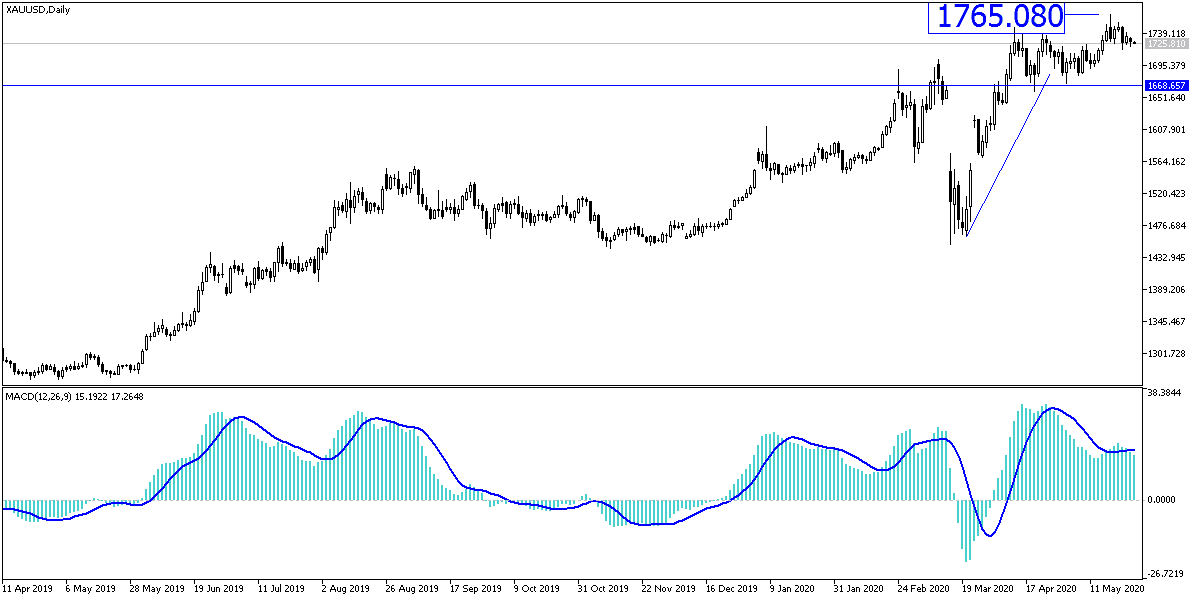

The optimism that prevailed in the financial markets due to the successive announcements that reaching a vaccine to counter the deadly Coronavirus was close, pushed investors to take risks, and give up safe heavens, with gold being among the most important ones. Accordingly, the price of gold fell to the $1707 support at the time of writing, after an upward stability around the $1740 resistance in the beginning of this week’s trading. Despite the recent decline, there are many factors that may contribute to pushing gold to move upward again. The dispute between the United States and China has not ended, and the formal and final announcement of a drug to deal with the Covid-19 has not yet taken place, and what has been announced are just preliminary results of experiments. This is in addition to the European concern about a mysterious future for Brexit and the political situation in the United States with the upcoming presidential elections.

Equity markets across Asia and Europe, as well as US stocks, closed higher, as more countries relax restrictions on social, commercial and travel activities. This coincides with a record number of 100,000 coronavirus deaths in the United States. Meanwhile, photos and videos of memorial celebrations across the United States have shown a lot of people going to beaches and parks.

In Paris, parks and café terraces have reopened, and people are said to be turning in large numbers to enjoy an early morning sunbathe at Madrid's famous Retiro Park. Spain and Germany also reopened gyms and swimming pools. Many other countries, including Greece, Iceland and Italy, are also reopening businesses. Meanwhile, US biotechnology company Novavax announced on Monday that it had begun its first human study of its experimental vaccine against the Coronavirus, and expected preliminary results on safety and immune responses in July.

On the economic side. The results of a survey conducted by the GFK market research group showed that German consumer confidence is set to recover slightly in June from a record low after the gradual reopening of many companies. Therefore, the consumer confidence index increased to -18.9 in June from -23.1 in May. The result was expected to improve to -18.3. However, -18.9 points was the second lowest level ever recorded. Control measures to contain the spread of the coronavirus led the sentiment index to a record low in May.

"The gradual opening of many companies has certainly contributed to the tendency of non-essential consuming not having to take any more blows, and to increase it slightly at the moment," said Rolf Borkel, a consumer expert at GFK. "However, the uncertainty among consumers is high," said Borkel. In their opinion, the German economy is far from overcoming the crisis and expects a difficult recession.

According to gold technical analysis: Holding on to the $1700 psychological resistance until now, bulls are still given control over the performance. Recent sell-offs may push gold price to good buying levels, the closest ones at the present are 1705, 1690 and 1675, respectively. Returning to the 1725 and 1740 resistance will restore the strength of the bulls' control over performance and push prices to new record and historical levels. I still prefer buying gold on every downtrend. Global geopolitical and trade tensions are not over.