemployment benefit claimants did drop to 30.2mn from 31.8mn, but we must remember this is for the week of 11 July as it lags two weeks behind initial claims (25 July) and one week behind continuing claims (18 July). Given both the latter two are on the rise again, we should expect total unemployment benefit claimants to rise next Thursday.

This reinforces our nervouseness that the Covid 19 fear factor, states reversing course on reopenings (leading to job losses) and the likelihood of a significant cut to the level of unemployment benefits means that the upcoming data flow may not point to as vigorous recovery as markets are pricing.

Download

Download snap31 July 2020

Covid-19: The shocking numbers are in This bundle contains {bundle_entries}{/bundle_entries} articles